BTC Nears $100K Floor Amid Retail Exit, While ETFs and Institutions Stay Bullish

Bitcoin (BTC) declined again on the second day and traded at this time in the range between the support of $100,000 and the resistance of slightly below the absolute high of 111,980. The recent slump is accompanied by clear decreased interest in the crypto market among retail investors, which begs the question of loss of faith in the crypto market as a whole.

This is also what is being experienced in the altcoin scene that has still not presented much indication that it will feel the influx of renewed investor interest. The altcoin season is still nowhere to be seen as Ethereum (ETH) indicates the general apathy of the market. The second most important cryptocurrency lost its momentum during the June rally at around $2,882 and instead fell to the level of $2,111 amid the dynamics of geopolitical tensions and macroeconomic uncertainty.

Market Awaits Powell and Lagarde as Institutional Crypto Demand Defies Retail Slump

The key players in the market stay wary before the speeches of the chairman of the Federal Reserve Jerome Powell and European Central Bank President Christine Lagarde at the 2025 ECB Forum on Central Banking, during which they are expected to take the podium on Tuesday.

During its last policy announcement in late June, the Fed decided to leave the interest rate at the current rate of 4.25 – 4.5 percent pleading with patience in assessing the new economic reports before it proceeds with altering the interest rates.

Although the Fed has adopted a hawkish tone and its officials have warned about the near-term inflationary pressures associated to tariffs, the policymakers are still expected to take two rate cuts before the completion of 2025, which provides a certain relief to markets, who have sought a clear idea about the policy direction of the central bank.

After the decision made on the part of the Fed, Bitcoin, Ethereum, and XRP experienced a temporary recovery that is supported by the weaker US Dollar. On Tuesday, the US Dollar Index has hit 97, its lowest level since March 2022.

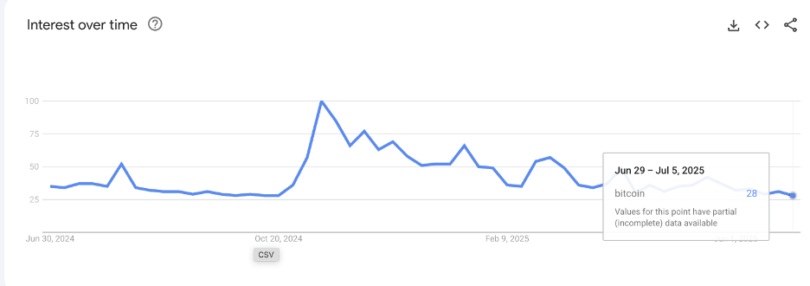

Nevertheless, the attention toward Bitcoin is not widespread. As the data demonstrates at Google Trends, the interest in search terms bitcoin reached 28 which is the lowest since October, whereas the price of BTC is more than $100,000 now. The intensity of interest, which reached 100 in the month of November, following the US elections was on the continuing downward trend since then.

Though such signs of retail slump, sentiment indicators they are positive. Crypto Fear & Greed Index is set to 64, which is rather bullish, according to CryptoRank data. Though this is an indication that traders and investors are having high risk appetite, it is also a factor that points to a possible correction because profit-taking is an attribute that accompanies spells of excessive greed.

Institutional activity on the other hand has remained resilient. On Monday, Spot Bitcoin ETFs registered approximately $102 million of net inflows with significant institutional demand. The grand total of BTC ETF during the last week equaled $2.2 billion.

Ethereum spot ETFs too sunk their teeth deeper in bullish momentum as they received $32 million in a day in terms of net inflows on Monday. To finalize the week of June 27, the inflow of ETH spot ETF was about $283 million, which again showed the keen interest of the institution when taking into account the weak mood of retail context.

Bitcoin Slides Toward Key Support as Altcoins Show Signs of Weakness

Bitocin (BTC) remains on extending its down leg, nearing major support at $106,500, last seen tested over the weekend before the short rebounded to a high Monday of $108,759. Momentum is also in the losing position, the Relative Strength Index (RSI) is down and stays slightly below the midline which shows decline of buying power.

In case the BTC breaks the support of 106.5K, then traders will focus on other technical levels. Further on the 8-hour exposure, the next line of immediate relieving would be at 50-period Exponential Moving Average (EMA) of 106146 and then the 100-period EMA of 105389.

Further push towards the bearish side might initiate a sharper 3.5% fall in the direction of the 200-period EMA, currently at 102,710, which may become a critical support area.

