Aave (AAVE) Price Prediction 2025-2030: Expert Insights and Market Trends

Aave maintains a market price point at $166.69 while its daily trading volume reaches $353.98M. Experts forecast Aave to trade between $250 – $350 in 2025, making it a promising investment option.

During the last 24-hour period the value of Aave decreased by 1.28% from its original value. Aave has experienced significant price growth throughout this week because it achieved a 19.21% increase. Aave is showing strong value potential which makes it deserve consideration for investment from prospective stakeholders. Let’s delve into the AAVE price prediction by Margex Blog to get the maximum insights.

The Aave cryptocurrency has reported a successive growth of 2.59% through the past month leading to an average price increase of $2.50. Aave demonstrates the potential to develop into a stable asset according to current market trends.

Aave Price Prediction for 2025

The technical analysis of the Aave price prediction in 2025 shows that the market can reach a minimum of $234.80 and rise to a maximum of $273.27. The expected value range for trading Aave amounts to $243.52.

Researchers at the market expect Aave to maintain a minimum price value of $167.19 during March 2025 and potentially exceed $259.52. The projected average market price for Aave will reach $240.82 across March 2025.

In the prediction of Aave price specialists for April 2025 the digital currency is estimated to reach $225.02 at its absolute minimum yet could reach $262.52 at its peak. The predicted average price for trading Aave stands at $246.89.

The historical prices of Aave have led analysts to predict an average trading value of $243.99 for May 2025. The estimated minimum price for Aave in this period will be $225.02 whereas the maximum possible value will extend to $259.52.

The average price projection for the digital currency Aave in June 2025 approximates to $242.62. Aave might reach $260.02 by June 2025 as the minimum possible price stands at $225.02.

The expert analysis predicts that Aave will trade at $242.62 on average across July 2025. According to experts the token could trade as high as $262.02 and reach minimum value of $226.02.

Analysts predict Aave will trade at $245.24 on average during August 2025 as per summer predictions. The minimum trading value will likely fall at $226.02 whereas the peak amount could achieve $262.52.

Studies on past Aave historical data suggest the token can rise to $258.02 as its peak value during September 2025. The estimated minimum stands at $225.02 while the market experts predict an average trading price of $242.69 for Aave.

Aave will maintain an average market price of $243.54 throughout October 2025. The prices within this period are expected to reach a minimum of $226.02 and extend up to $262.52.

The market experts predict Aave will hit a minimum price of $225.02 for November 2025 but see it reaching $262.52 as the apex value. The anticipated trading value sets at $243.87.

Cryptocurrency analysts suggest Aave will achieve its highest trading point at $262.02 while maintaining a lower limit at $224.52 before December 2025 ends. Experts agree that the average price of Aave will be $242.80 during December 2025.

Aave Price Prediction for 2026

Expert analysts based their estimate of Aave reaching $344.06 minimum value after conducting through examination of historical prices during 2026. The forecasted high value for Aave stands at $401.56 and its average selling price will be approximately $353.79.

Aave Price Prediction for 2027

The technical assessment shows that Aave will trade within the price range of $504.97 to $601.26 during 2027. The market experts predict that trading value for 2027 will be $519.12 on average.

Aave Price Prediction for 2028

The experts predict that Aave is expected to trade within a price range between $713.84 and $870.30 during 2028. The current data indicates that the typical transactions cost amounts to approximately $739.80 among traders.

Aave Price Prediction for 2029

The market predicts that Aave tokens will trade between $1,025 to $1,234 during 2029 at an average price level of $1,054.

Aave Price Prediction for 2030

Continuous observation of Aave market dynamics leads experts to anticipate an average trading value of $1,562 for 2030. The yearly price movement of Aave will extend from $1,520 at its minimum to $1,777 at its maximum.

Can Aave Reach the $1000 Milestone?

Many investors demonstrate interest in Aave reaching $1000 since its price continues to rise. The Aave platform provides financial services through its banking solutions and loan products as well as multiple financial products. Aave launched its operations in 2017 and steadily has grown its presence since then.

Aave launched its lending platform in 2020 while allowing users to obtain funds from other participants through the platform. Aave’s platform success created conditions for the company to enter new business sectors including savings and investments. The company stands prepared to expand because it maintains a diverse product selection while attracting increasing numbers of customers.

Recent market performance indicates AAVE could reach an average price of $1000 based on its past high of $666 which was achieved in May 2021. For successful investments in this opportunity, investors must make detailed research combined with market condition analysis.

