Bitcoin Price Recovers as $150M in Altcoin Shorts Liquidated

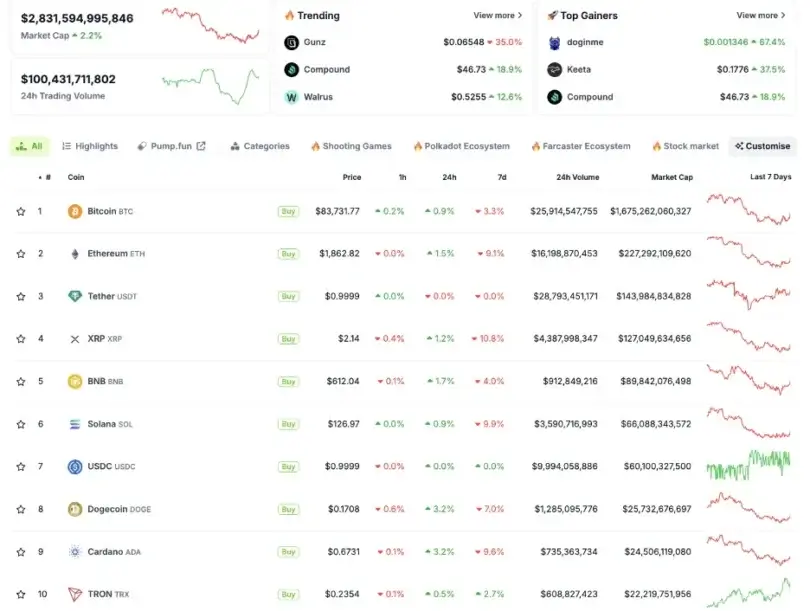

During early European hours on Tuesday, Bitcoin (BTC) reclaimed the $84,000 price mark following a short stabilization at $82,500 during Monday trades. The leading cryptocurrency has experienced updated investor confidence, which emerged following its 4.29% weekly decrease.

Crypto Finance reported that Bitcoin ownership control currently stands at 61.4%, indicating emerges as the preferred safer investment during uncertain economic conditions. Market experts indicate that investors show defensive behavior by choosing Bitcoin over other cryptocurrencies since market challenges are increasing.

The market recovery has occurred yet investors show reserve because of upcoming macroeconomic threats. BTC faces potential market declines from Bitcoin’s relationship with equity markets and US President Donald Trump’s proposed tariffs together with impending stagflation situations.

The market faces ongoing challenges and investors follow Bitcoin’s progress closely to gauge its momentum retention potential in upcoming days.

Bitcoin’s Recovery Strengthened by Tether’s $735 Million BTC Purchase

Tuesday brought Bitcoin its highest trading point yet when prices passed $84,00, while the cryptocurrency market control climbed to 61.4%. Based on data from Crypto Finance, Bitcoin should uphold its market strength because both economic ambiguity and trading volatility maintain their existence. Elevated risk-taking behavior would trigger a probable return to the average price ratio of ETH/BTC and broader digital currency market performance.

The market shows reluctance at present while Bitcoin’s dominance amounts to hold its position during the upcoming months.

Bitcoin experienced additional recovery after Tether withdrew 8,888 BTC worth $735 million from Bitfinex hot walletx ccea on Tuesday. The Bitcoin reserves of Tether have increased to 92,647 BTC, totaling approximately $7.65 billion after this transaction. The Bitcoin wallet operated by Tether now ranks as the sixth-biggest in the world.

The crypto market interprets the movement of exchange funds from trading wallets to non-exchange wallets as a positive sign because it decreases immediate buying pressure. The purchase demonstrates that institutional investors increasingly want BTC and solidifies its position in this market environment.

Bitcoin Faces Potential Downward Pressure

The risk-off investor sentiment produced by current economic instabilities and Donald Trump’s trade policies, and increasing stagflation risks exists as a potential reason for Bitcoin price pressure.

