Bitcoin Dips Below $118K as Ethereum Withdrawals Climb

Bitcoin (BTC) dropped slightly on Wednesday, trading just under $118,000. Earlier in the session, it had tested the upper edge of its recent range near $120,000. This dip comes after two straight days of outflows from U.S.-listed spot Bitcoin ETFs. That shows institutional investors are growing more cautious. Technical signals also point to a short-term pullback, with momentum indicators showing weakness.

ETF Outflows Reflect Growing Investor Caution

Data from SoSoValue shows U.S. spot Bitcoin ETFs recorded outflows of $67.93 million on Tuesday. That’s the second day in a row of money leaving these funds. If this continues or picks up, analysts say it could lead to more downward pressure on Bitcoin’s price.

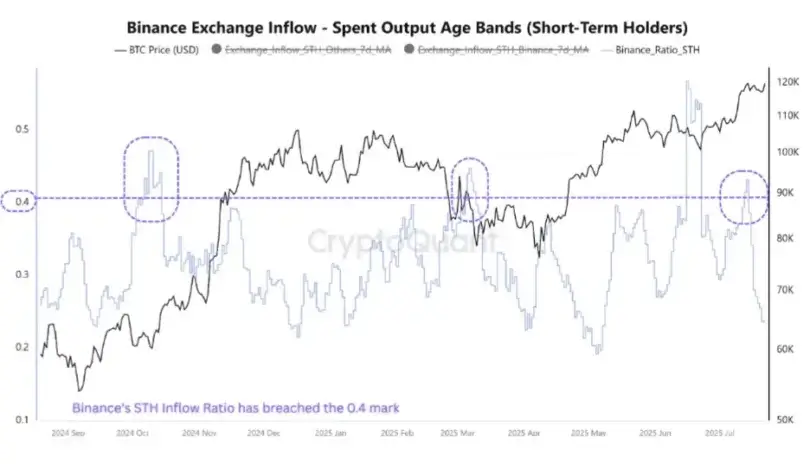

Meanwhile, on Binance, CryptoQuant spotted a rise in short-term holder (STH) activity. That suggests many retail investors are locking in profits. The STH metric climbed past 0.4 earlier this week. Historically, that level has marked retail-driven selloffs near local highs, usually after sharp rallies.

Whales Continue to Buy Despite Retail Selling

Even with less institutional inflow and more retail selling, large holders are still accumulating BTC. Over 9,600 BTC were taken off Kraken on Tuesday, one of the biggest single-day withdrawals in recent months, according to CryptoQuant. Big withdrawals like this reduce available supply for selling, which can help prevent deeper drops in price.

In past bull markets, retail investors often cashed out early, while long-term holders took advantage of those exits to buy at lower prices and hold through the volatility.

Metrics Show Whales Are Holding

The Inter Exchange Flow Pulse (IFP), which tracks how much BTC is moving between exchanges, supports the idea that big holders are still holding. Even though BTC hit an all-time high of $123,218 on July 14, the IFP shows less Bitcoin is moving onto exchanges right now. That usually means people aren’t looking to sell.

In past cycles like 2017 and 2021, the IFP spiked before major crashes, as whales moved coins to exchanges to sell. Right now, it’s not spiking. It’s stable. That suggests whales are still in accumulation mode, and exchange supply remains tight.

Bitcoin Price Outlook: Holding Below Resistance

After last week’s new high, Bitcoin has mostly stayed between $116,000 and $120,000. As of Wednesday, it’s down a bit from the top of that range.

If BTC closes below $116,000 on the daily chart, the next major support lies at the 50-day EMA, which is $110,948.

Technical charts are cooling off. The Relative Strength Index (RSI) is down to 46 after briefly hitting overbought territory Tuesday. MACD lines are tight, showing no clear direction. Still, if BTC manages to close above $120,000, it could trigger a push toward the recent high of $123,218.

Ethereum Validators Rush to Withdraw as Price Rallies 160%

Ethereum (ETH) validators are lining up to withdraw staked ETH, with the exit queue growing fast. This shift comes after a 160% price rally over four months. At the same time, staking interest is slowing down, showing a change in sentiment.

Exit Queue Surges as Profit-Taking Begins

Ethereum rose from $1,385 in early April to over $3,700 last week. That strong move seems to have prompted many validators to take profits. Data shows the amount of ETH waiting to exit the network is now 521,252 ETH, worth about $1.95 billion. That’s up from just 1,920 ETH a week ago.

Because of the sudden jump, the wait time for withdrawals has climbed to over nine days compared to just 0.03 days last week. When a lot of validators exit like this, it often means staking demand is cooling. But it also helps balance the network by adjusting the number of active validators.

