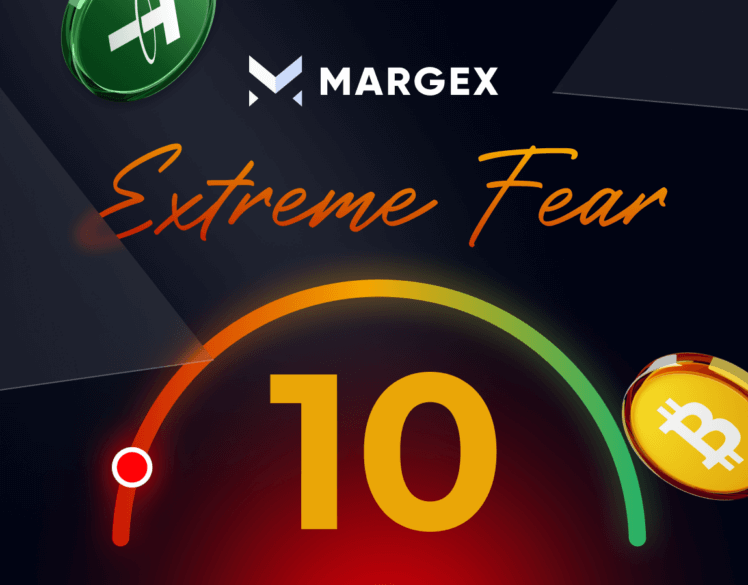

Bitcoin Fear And Greed Index Hits Record Low Before Rebounding to 33

Last week, on February 26, the Bitcoin Fear and Greed Index crashed into the “extreme fear” zone while Bitcoin nosedived below the $85,000 level. That was one of the lowest index readings recently. By now, the index has rebounded, rising to just “fear” as the Bitcoin price and market sentiment have begun to recover. Currently, the Bitcoin Fear and Greed Index stands at 33.

The Bitcoin Fear and Greed Index is one of the key analysis tools for analysing market sentiment used by traders and investors when they want to gauge the general market mood. The index ranges from 0 to 100, starting from the “extreme fear” category, then moving to “fear” and also showing “extreme greed” and just “greed,” meaning potential market trends.

Bitcoin drops below $80,000, pushing index to “extreme fear”

The recent shift in the aforesaid Bitcoin sentiment indicator took place when the BTC price plunged to $83,780 on February 26 and then also collapsed lower, hitting a bottom of $78,764 a couple of days later.

This massive decline was triggered by the approaching start of the import tariffs day against goods from Mexico and Canada imposed by US president Donald Trump – they are scheduled to take effect on March 4. The shift in the crypto market sentiment has brought up discussions about Bitcoin’s future price movements. When extreme fear sweeps over the market it is indicative of potential high buying opportunities, while ongoing concerns and regulatory developments continue to put high pressure on the crypto market. Besides, last week Bitcoin ETFs, especially BlackRock experiences largest outflows since inception.

When the crypto sentiment index entered the state of “extreme fear” at the score of 10, it marked the lowest point since May 2022. Back then, the world’s largest digital currency, Bitcoin, suffered an enormous price crash after the collapse of three crypto platforms – Terra, Three Arrows Capital (3AC) and Celsius. The latter two were crypto lending firms which went bankrupt.

Just to remind you, in November of the same year, the crypto market was slapped with an even bigger bearish event – the collapse of the FTX exchange. That shook the crypto market from the top to the bottom and the turmoil was even harder.

Key reasons for this heavy market decline

There were several key drivers that provoked this sharp decline in the market sentiment.

That was the said Bitcoin crash below $85,000 as BTC lost more than 17% in value during the past month. This decline triggered panic among investors and began sell-offs across the market.

Then there was heavy macroeconomic uncertainty regarding US trade policies, inflation, and potential rise of the interest rates. Aside from the tariffs against Canada and Mexico, Trump is threatening to impose 25% tariffs on goods from the European Union, which adds to the rising economic instability around the world.

The Fear and Greed Index dropped to a similar low as on February 26 in June 2022. Back then, Bitcoin collapsed to the $19,000 mark triggered by the loud crash of the Terra ecosystem and the downfall of the 3AC investment fund.

That summer, the crypto sentiment index fell to the score of 6, showing extreme fear pessimism.

Once the those two platforms crashes in May and June 2022 and the insolvency of Celcius followed, financial institutions began liquidating their crypto holdings and investors started panic-selling.

Bitcoin sentiment recovers to “fear,” price soars briefly

As of now, the Fear and Greed Index has made a slight rebound, rising from Extreme Fear to just Fear, showing 33. This indicates a modest recovery in investor sentiment towards the situation in the market. The lift has been down to a big factor – Donald Trump has finally approved the creation of the US Strategic Crypto Reserve. He wrote about that on Sunday on the Truthsocial platform, stating that it will consist of Bitcoin, Ethereum, XRP, ADA, and SOL.

Bitcoin price skyrocketed to $95,000 by Monday morning with many considering Trumps’ social media posts about the crypto reserve to be a definite bullish sign. However, some key figures in crypto and finance criticized him for this. Coinbase CEO Brian Armstrong believes that the reserve should consist of Bitcoin only as it is the digital analogue of gold. Economist and gold advocate Peter Schiff tweeted that, though he was against Bitcoin, he understood the rationale behind making a Bitcoin reserve. But as for adding XRP to it, he tweeted: “Who the hell would need that?”

Besides, many questions arose as to how the government plans to go about creating this reserve, where funds would be allocated from. Also, many are asking if Trump has the legal authority to create this reserve – a bill should be prepared and then approved by the Congress, etc.

As a result, the bullish surge has reversed and BTC has plunged by almost 7% back to $87,260.

Still, many influencers on X say that now it is the best moment to buy the dip and one of the largest BTC holders, Strategy, bought $2 billion worth of Bitcoin last week. After-all, fear market states do not last forever, as history shows, and then markets resume growing, pleasing investors and traders.