BTC Dips on Profit-Taking, ETH Rallies on $425M Treasury News, SOL Stood Strong

Bitcoin is currently worth around $109,000 on Wednesday, recovering after a slightly lower price the previous day. There could be weakness coming soon, according to on-chain metrics, since investors are selling assets at levels not seen in the past three months. We wait to see what the Federal Open Market Committee (FOMC) will write in their Minutes from the May meeting, available later in the day, as it may again shake up the biggest cryptocurrency in the world.

Profit-Taking Hits Highest Level Since February

According to Santiment, the spike in the Network Realized Profit/Loss (NPL) metric on Tuesday represents the highest level of realized profits for the last three weeks. Bitcoin’s modest rise on Monday caused the uptick, at least in part because Donald Trump decided to put off EU tariffs.

Rising NPLs hint that those who own them are selling for advantages and profits. As a result of this behavior, selling usually rises, causing the market to correct momentarily.

Before the release of the FOMC Minutes, traders begin to book their profits. Analyst Haresh Menghani said that investors are paying particularly close attention to hints about future interest rates from the Federal Reserve.

The expert pointed out that concerns about trade tensions between the US and China, the US government’s finances and other geopolitical problems make people hesitant.

If the Fed takes on a cautious stance, it could trigger more interest in risk assets which could help Bitcoin rise. By contrast, a hawkish move could lead to further declines in the crypto market.

High Leverage and Sentiment Suggest Volatility Ahead

According to a K33 Research report on Tuesday, leverage and OI in Bitcoin perpetual futures have jumped, making it more likely that the price will be more volatile in the next short period.

The report finds that OI has experienced a big increase since Bitcoin reached a new record price last week. With more money being put into trading, it appears traders believe the main markets may move sharply up or down, but no clear direction is recognizable.

Alternative.me Fear and Greed was at 71 on Wednesday, showing more buyers in the market than sellers, but this was down slightly from a score of 74 the day earlier. The market isn’t showing signs of maniacal optimism, though that’s often seen as a warning about possible market overheating.

These experts say that if greed rises high enough, retail investors may jump in too quickly which typically marks the top of a small rally and signals a quick change.

| Day | Minimum Price | Average Price | Maximum Price |

|---|

Institutional Inflows Offer Support Despite Caution

Some evidence of overheating and more speculation has not stopped institutions from showing continued interest in Bitcoin. According to SoSoValue, US spot Bitcoin ETFs had inflows of $384.85 million on Tuesday, continuing a streak of positive flows that began in mid-May.

If institutions keep their interest in Bitcoin, it could shore up the prices if there is an immediate dip, helping calm the market in times of turmoil.

Bitcoin has dipped after reaching its new all-time high and some signs indicate it may be facing exhaustion.

Bitcoin climbed to reach an ATH of $111,980 on Thursday, but then pulled back by 3.92% on Friday. Bitcoin met strong support at $106,406 on Saturday and then began to rise over the following three days. But there was a slight dip in prices on Tuesday. At present, the price of BTC is nearly $109,000.

It looks like technical indicators are pointing to Bitcoin’s bullish momentum fading. As you can see on the daily chart, the RSI currently stands at 64 and turned downward after failing to close above 70. On Sunday, the MACD indicator went bearish, strengthening this view. Often, this event lets traders know that a selling opportunity exists and that the trend might be breaking down.

If Bitcoin drops further, its price could fall to revisit the $106,406 support. A secure close below this point may cause prices to keep dropping, aiming toward the major psychological support of $100,000.

On the other hand, if BTC increases once more and surpasses its earlier record, the rise could pick up speed and push toward a new milestone at $120,000.

| Month | Minimum Price | Average Price | Maximum Price |

|---|

Solana Price Consolidates as DeFi TVL and Futures Activity Signal Growing Market Confidence

The price of Solana (SOL) is sticking to around $174 after trading in a specific range since its latest rally. Despite the April 7 drop to $95.55 because of tariff-related events, SOL has now stabilized its price. In the past, higher lows have become the norm, thanks to widespread positive feelings in the crypto sector. Positive feelings are mirrored in the ongoing rise of Solana’s DeFi Total Value Locked (TVL) and Futures Open Interest (OI).

DeFi TVL on Solana Surges Past $9 Billion

Solana plays a key role in the DeFi sector because of its affordable fees and superior speed. With these, users stake their SOL in smart contracts to help protect the network and still earn rewards.

According to DefiLlama, the value of Solana’s DeFi protocols has grown from $6.63 billion on April 1 to $9.34 billion today. The fact that investment has increased by 28% shows investors are more confident and plan to stay in the ecosystem.

The surge in TVL typically indicates that investors are locking their assets in protocols rather than keeping them on exchanges, thus reducing available supply and potential sell pressure. This trend is generally seen as a positive indicator of price stability and upward momentum.

