BTC Slips Under $110K, ETH Accumulation Builds, SOL Sentiment Peaks

Bitcoin (BTC) slipped under $110,000 on Friday, extending its losses for the week. The world’s largest cryptocurrency is now down more than 10% from the record high it set in mid-August. The decline has triggered more than $1.8 billion in liquidations, mostly from long positions. Analysts say sentiment in both spot and derivatives markets remains weak.

BTC Falls Despite Powell’s Jackson Hole Remarks

The slide began early in the week. From its August 14 peak of $124,474, BTC dropped more than 13%, hitting a low of $108,666 on Tuesday. The fall came even after Federal Reserve Chair Jerome Powell gave a speech at Jackson Hole. Powell said the Fed would adopt a flexible inflation target and abandon the earlier “makeup” policy. He stressed that the Fed would take a balanced approach when different economic goals conflicted.

The correction caused heavy liquidations across exchanges. Data from CoinGlass shows the market lost more than $1.8 billion, with 74% of that from long trades. Bitcoin itself saw $544.3 million in long positions wiped out. The largest single liquidation, worth $39.24 million, happened on Huobi (HTX).

| Day | Minimum Price | Average Price | Maximum Price |

|---|

US Data Provides Some Stability

Bitcoin found temporary support near $110,000 in the middle of the week. U.S. economic data gave some relief. The Bureau of Economic Analysis revised second-quarter GDP growth to 3.3% from 3.1%. Weekly jobless claims also fell to 229,000 from 234,000, showing labor market strength. Traders are now waiting for the July U.S. core PCE Price Index. That inflation report is the last before the Federal Reserve’s September meeting and could set the direction for risk assets like Bitcoin.

American Bitcoin Preparing Nasdaq Listing

American Bitcoin, a mining firm backed by two of former U.S. President Donald Trump’s sons, is preparing for a Nasdaq listing. According to Reuters, the company is finalizing an all-stock merger with Gryphon Digital Mining (GRYP.O). Hut 8 CEO Asher Genoot confirmed trading could begin in early September. He said the merger offers better financing than a direct IPO.

The news came as the Bitcoin Asia conference opened in Hong Kong, the world’s second-largest crypto gathering. Eric Trump attended the event and is scheduled to travel to Tokyo this weekend for another meeting hosted by Metaplanet, a Japanese Bitcoin treasury company.

Institutional Demand Holds Up

Institutional flows into Bitcoin ETFs remained positive despite falling prices. SoSoValue data show spot Bitcoin ETFs recorded $567.35 million in inflows this week. That’s a reversal from last week’s $1.17 billion outflow. Corporate buyers also stepped in. Metaplanet and Strategy together bought 3,184 BTC on Monday, taking advantage of the pullback.

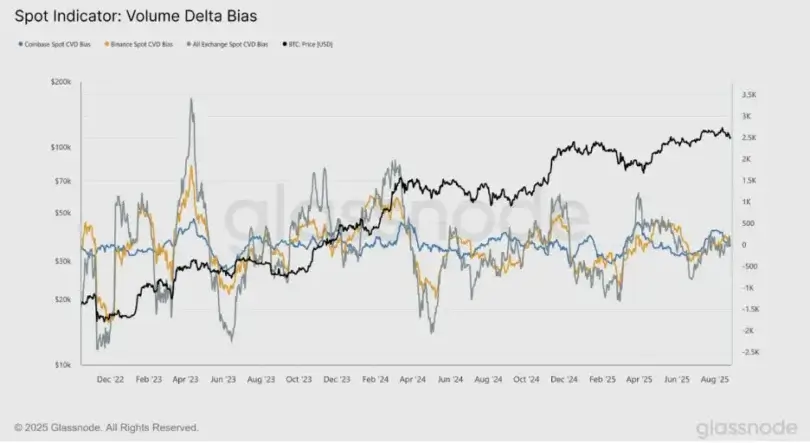

On-Chain Data Shows Neutral Demand

Glassnode data suggest spot market demand has turned neutral. The 30-day moving average of Cumulative Volume Delta (CVD) is now close to its 180-day median across Coinbase, Binance, and other major exchanges. This contrasts with April, when strong spot demand pushed BTC from $72,000 to new highs.