Analyst Sees Possible ETH Run to $5,500

Not everyone is turning bearish. A TradingView analyst, Xanrox, expects ETH to surge to $5,500 in the short term. He pointed to signs that banks and governments may be buying ETH. He also hinted that Ethereum could now be held in U.S. government reserves, which would be a huge shift.

Xanrox believes Ethereum ETFs could play a key role in demand. If approved for staking features by the SEC, these funds might attract even more capital.

Ethereum ETFs See More Inflows Than Bitcoin

According to Xanrox, Ethereum ETFs are now pulling in more money daily than Bitcoin ETFs. That shows institutional investors may be shifting their focus to ETH. They see Ethereum as central to the crypto ecosystem.

Also, the number of people waiting to become validators is going up. Right now, about 359,557 ETH worth around $1.33 billion is queued up for staking, with a delay of six days. While still less than the exit queue, this shows some validators are still interested.

Active Validator Count Levels Off

Even with all this movement, the number of active validators has leveled off. The total stands at 1,093,671, slightly below last Thursday’s high of 1,096,339. Right now, 35.67 million ETH is staked.

Ethereum derivatives are also seeing strong action. Coinglass reports ETH Open Interest (OI) at $55.89 billion, near the all-time high of $57.69 billion. Higher OI usually means more money is flowing in and more traders are watching closely.

Bitwise CIO Warns of Demand Shock

Matt Hougan, CIO at Bitwise, said ETH is facing a strong demand shock. He noted ETH has risen over 50% in the past month and 150% since April. This has been driven by growing institutional interest.

Hougan pointed out a gap in ETF exposure. Ethereum’s market cap is 19% of Bitcoin’s, but ETH ETFs only manage 12% of the assets that BTC ETFs do. That means there’s still room for more ETH buying, which could fuel more price gains.

Ripple’s XRP Falls From Highs as Indicators Flash Bearish Signals

XRP dropped during Wednesday’s U.S. session, falling to around $3.27. That follows a rejection just under Monday’s swing high of $3.66, which matched Friday’s peak. The latest move suggests weakening momentum, backed by technical data.

The Relative Strength Index (RSI) has fallen from 88 to 68. That shows buyer energy is fading. Meanwhile, CoinGlass shows futures Open Interest for XRP has dipped to $10.79 billion, down from $10.94 billion at the year’s peak.

This lower participation has also caused more liquidations. In the past 24 hours, total liquidations hit $29 million, with long trades making up $26 million. Shorts saw just $2.8 million. This shows bulls may be backing off as prices cool.

Key Levels and Indicators to Watch

XRP is now trading at $3.29, having dropped below $3.40. That price level had served as key support and resistance before. If the RSI keeps falling, the next key supports are at $3.20, which was last tested in January, and $3.00, a level that was resistance in March.

The MACD is also being watched. If the MACD line crosses below the signal line, it would confirm a bearish trend. That would likely trigger more long exits and new short positions.

VERT Launches Private Credit Platform on XRP Ledger

Ripple is still pushing forward with new enterprise tools. On Wednesday, it announced that VERT, a firm offering securitization and fund services, launched a credit management platform on XRPL.

The platform digitizes fund operations and securitization workflows. It records key events and transactions directly on the blockchain. Ripple says this is part of a larger plan to modernize Brazil’s capital markets and improve access, transparency, and speed.

The first transaction on the platform was a $130 million Agribusiness Receivables Certificate (CRA). CRAs are common in Brazil for financing agriculture and exports. Putting them on-chain helps with tracking, cuts costs, and improves clarity.

This solution is also connected to XRPL’s new EVM Sidechain, which supports Ethereum-style smart contracts. That means more automation and stronger reporting features are possible.

Ripple Continues Focus on Real-World Asset Tokenization

The launch aligns with Ripple’s broader strategy to lead in the tokenization of real-world assets (RWAs) by leveraging the capabilities of its EVM-compatible XRPL Sidechain. Ripple continues to position XRPL as a key infrastructure layer for institutions seeking secure, cost-effective digital asset solutions.

Despite the recent pullback, market sentiment has not fully turned bearish. If bulls manage to consolidate liquidity at current levels and re-establish upward momentum, XRP could still attempt another push toward its record high of $3.66.

While short-term indicators suggest caution, the longer-term trend remains intact provided XRP maintains support above $3.20 and avoids deeper losses below $3.00. The coming days will likely hinge on broader market sentiment, technical signals, and Ripple’s ongoing enterprise developments.