BTC Recovery Gains Momentum, Can Corporate Buying Sustain the Rally?

Bitcoin (BTC) resumed its recovery on Friday and is currently trading near the level of $112,000. The relocation indicates a weekly improvement of almost 4 percent, following a fall of 4.62 percent the previous week.

The resurgence is accompanied by consistent backing of the corporate and institutional investors, even as traders are wary in the run-up to some of the most important US employment data. The information may influence the future Federal Reserve interest rate and may determine the future trend of the biggest cryptocurrency in the world in terms of market value.

| Day | Minimum Price | Average Price | Maximum Price |

|---|

Fed Rate Cut Bets Lift BTC Outlook

Bitcoin has gone three consecutive weeks, hitting lows not seen since it was at its peak of 124,474, and dropped to 107,255 in the Asian session on Monday before it made a recovery. Towards the end of the European trading hours, on Friday, it stabilized at around $112,000.

It began picking up again with the US JOLTS Job Openings report on Wednesday, indicating a slowdown in the labor market, reaffirming that the Federal Reserve could lower rates in September.

According to the FedWatch tool, the CME Group indicated that there was a 99.3 percent probability of a 25 basis points (bps) reduction at the September meeting. The rate cut would deflate the US Dollar and enhance risk appetite, which would favor an asset such as Bitcoin. It is also expected that traders will at least have two additional cuts before the year 2025, which will also help to support risk-sensitive markets.

The same labor market malady was strengthened on Thursday, when Automatic Data Processing (ADP) announced that private-sector employers created 54,000 jobs in August. This was a big drop compared to the updated 106,000 jobs in July and lower than the projected 65,000.

The focus is now on the official Nonfarm Payrolls (NFP) August report, which is released on Friday at 12.30 GMT. Such a release is regarded by the participants of the market as one of the most important events that may influence the Fed rate policy and provide Bitcoin with the next obvious signal.

Institutional and Corporate Support Cushions Bitcoin Downside Pressure

Bitcoin has been cushioned on the downside this week by institutional and corporate investors. According to data supplied by SoSoValue, spot Bitcoin Exchange Traded Funds (ETFs) have inflows of $406.60 million as of Thursday. It will be the second consecutive positive flows, but the levels are still lower than in mid-July when Bitcoin momentarily reached $120,000.

The recovery trend was also contributed to by corporate activity. Nasdaq-traded CIMG Inc. announced on Tuesday that it sold 220 million of its common shares, raising 55 million dollars it then converted into 500 Bitcoins.

It buys Bitcoin as a part of its long-term acquisition plan. Japanese investment company Metaplanet purchased 1,009 BTC earlier in the week, bringing its total number of BTC up to 20,000 BTC. Meanwhile, Michael Saylor announced a dividend raise of STRC preferred stock to 10 percent, indicating Strategy (previously MicroStrategy) plans to fully leverage the value of its Bitcoin holdings.

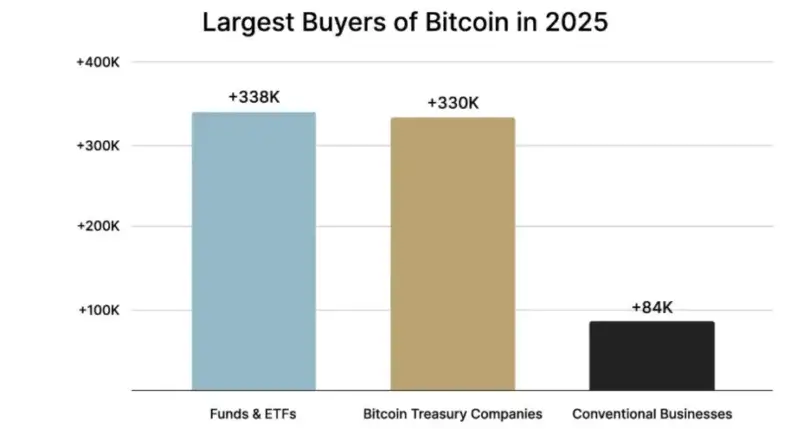

Bitcoin financial services provider River provided further background with a report indicating that treasury-oriented companies have become the second-largest daily purchasers of BTC in 2025, buying an estimated 1,400 BTC a day. This is because such purchases are motivated by high investor demand for the securities of such firms.

A survey of companies using its platform in July 2025 by River revealed that companies on its platform are devoting an average of 22 percent of net income to Bitcoin, with a median of 10 percent. The findings indicate that companies are well above the more frequently quoted 1% allocation and that there is a significant penetration in the market.

Market Sentiment Shows Signs of Recovery

The situation in the broad market has become better this week. The Crypto Fear and Greed Index shifted again to 48, which is a neutral score that indicates that bearish pressure has begun to decline. The indicator was at a four-month low last Saturday, which shows that everyone is very scared because Bitcoin is testing its July lows.

Ray Dalio, founder of Bridgewater Associates, contributed to the discussion in comments to the Financial Times. He indicated that crypto has now assumed the role of an alternative currency due to the limited supply of this currency. Dalio believes that in the event of an increase in the supply of US Dollars or a decrease in demand, cryptocurrencies will have an advantage.

He argued that fiat currencies with excessive debt are eventually displaced as workable stores of value, citing examples of such circumstances in the 1930s to 1940s and later in the 1970s to 1980s.

Bitcoin Remains the Primary Gateway to Crypto Adoption

Bitcoin is the main gateway to the digital world, as a new report by Chainalysis revealed. This week, the 2025 Global Crypto Adoption Index revealed that, within the period from July 2024 to June 2025, Bitcoin received more than 4.6 trillion of fiat through inflows. This is over two times the total inflows into all Layer 1 tokens other than BTC and ETH.