Understanding the Aave (AAVE) Protocol

Users can access Aave’s decentralized lending protocol through the Ethereum blockchain network. The platform enables users to obtain crypto interest payments while letting them borrow money by depositing assets on the platform. The market determines interest rates for borrowers to pay more consistently than what they receive. The blockchain protocol of Aave operates with trustless transparency because it records all transactions on its network.

The development of Aave took place in Switzerland in 2017 when it started as ETHLend until it adopted its current name in September 2018.

The Aave platform distinguishes itself from traditional lending providers by omitting the requirement for credit verifications or traditional financial documentation. Borrowers have the option to secure loans through their crypto assets which they present as collateral. Aave enables all cryptocurrency owners to request loans without extensive credit verification checks. Aave implements an original functionality named “flash loans” through its platform. The platform provides borrowers with an opportunity to request instant short-term loans which need immediate repayment thus serving traders requiring fast market capture functions.

Aave provides users with a staking tool that allows them to receive interest income from their cryptocurrency deposits. The incentive system drives users to maintain their assets in the Aave platform which results in further strengthening both the platform’s stability and its expansion. These features combine to establish Aave as a resilient lending service with a high capability for growth.

AAVE, the native token of the Aave network, adheres to the ERC-20 token standard on the Ethereum blockchain. The possession of AAVE tokens provides users with multiple advantages that include fee reductions on the platform. The AAVE token functions as a governance token for the platform which enables users to participate in voting for platform development proposals that shape its future direction.

Aave maintains its position as an important organization within decentralized finance (DeFi) through its substantial market adoption. Aave was launched in January 2017 and has shown remarkable development since its start. Today Aave serves more than 100,000 users who lock $5 billion worth of assets inside their smart contracts. Additionally, Aave Swap allows users to seamlessly exchange assets within the Aave ecosystem, enhancing liquidity and user experience while maintaining decentralized security and efficiency.

AAVE Investment Analysis: Is It a Viable Opportunity?

The history of AAVE’s price changes causes investment uncertainty as potential investors speculate about its investment quality. Several essential pieces of information can assist users in making a knowledgeable decision despite the elusive answer. The professional developers of AAVE succeeded in delivering their project plan. The platform achieved tremendous development through exponential increases in its lending volume in the past year.

Major cryptocurrency exchanges along with wallets endorse AAVE which strengthens its liquidity while providing stability. The above characteristics establish AAVE as a project with meaningful advantages for potential growth. Investors need to perform detailed investigations when deciding to make any financial commitment.

Latest Development in AAVE

The new Horizon initiative developed by Aave Labs serves as a mechanism to encourage TradFi institutions to join DeFi by offering tokenized securities and RWA products. The main goal establishes Aave as the essential infrastructure to unite TradFi with DeFi systems.

The first product of Horizon will offer institutions a structured real-world asset solution that allows them to use tokenized money market funds to obtain stablecoin liquidity. Atomization liquidity resources will be provided by GHO the native stablecoin of Aave. The Aave DAO stands to obtain new revenue opportunities through this plan that simultaneously improves GHO’s utility throughout DeFi networks. The founder of Aave Labs Stani Kulechov explained that Horizon would build products that connect TradFi and DeFi while depending on GHO as its foundational liquidity source and the Aave ecosystem as its base.

The Horizon initiative enables its users to pledge permissioned RWAs as collateral since this functionality suits institutions that need to maintain DeFi compliance and risk management capabilities. Horizon represents the next-generation evolution of institutional-focused products from Aave Labs because it introduces more comprehensive real-world asset integration to decentralized finance.

Horizon differs from Aave Arc since it operates with a dual framework consisting of permissionless liquidity and permissioned issuers. Permissioned RWA tokens can be deployed with asset-level controls through this approach which ensures open access to stablecoin liquidity primarily through GHO. The combination of these elements lets institutions satisfy compliance standards and still capitalize upon DeFi’s open systems structure.

The market has shown substantial growth in tokenized securities because these digital assets represent ownership of physical assets like stocks bonds along with funds stored on blockchain networks. The tokenization of financial products now enables better market liquidity together with improved transparency to achieve higher efficiency in financial markets through digital asset instruments from single equity holdings to crypto finance funds. Major traditional financial institutions including Blackrock and Franklin Templeton have started the process of entering the emerging DeFi segment.

AAVE Price Overview and Future Projections

AAVE News – During the last 24-hour period Aave (AAVE) demonstrated minor price devaluation through the reduction of its value by 0.041%. The price movements during the day stay secure while showing minor fluctuations between the $175.47 peak and $168.43 low point due to price consolidation patterns. AAVE maintains its trading value at $168.83 as of the current moment.

In the previous week, AAVE experienced a major price decline of 22.18% which brought its value from $215.96 to its current level.