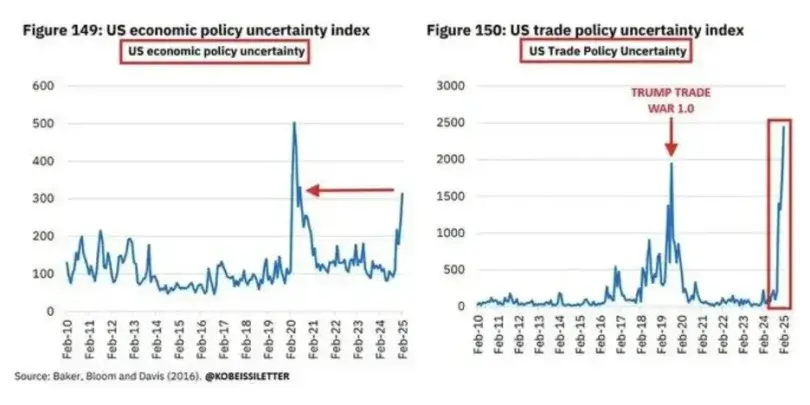

The Kobeissi Letter released its Monday report which showed the U.S. Trade Policy Uncertainty Index surpassing earlier Trump-era trade war levels to reach 25%. Research outlines this occurrence as an unprecedented event throughout the whole of history.

The combination of escalating market volatility and uncertainty frequently pushes investors toward selecting gold as a secure asset, which reduces their demand for cryptocurrencies. However, in the event of a market recovery, investor confidence may shift back toward riskier assets like Bitcoin and altcoins. A sustained market recovery could therefore reignite interest in the crypto sector, driving up both trading volume and prices.

According to the analysis provided by analyst Ray Wang the proposed EU trade tariffs could target about $600 billion in European goods entering the US market. The introduced tariffs will cause a 70 basis point decline in U.S GDP alongside a 40 basis point inflationary effect.

The economic conditions under Trump’s tariff policy combined with stagflation concerns and increased market uncertainty, have created temporary obstacles for Bitcoin because its price moves similarly to stocks during risk-averse market phases.

The cryptocurrency shows potential to serve as an inflation hedge and defense against stagflation and decreasing U.S. dollar values in medium-term to long-term market situations. The outlook for Bitcoin growth strengthens when the Federal Reserve adopts a less restrictive monetary approach.

Asset holders should exercise caution because market volatility will intensify during the approaching weeks starting from Wednesday when Trump announced “Liberation Day.” Long-term BTC investors often take advantage of price drops to build their cryptocurrency holdings because they believe stagflation might persist in the market.

Bitcoin Price Analysis

Bitcoin started recovering from its previous dip by passing the $84,000 mark on Tuesday. Bitcoin spent most of the previous week capped between $85,000 and $88,000 but broke this boundary on Friday. During this period, BTC experienced a 5.53% decrease which dropped its value to $82,500 by Sunday. The market demonstrated recovering strength during the recent week.

The current market sentiment shows signs of both positive and negative signs based on technical indicators. The RSI showed 45 on the daily timeframe while gaining momentum to approach the middle position at 50, thus showing declining bearish pressure. The point when Bitcoin rises above this particular threshold may indicate a stronger market recovery. The current indecision among traders is illustrated through the Moving Average Convergence Divergence (MACD) lines that maintain proximity to each other.

Bitcoin will try to challenge the $85,000 resistance level if its price maintains its upward trend. The successful clearing of this zone would allow for an attack on the important $90,000 psychological level. The inability to surpass resistant price barriers could lead BTC to return towards the next major support level at $78,258.