India, the United States, and Pakistan were also ranked by the report as the top three countries to adopt after followed by Vietnam and Brazil. India, Vietnam, and Pakistan contributed to the 69 percent year-over-year growth in on-chain transactions in the Asia-Pacific region. Close behind with 63 percent growth was Latin America, with strong adoption in emerging economies.

Bitcoin Price Forecast

The 4-hour chart showed that the price movement of Bitcoin validated the bullish divergence in the Relative Strength Index (RSI) that was witnessed on Monday and ensured the recovery. The cryptocurrency breached an overall downward trendline based on several highs since August 22. BTC recovered after revisiting this line on Thursday, and it was trading close to $112,000 on Friday.

When this trend persists, analysts believe that Bitcoin may challenge its August 22 high of $117,429. The RSI of 57, which is a stronger buying power, appears on the same 4-hour chart as above the neutral 50 level. Moving Average Convergence Divergence (MACD) also approaches a bullish crossover, which is another indicator of momentum on the upside.

Bitcoin ended the day above the 100-day Exponential Moving Average (EMA) at $110,753 on Tuesday and has maintained that position as support since then, despite the selling pressure of Thursday. An upward trend would increase the daily resistance to $116,000. Daily RSI stands at 47 and is trending in an upward direction towards neutral 50, indicating that bearish pressure is dissipating following the recent reversal. The positive view was supported by the daily MACD that indicated a bullish crossover on Friday.

Ethereum trades near $4450 as validator entry queue hits two-year high

Ether (ETH) is trading at an annualized range of 4,300-4,460 and has resisted the threat of falling by almost 4% per week. The outflows of ETFs and conventional September weakness have put a strain on market sentiment, but both retail whales and institutional investors have come to the rescue. According to on-chain data, over 218,000 ETH (worth nearly 1 billion) has been accumulated within the last few days, which has contributed to stabilizing prices.

Validator Entries Surpass Exits As Institutional Demand Rises

Ethereum staking dynamics changed when data on the Validatorqueue.com indicated that the queue to enter the validators exceeded exits on Thursday. The validator queue controls entry and exit of the participants and minimizes risks associated with large staking/unstaking events.

On Tuesday, the entry queue stood at 860,300 ETH, the highest in two years. In the meantime, the exit queue fell to 822,700 ETH on Thursday compared to the 1.05 million ETH high on August 29. This turnaround is causing analysts to lessen their fears of mass sell-offs as last month the increase in exits was less to do with large-scale profit-taking and more to do with portfolio realignment between liquid staking and lending platforms, they say.

In an X post, staking provider Everstake stated that sentiment and increasing institutional participation were improving as more and more validators joined. The figures at Strategic ETH Reserve also indicated more robust balances, which have swelled to 3.60 million ETH over the last few weeks.

BitMine Immersion Technologies (BMNR) reportedly bought over 80,000 ETH through an over-the-counter transaction with Galaxy Digital among clients, according to data from Arkham, which was cited by smart wallet tracker EmberCN. Besides this, SharpLink Gaming (SBET) announced that it bought approximately 39,500 ETH on Tuesday.

Ethereum Price Outlook

On the technical side, Ethereum is firmly above its upward trendline on the daily chart, and its short-term support is close to the 50-day EMA, which is at $4,053, and a further safety line at the 100-day EMA, which is at $3,580. The recent high of (4,956) and the critical psychological barrier of (5000) are observed as a resistance level and will play a critical role in the upcoming leg higher. Signs are displaying a guardedly optimistic future.

Relative Strength Index (RSI) is about 54, indicating slightly positive bullish action without being overbought, and most moving averages and other technical indicators on the platforms are reporting an ETF of Strong Buy.

Generally, Ethereum is coalescing inside the 4,200-4,500 zone, and the risks to the downside are limited by good support levels and the opportunities to the upside, depending on a break over 5,000 and above. There are market signs that, in the event of further accumulation and a reduction in macro pressures, ETH may soon be poised to test its recent tops once again.

XRP Price Holds Bullish Momentum Amid Market Volatility

XRP continues to display bullish momentum despite its recent corrective phases. After briefly dipping below $2.80, the token managed a swift rebound, reclaiming this level as support. This recovery has kept XRP aligned with an ascending trendline, a setup analysts describe as a potential trigger for significant upside movement. If momentum sustains, bulls may drive the token back toward its July highs, reigniting broader optimism across the market.

Insights from CMF Trading Point highlight XRP’s positioning at a pivotal juncture following the formation of an ascending trendline. Historically, this structure has signaled bullish continuation, and with buyers regaining control, conditions appear favorable. Currently, XRP trades around $2.82, showing resilience after reclaiming the $2.80 support level.

Should the ascending trendline breakout confirm, analysts set the first target at $3. Reaching this milestone could pave the way for a secondary push toward $3.40. Such a move would represent a 20% increase from current levels, with potential for further gains if momentum persists. Sustained buying pressure could even steer XRP toward fresh all-time highs.

However, analysts caution that failure to hold the ascending trendline could reverse XRP’s bullish structure. The critical threshold remains between $2.20 and $2.25; holding above this range is vital to maintain the breakout outlook. A breakdown beneath would undermine the bullish scenario and risk triggering a deeper correction.

If selling intensifies below $2.20, the price could test the $2 mark. Extended downward pressure might drag XRP below $2, exposing the token to renewed bearish conditions and the possibility of another prolonged market downturn.