Bitcoin Reached A New All-Time High of $75,400 Amid Trump’s US Election Victory

After Donald Trump was elected the 47th President of the United States, Bitcoin (BTC) surged over 7% to $75,407, a new record. The rise is attributed to Trump’s perceived crypto-friendly stance, which many believe may further catalyze cryptocurrencies in the Marketplace.

BTC could be moving towards its next target, which is in the $78,777 – $78,955 range for technical analysis. Recent reports highlight the build-out of the so-called ‘Trump trade,’ a concept that has seen flows to the U.S. Dollar (USD), cryptocurrencies, and elevated Treasury yields.

This is Bitcoin’s latest leap in value past the previous all-time high of $73,777 when Trump was declared the next U.S. president. Wednesday’s new peak is $75,407.

The Associated Press reported that Trump won key swing states like Wisconsin to secure the 270 electoral votes necessary to win the presidency.

A report from the crypto-asset trading firm QCP said the Trump trade—including long positions in the dollar, crypto, and higher Treasury yields—gained steam ‘as Trump led in pre-election prediction markets’ and has logged more than $1 billion since April.

Trump’s Promise to Replace SEC Chair Gensler

Kamala Harris and Donald Trump are considered more crypto-friendly. Trump has been active in the crypto community, including speaking at a Bitcoin conference.

Among his pro-crypto initiatives, Trump proposed the creation of a strategic national Bitcoin reserve that would elevate the U.S. to global leadership in cryptocurrency adoption.

He also pledged to form a Bitcoin and cryptocurrency advisory council to help guide regulatory decisions. He said he would replace Securities and Exchange Commission (SEC) Chair Gary Gensler, most likely to assuage industry concerns about regulatory clarity.

Coinglass shows that outflows of $657.9 million from U.S. spot Exchange Traded Funds indicate a possible fall in institutional demand for Bitcoin. However, this is retrospective data, and it still doesn’t incorporate what the U.S. presidential election will mean.

Santiment’s Network Realized Profit/Loss (NPL) shows that some Bitcoin holders profited from their holdings, as NPL spiked from 35.75 million to 909.41 million between Tuesday and Wednesday. The increase indicates that, on average, during this period, holders cashed in on their gains.

In mid-October, Bitcoin successfully retested its breakout of a downward-sloping parallel channel pattern position on its weekly chart and has now broken above it, sitting in the green above $67,800 at the time of writing.

How U.S. Presidential Elections Have Historically Impacted the Crypto Market?

You can look back at past U.S. presidential elections and see how the crypto market reacts to political changes, sometimes seeing immediate price actions reflecting a broader view of investor sentiment.

After Trump’s victory on Nov. 8, 2016, the price of Bitcoin dropped to 5.5 percent over five days. The future president was a man of uncertain white, filled with uncertainty and doubt about what he would bring to the presidency. However, the first dip didn’t capitalize, and Bitcoin, as well as the rest of the altcoins, quickly came back up.

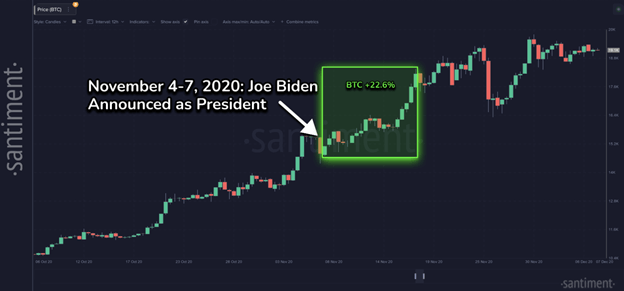

On the other hand, the November 4, 2020, election was much more friendly for the crypto market. In 11 days of announcing the results of the votes, Bitcoin rose about 22% from its level before the surge.

However, the rally following this post-election coincided with the economic impact of the COVID-19 pandemic. Many analysts say that said growth was largely due to pandemic-related factors like stimulus checks and interest rate cuts and not solely because of the election outcome.

What we do know, however, is that the 2016 and 2020 elections reveal how crypto has responded to popular political events. The data is too small to draw definitive conclusions about trends in election-related performance.

Nevertheless, one pattern is evident: During political uncertainty, crypto markets are volatile during election cycles. Incoming administrations send regulatory solid and policy change indicators that tend to trigger strong reactions from traders.