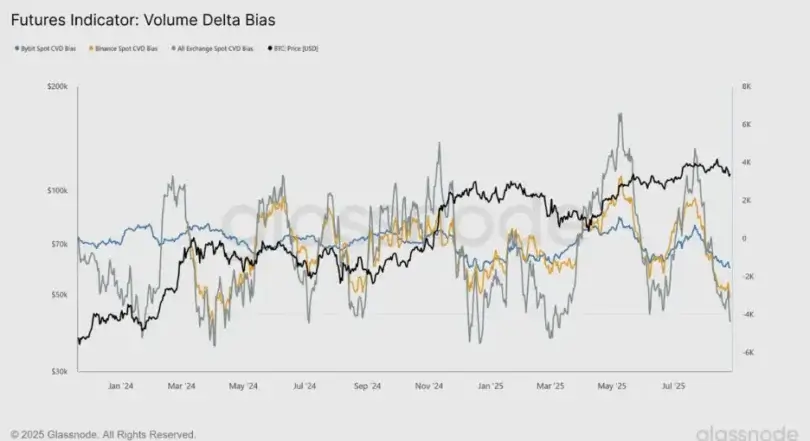

In derivatives, the tone has turned bearish. Futures CVD has been negative since July, showing sell-side pressure. Many perpetual traders are now favoring short positions.

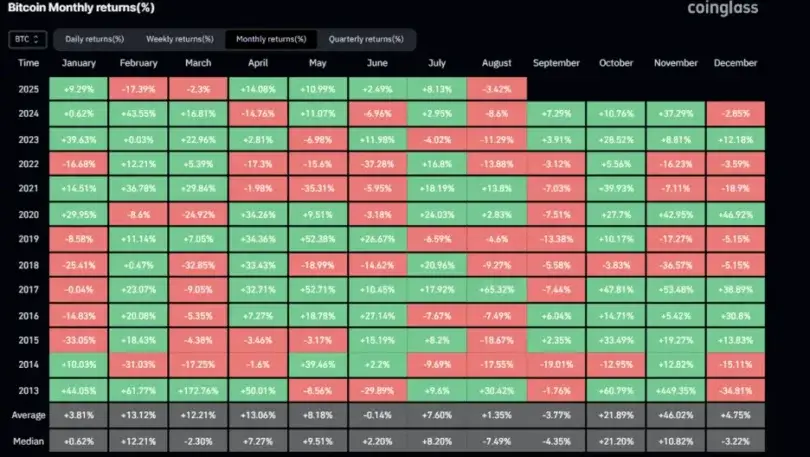

Bitcoin touched a record $124,474 on August 14 but has since slipped. It is already down more than 3% in September. Historically, September has been a weak month for Bitcoin, with average returns of -3.77%. Still, a Federal Reserve rate cut, combined with ongoing ETF inflows and corporate buying, could help the market recover.

Bitcoin Price Analysis

The weekly chart shows Bitcoin falling for three straight weeks since mid-August. It has dropped below the $111,980 support level. If the weakness continues, the next target could be $104,463. The weekly RSI has slipped to 55 and is pointing down. The MACD has also turned bearish, suggesting momentum is fading.

The daily chart shows similar weakness. Between Saturday and Monday, BTC fell more than 5% and closed under the 100-day EMA at $110,849. It briefly stabilized midweek but fell again, now trading below $110,000. If the slide continues, the next key support is the 200-day EMA near $103,974. The daily RSI is at 39, confirming strong bearish momentum.

Still, if Bitcoin manages to reclaim the 100-day EMA, resistance near $116,000 could be the next upside target.

Ethereum Holds Steady Around $4,500 as ETFs Bring Inflows and Whales Accumulate

Ethereum (ETH) traded around $4,500 on Thursday. The price showed little movement, but institutional and whale accumulation continued.

ETFs and Whales Drive Buying

Ethereum ETFs have brought in $4 billion in net inflows since early August, according to SoSoValue. Wednesday added $309 million, making it the fifth straight day of inflows. Bitcoin ETFs, meanwhile, saw $800 million in outflows this month. Some analysts say institutions may be shifting toward ETH.

“There is a relentless bid for ETH right now,” Bitwise CIO Matt Hougan wrote on X Thursday.

Institutional filings show major firms among the top ETH ETF holders in the second quarter. These include Goldman Sachs, Jane Street, Millennium Management, and DE Shaw, according to Bloomberg analyst James Seyffart.