Technically AAVE is in an extended bearish trend through a descending wedge pattern that started when it reached its highest point at $402.27. The recent wave E reached a price level near $162.61 which corresponds with the 0.786 Fibonacci retracement so this point becomes crucial for market support.

Various prominent crypto analysts have detected a bullish sign in the market for AAVE which suggests that if the price achieves a successful move above the $250 resistance level it could advance to $360 within the upcoming weeks.

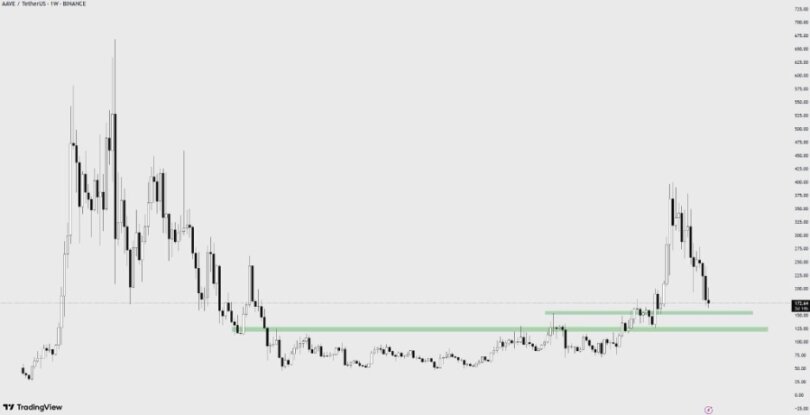

The chart presented by crypto trader BOBO through his post identifies $125 and $150 as a support zone for AAVE (AAVE) cryptocurrency which represents a favorable buying condition when prices drop to this level.

According to CoinCodex, the AAVE price will decline 4.21% before reaching $220.65 during the period from April 5 – April 5, 2025. A 5.00% increase in the upcoming six months will raise the price to $222.33 by September 2, 2025. Future analysis indicates that the AAVE price may drop by 37.01% until it reaches $133.36 by March 6, 2026.

According to FX Leaders, the AAVE price will fall within the range of $200 to $450 during 2025 due to the combination of Aave V3 upgrade and Layer-2 integrations as well as the growing DeFi adoption by crypto hedge funds and traditional finance institutions.

Conclusion

The recent downward price trend of AAVE might signal a potential uptick because of its descending wedge pattern which approaches essential support lines. The Horizon initiative introduces new elements that could strengthen institutional interest and adoption. Absolute buyers should gather coins at present prices yet traders with short time horizons should monitor resistance to validate their buy entry. Investors must use caution while performing complete research before deciding on any investments, You can trade AAVE on Margex with up to 50x leverage.

FAQs

Current AAVE Price

At present, the value of Aave (AAVE) stands at $91.73, with a market capitalization of $1,358,451,550.29.

Is AAVE a Viable Investment?

The outlook for AAVE is positive, with expectations of a bullish trend in the near future. Nevertheless, it is crucial to perform independent research before investing.

Can Aave’s Price Increase?

Projections suggest that AAVE’s average price may reach $126.89 by the end of the year. Over a five-year period, it could potentially rise to $381.72. Given market volatility, thorough research is advised before investing in any asset or project.

What does Aave mean?

Aave is a decentralized finance (DeFi) protocol that allows users to lend and borrow cryptocurrencies. The name “Aave” means “ghost” in Finnish.

Is AAVE a good investment?

It depends on market conditions, your risk tolerance, and the project’s development. Aave is a well-established DeFi platform, but like all crypto assets, it carries risks. Always do your own research.

AAVE Price Prediction for 2025

With Aave’s rapid network development, the forecast for 2025 is optimistic. The average price is expected to range between $179.82 and $214.83.

AAVE Price Prediction 2030

Under favorable conditions, AAVE could reach a maximum price of $1,307.87 by 2030. It is important to note that this data is not considered fundamental analysis or investment advice.

What is AAVE?

Aave is not classified as a coin but rather a token, serving as the native cryptocurrency of the Aave platform. Misleading references to an “Aave coin price forecast” are common. For more information on the distinction between coins and tokens, refer to the related article.

What is Launch Date of AAVE

Aave was introduced in 2017 under the name ETHLend. The token was rebranded to Aave in September 2018.

Who is Founder of AAVE

Aave was founded by serial entrepreneur Stani Kulechov.

How to Buy AAVE?

You can buy AAVE on Margex with up to 50x leverage. Simply sign up, deposit funds, and start trading securely.

This content is not intended for U.S. or Canadian residents. We disclaim any liability for losses incurred based on the information provided.