Crypto Market Surges $54 Billion as Buyers Step In Amid Sell-Off Slowdown

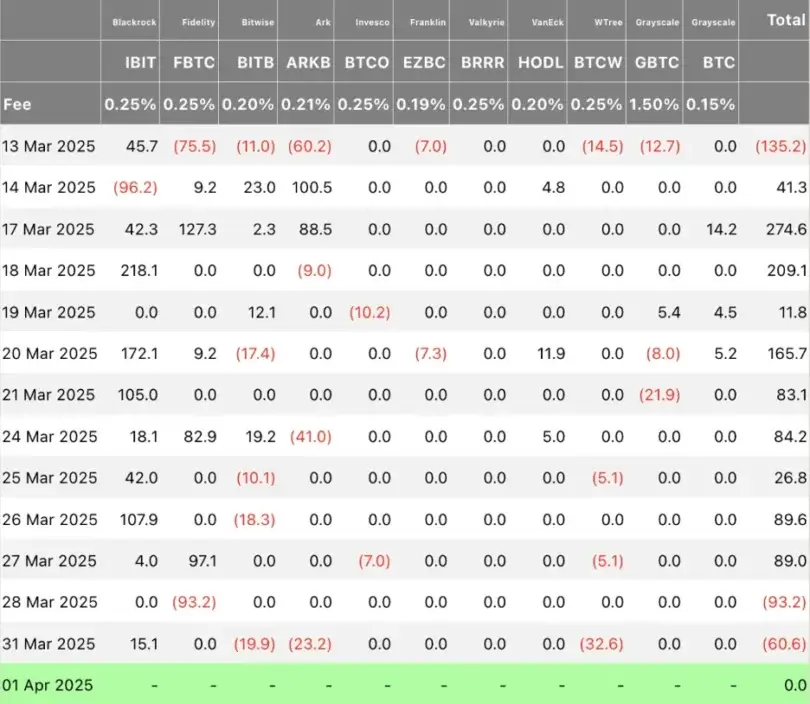

The cryptocurrency market achieved a substantial recovery through the $54 billion growth across the past day because investors returned to monitor Monday’s market decline. Several US-based firms have announced their plans to buy Bitcoin (BTC) as Congress prepares to evaluate stablecoin legislation throughout Wednesday. The IBIT ETF, operated by BlackRock, received $15 million worth of incoming funds.

The aggregate outflows from Bitcoin exchange-traded funds (ETFs) reached $60.6 million on Monday, as reported by the Fairside analytics platform, which demonstrated the first back-to-back losing period since March 14.

IBIT from BlackRock received $15 million in net investment inflows after Larry Fink implied Bitcoin might replace USD as the world reserve while addressing shareholders about US debt levels in his yearly report.

Altcoin Market Sees $150M in Short Liquidations as SOL, ETH, and XRP Rally

The altcoin market recorded a strong surge from short traders losing $150 million, while the top 25 cryptocurrencies showed positive performances during the last 24 hours.

The Crypto market registered increasing values of 2.2% based on CoinGecko, showing that every top 25 digital asset maintained positive prices. Ethereum (ETH), Solana (SOL), XRP, Dogecoin (DOGE), and Chainlink (LINK), along with Cardano (ADA), reported 2% growth while the crypto market experienced a 4% surge, according to CoinGecko statistics at present.

The significant price surges observed in the market correspond to a redistribution of capital between digital assets in the cryptocurrency sector.

Traders Shift Funds Toward Large-Cap Altcoins as Short Liquidations Top $225 Million

Market forces now favor established cryptocurrencies because traders move their capital investments from smaller-cap assets to large-cap altcoins. The leading crypto assets risk losing their gains throughout the session if total market capitalization stops increasing above 2%.

The outlook in the derivatives market remains bullish because bulls have recently executed major short position dissolutions.

Shorts who traded Bitcoin encountered $65.58 million in losses combined with $59.21 million in liquidations suffered by Ethereum (ETH) shorts throughout 24 hours. XRP as well as Dogecoin (DOGE) short sellers faced tremendous losses when each exceeded $5 million.

Decompositions of short positions reached $115 million out of $225 million in combined market processing during Tuesday due to increasing bullish market strength that renders wagering against price increases unprofitable.

Here’s an outlook of crypto news in short:

Brian Armstrong Advocates for US Stablecoin Regulation Overhaul

Brian Armstrong from Coinbase is calling on American lawmakers to change the regulations that stop individuals from gaining interest on their held stablecoin deposits. According to Armstrong, users should receive interest payments from stablecoin reserve assets, which resemble traditional bank interest on checking and savings accounts.

Because of existing US regulatory restrictions, stablecoin holders do not gain the advantages that the industry could offer them.

Bybit to Discontinue NFT and IDO Services by April 8

Bybit Web3 has scheduled April 8 for its NFT Marketplace with Inscription Marketplace, and IDO product pages will permanently cease operations. All users need to handle their assets before the specified date. The available options for NFT trading include OpenSea and Blur together with Magic Eden on Ethereum combined with Element Marketplace and Mintle on Mantle.

IDO participants needed to move their acquired tokens from the exchange to secure seed-phrase or private-key protected Bybit Web3 wallets to maintain asset safety.

For those seeking a secure and intuitive environment to continue their crypto journey, safe trading on Margex offers a reliable alternative. With robust security protocols, user-friendly tools, and instant Bitcoin purchases via Margex’s platform, traders can confidently manage their assets without sacrificing simplicity or safety.