However, investors and the broader crypto community are also watching candidate positions on digital assets as they close in on the 2024 election—and could be in for a rude awakening. The result could have a far-reaching impact on crypto. Crypto assets could be experiencing marked price movements depending on the perceived support or limitations under new leadership.

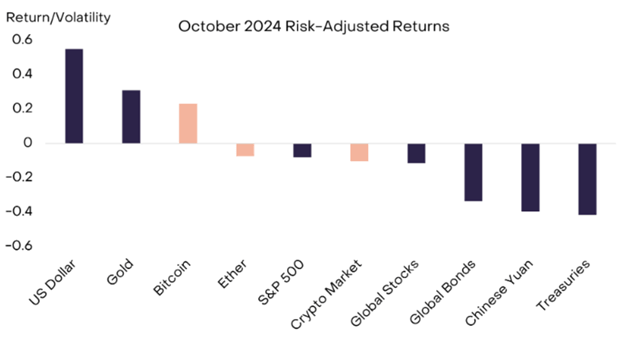

Grayscale Report Links October Market Trends to Potential Trump Election Influence

Grayscale shed light in a recent report on how October’s movements were affected by ‘a Trump trade’ but how this market prediction for a Trump victory is actually hard to measure precisely. Grayscale said its analysis showed cross-asset returns in October matched the patterns that historically coincided with Trump policies, as seen in the data included in its report.

The US Dollar was strong, and the Chinese Yuan has depreciated, perhaps they have increased tariff risks from a macroeconomic point of view. At the same time, bond yields jumped (and bond prices fell) as gold prices shot up if a Trump administration scenario was expected to produce bigger deficits and higher inflation.

In October, Bitcoin stood out among asset classes, increasing 9.6%. On a risk-adjusted basis, it outperformed other assets.

In the run-up to the US election next month, Grayscale’s report discusses the impact of the forthcoming election on the digital assets landscape. However, it says that the next presidential administration and Congress could also move to adopt crypto-specific regulations and broadly reform tax and spending policies on the financial markets.

The significance of Senate control is straightforward because the Senate confers authority to confirm presidential appointees to vital regulatory positions, including the head of the Securities and Exchange Commission and the Commodity Futures Trading Commission, whose decisions will largely shape crypto regulation.

Bitcoin Price Analysis

After this retest, Bitcoin spiked but was unable to surpass the previous all-time high of $73,777 we recorded at the end of last week. It is still climbing over this threshold, reaching a new all-time high of $75,407.

In theory, the rally could extend further, particularly if it reaches the pattern’s technical target, which is the space between the two trend lines, and then pushes up to a new all-time high of $78,955.

On the weekly chart, the Relative Strength Index (RSI) is 63, above neutrality (50) and well below overbought. This indicates strong bullish momentum.

Based on the strength of the bullish momentum, there is a strong possibility of a rally ahead, according to the daily chart. On Monday, Bitcoin found support near $67,000 and rose 2.24% on Tuesday. Wednesday saw it top out at $75,407 before falling back slightly, reaching an all-time high of $73,777.

A daily close north of the previous all-time high of $73,777 could pave the way for Bitcoin to aim for the 141.4% Fibonacci extension level, based on July’s high at $70,079 and August’s low at $49,072, at $78,777. This is a close line to the technical target of $78,955, coming from the descending parallel channel on the weekly chart.

On the daily chart, the Relative Strength Index (RSI) has rebounded from its neutral level of 50 to 68, suggesting a strengthening of bullish momentum.

If we close below $73,777 in Bitcoin, it may revisit the psychological support level of $70,000.

Crypto Community Celebrates

The cryptocurrency community joyously celebrates President Donald Trump’s projected victory against incumbent President Joe Biden in the 2024 United States presidential election.

On the night of the election, November 6, when Republican nominee Trump declared to his supporters with the promise of a “golden age” for the nation that he had won, he was wrong.

French President Emmanuel Macron has already congratulated Trump on what is likely to be a win, as have global leaders. The election outcome has also seen early responses from the cryptocurrency market.

Encouraging developments for the U.S. crypto sector could result from Trump’s victory—he has consistently championed cryptocurrency. When Trump ran for the presidency, he positioned himself as a pro-crypto candidate, vowing to end a ‘war on crypto’ and even promising to make the US the ‘crypto capital of the planet.