Futures Market Reflects Sustained Bullish Sentiment

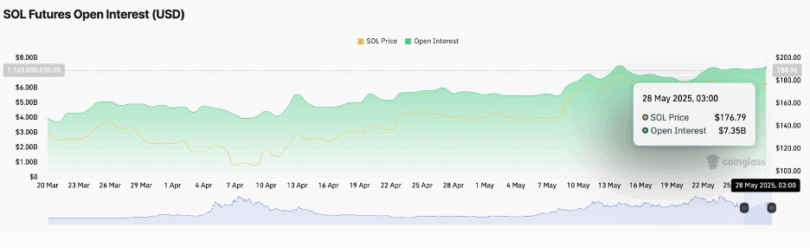

In the derivatives market, Solana is showing robust performance, with increasing interest among traders. According to CoinGlass, Open Interest in SOL futures is consolidating around $7.35 billion, up from $6.4 billion as recorded on May 20.

Open Interest measures the total number of active derivatives contracts, such as futures or options, that have yet to be settled. The combination of increasing OI and a trading volume of $9.4 billion points to intensified market activity and a strengthening belief in future price gains. Traders appear to be initiating new positions in anticipation of continued upside, further reinforcing the bullish outlook for Solana.

Can Solana Bulls Hold the Line at Key Support Levels?

Solana (SOL) is now moving between $164 and $185, two important technical levels, with the 200-day EMA giving support at around $164 and resistance at $185 marking the end of the recent climb.

The Moving Average Convergence Divergence (MACD) showed bearishness by showing a cross-below with the blue line below the red line. A decrease toward zero on the mean line, paired with bigger red bars, tells us that bears are getting stronger.

Closing levels of the RSI are moving lower and approaching the average level, implying weakness in the uptrend. Should Solana’s price move below it, it could trek toward the downside, potentially attracting more sellers.

Solana’s actions close to the ascending trendline are being carefully tracked by market members. A fall under this mark might mean even greater losses. Traders are closely watching a number of support regions, including the $164 area given by the 200-day EMA, the $159 spot that is confluence support, and the $140 area tested during May’s market downturn.

Alternatively, a bullish shift might occur as soon as the SuperTrend indicator changes from red to green after the dynamic line is broken above. It would make the pattern of Solana more attractive for traders using trend-based approaches. If the $185 level is decisively broken, Ethereum could see more gains toward $200, the level tried as resistance in early April.

Ethereum Gains 4% as Sharplink Gaming Unveils $425M ETH Treasury Strategy

On Tuesday, Ethereum (ETH) rose 4%, due to Sharplink Gaming unveiling its decision to reserve most of its treasury in ETH. The private placement at the heart of the move is valued at $425 million and is led by Consensys.

A press release on Tuesday emphasized that Sharplink Gaming has launched a private investment in public equity (PIPE) agreement, by issuing and selling 69.1 million shares to investors. The transaction, meant to generate $425 million total, will finance Coinbase’s plan to buy a large amount of ETH.

The investment round is being led by Consensys, along with partners Pantera Capital, ParaFi Capital, Galaxy Digital, and Ondo. Following the closure of the private placement on Thursday, Ethereum co-founder and Consensys CEO Joseph Lubin will become Chairman of Sharplink’s Board of Directors.

Sharplink’s use of ETH in its treasury is part of a wider movement for businesses to incorporate digital assets into how they use their money. This year, BioNexus Gene Lab (BGLC) said it would purchase and hold ETH. Last month, Nasdaq-listed BTCS revealed it bought $8.42 million in ETH which brought its total ETH holdings to 12,500.

The update could signal a major change for ETH which has so far trailed behind Bitcoin (BTC) and Solana (SOL) when it comes to institutional adoption. Accumulating BTC and SOL has helped Strategy and DeFi Development Corp outpace ETH over the past year. Sharplink’s considerable investment could shift the balance and make Ethereum’s price rise sharply.

At the same time, Etherealize, an Ethereum-focused company founded by Vivek Raman, is determined to bring Ethereum into the mainstream of finance. The firm is preparing tokenization tools and safe trading options specifically for financial institutions, ETF issuers, and everyday investors which highlights the growing relevance of Ethereum in regular finance.

Ethereum Technical Outlook: Bulls Eye Break Above Key Resistance Zone

According to Coinglass, liquidations totaling $68.43 million were wiped out for ETH in the previous 24 hours. A total of $22.53 million was in favor of the long market, but there were $45.89 million against it which means the market is uncertain at this level.

ETH appears restricted between $2,750 and $2,850 which has traditionally been a difficult area for buyers to break through. When the lower part of a symmetrical triangle is recovered on the weekly chart, the ETH price looks set for a possible breakout.

A solid move over $2,850 with many buyers could see ETH push toward the triangle’s ceiling, but a break above $3,250 is needed to make the rise official. If it fails to break above the $2,700 level, Bitcoin might fall to the $2,500 level and possibly even lower, with possible targets between $2,250 and $2,100.

They show there is an upward trend in the market. Since RSI and MACD bars are above the midlines, that signals the stock may move upward. Yet, the Stochastic Oscillator has climbed into overbought territory, making a drop in the short run more likely before any strong rally begins.