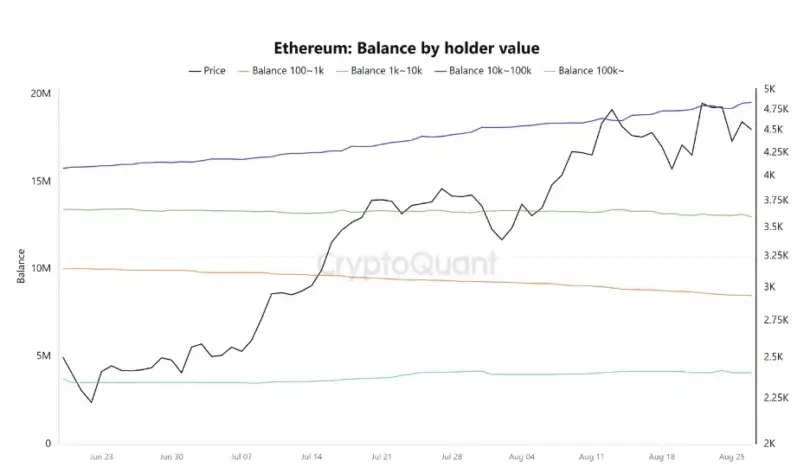

Whale wallets holding between 10,000 and 100,000 ETH have accumulated over 340,000 ETH in the past three days. Their total purchases in August now stand at 1.44 million ETH.

Corporate treasuries are also adding ETH. Firms like BitMine Immersion (BMNR) and SharpLink Gaming (SBET) now hold a combined 3.3 million ETH, worth around $15 billion. This buildup comes only three months after treasury allocations to ETH began gaining traction.

VanEck CEO Jan Van Eck described ETH as the “Wall Street token,” pointing to its role in stablecoins and financial infrastructure.

Still, profit-taking is visible. ETH holders have realized nearly $1 billion in gains over the past five days, showing selling pressure alongside buying.

ETH Futures Face Liquidations

In derivatives, Ethereum futures saw $88 million in liquidations in the past 24 hours. That included $63 million from long positions and $25 million from shorts, Coinglass data show.

ETH failed to hold above $4,600 earlier in the week and fell back to $4,500. That level is currently supported by the 14-day EMA. Analysts warn that a break below the EMA, combined with a drop under $4,000, could send ETH toward the 50-day SMA. A failure there could push prices closer to $3,470.

On the upside, ETH would need to reclaim its all-time high and flip it into support to fuel another rally.

Momentum indicators point to indecision. The RSI and Stochastic Oscillator are just above neutral but moving sideways, showing hesitation among traders.

Solana Sentiment Hits 11-Week High With Price Rally

Social media sentiment toward Solana (SOL) has reached its highest level in 11 weeks, matching the token’s latest price recovery.

Analytics firm Santiment reported that the ratio of positive to negative posts about Solana is the strongest since mid-June. The firm shared its data on X, showing a clear rise in its Positive/Negative Sentiment metric.

The tool measures how often Solana is discussed in bullish or bearish terms. It classifies posts, threads, and messages, then compares the totals. The latest reading shows 5.8 bullish mentions for every bearish one. That is the highest since June 11.

The increase in optimism is tied to SOL’s recent rally. The token has gained 16% in the past week, drawing interest from both retail and institutional traders. But analysts warn that extreme optimism can be risky. In the past, crypto markets have often moved opposite to the crowd’s expectations. Sharp rallies sometimes mark local tops, just as heavy fear can precede bottoms.

With Solana sentiment now at an 11-week high, some question whether enthusiasm and FOMO could challenge the rally’s strength.

Development Activity in the Solana Ecosystem

Santiment also shared data on developer work within the Solana network. The metric, called “Development Activity,” measures coding contributions on public GitHub repositories linked to Solana projects.

Over the past 30 days, Solana led with a score of 138.37. Wormhole followed at 41.47, while Drift ranked third with 31.9. The numbers show Solana remains the most active project within its ecosystem, with developers continuing to build and expand on the chain.

Together, rising sentiment and steady development reflect both optimism and progress. Still, analysts caution that sentiment-driven rallies may not last, making the next few weeks important for testing Solana’s momentum.

Solana Price Analysis

Solana (SOL) has been under pressure over the last 24 hours, and the market has fallen approximately 2-3% to be around the level of 208. The token traded between 205.7 and 217.8 with a degree of profit-taking following the recent increase. As of press time, Solana is moving in bullish momentum, currently trading at $209.90.

The 50-day simple moving average is moving around $198, and the 200-day exponential moving average is moving around 202, both serving as underlying support. The Relative Strength Index (RSI) has been maintained at the range of 60 across the platforms, indicating that there is rising momentum.

Meanwhile, the total value locked (TVL) on the Solana network has increased by approximately 15 percent to 11.6 billion, which highlights the activity in blockchains. Analysts note $205 and 200 as key support levels, with the resistance between 210 and 215. An aggressive move beyond these levels would be the gateway to $250, and some of the forecasts even beyond that.