Conversely, if bulls manage to engineer a trend reversal from the current range, immediate upside targets include Monday’s local peak at $108,759, the psychological resistance at $110,000, and the all-time high at $111,980—representing a 5% recovery from current levels.

Altcoins Update: Ethereum and XRP Struggle to Maintain Momentum

Ethereum (ETH) is also under pressure, battling to stay above support at $2,464 where the 50-period and 100-period EMAs converge on the 8-hour chart. The drop follows a brief rally over the weekend that stalled at $2,522. Fading sentiment suggests ETH may revisit deeper support levels if buyers fail to regain control.

Should the downward trajectory persist, Ethereum could fall toward the 200-period EMA at $2,398. A more pronounced breakdown risks retesting June’s low of $2,111, which remains the critical downside target if market weakness accelerates.

Ripple (XRP) mirrors this bearish pattern, with resistance firmly established below its 200-period EMA at $2.21. The price is gradually descending toward the 100-period EMA at $2.18, with further downside potential toward the 50-period EMA at $2.16.

Traders are closely watching the Moving Average Convergence Divergence (MACD) for direction cues. While the MACD still holds a buy signal issued Friday, momentum is weakening. A bearish crossover—where the blue MACD line falls below the red signal line—may confirm a sell signal, increasing the likelihood of further losses.

Support levels to monitor include Friday’s intraday low at $2.06 and the June 23 trough at $1.90, both of which could be tested again if sellers intensify their grip on XRP.

Approval Odds for Spot Crypto ETFs Surge to 95% as XRP, SOL, and LTC Lead the Charge

The odds of accepting spot cryptocurrency exchange-traded fund (ETF) are now at 95 percent with Ripple (XRP), Solana (SOL), and Litecoin (LTC) as the leading contenders. The optimism is coming after an anticipation by investors in the prices of securities traded by the U.S. Securities and Exchange Commission (SEC), which may possibly conclude by the end of this week on whether to allow Grayscale to convert its Digital Large Cap Fund (GDLC) into the spot ETF.

On Tuesday, Bloomberg analyst James Seyffart tweeted through his X account that the likelihoods of spot crypto ETF approvals by the end of 2025 have further gone up. Seyffart writes that the probability of approval of XRP, SOL, and LTC is 95. Strong odds are also registered by other tokens, such as Dogecoin (DOGE), Cardano (ADA), Polkadot (DOT), Hedera (HBAR), and Avalanche (AVAX), amounting to 90%.

The euphoria of these applications is partly given the fact that SEC is soon to rule on an updated request by Grayscale to convert GDLC to a spot ETF. On Monday, the SEC formally recognized a revised S-3 filing by Grayscale and once it is clear that the regulators have no objections to it, it is possible to expect the decision of the SEC to come this week.

The GDLC fund contains five major cryptocurrencies BTC (79.90%), ETH (11.32), Ripple (4.99), Solana (3.01) and Cardano (0.78). According to the company data, the fund had almost 774 million in assets as of Monday.

BNB Breaks Out Amid Successful Maxwell Upgrade, Price Holds Above $656

In the meantime, BNB experienced bullish breakout, with prices increasing over 656 by Tuesday. The rally is after successful adoption of Maxwell hard fork, which has tremendously boosted the performance of BNB Smart Chain. The upgrade shortened the block time to 0.75 seconds implying faster transactions in addition to the increased efficiency of the validators.

Finality can now be accomplished in about 1.875 seconds providing faster assurance and elevated network nominalcy.

Announced on Monday, the Maxwell upgrade has already shown measurable impact. Data from BscScan indicates a rise in new wallet addresses, transactions, and overall network activity since the upgrade was completed.

Market sentiment appears increasingly bullish, as reflected in CoinGlass’s OI-Weighted Funding Rate, which flipped positive on Monday and rose to 0.0034% by Tuesday. This suggests that more traders are betting on BNB’s price increasing rather than falling, with longs now paying shorts.

The BNB price broke above the upper boundary of a falling wedge pattern on Saturday, gaining nearly 2% through Monday. The pattern, formed since mid-May by linking lower highs and lower lows, typically signals a bullish reversal when breached.

As of Tuesday, BNB is trading near $657. If the uptrend persists, the token could target its weekly resistance at $709.29.

Technical indicators support the bullish outlook. The Relative Strength Index (RSI) on the daily chart is at 55, surpassing the neutral 50 level, while the Moving Average Convergence Divergence (MACD) indicator flashed a bullish crossover on Saturday, reinforcing upward momentum.

However, in the event of a market correction, BNB may retrace its recent gains and revisit its daily support level at $646.04.