Crypto Market Outlook: ETH Faces 25% Decline and BTC Amid $58B Crypto Market Crash

The crypto market reacted with intense selling after Chinese artificial intelligence startup DeepSeek launched on Friday, causing Ethereum’s price to drop by 8%. Technical analysts see the most successful cryptocurrency close to a vital price floor where losses could reach 25%. Major ETH investors and derivatives players keep adding to their holdings because they see future gains ahead.

Summertime brought big coin sales by Ethereum investors which drove the price below $3,200. Saturday saw investors make more than $430 million in profits from the platform which tracks this metric. During Monday’s market sell-off traders reported financial losses of $50 million.

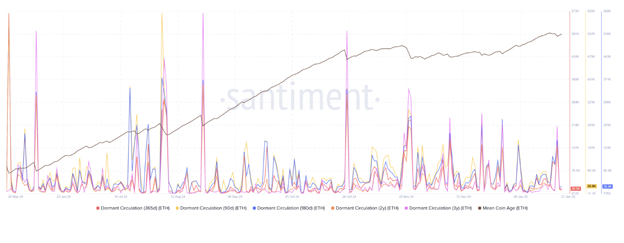

Investor age groups demonstrated a collective selling wave through rising Dormant Circulation as short-term and long-term holders sold their Ethereum holdings. Ethereum keeps falling in value because analysts predict it will keep losing ground.

Whales Accumulate as Futures Market Shows Optimism

Recent changes in Ethereum’s supply distribution tell us things may improve soon. Large investors have bought over 120,000 ETH coins in the past three days because they believe Ethereum’s value will rebound soon.

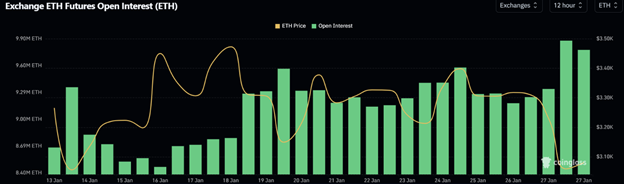

On Monday, the number of traders holding Ethereum futures rose to 9.77 million ETH despite the lower prices. Market traders believe the recovery will happen quickly because they invest in Ethereum.

Whale investors and derivatives traders believe Ethereum will bounce back despite ongoing selling pressure.

During their Friday call, most Layer 2 executives agreed to use both “based” and “native” rollups to make Ethereum more resilient and decentralized. The team wants to improve transaction handling on the blockchain to keep vital operations running smoothly and safely.

On Saturday, venture capital firm Paradigm released an article that supports faster Ethereum protocol updates. The company chose to develop the network faster than to postpone updates for decentralization.

Ethereum Price Analysis: Potential 25% Decline if Key Support Fails

New data from Coinglass shows investors sacrificed $140.22 million worth of Ethereum futures contracts over the last day to manage their positions. Data from Coinglass shows market volatility increasing because traders exit $121.61 million long positions plus $18.62 million short positions.

The cryptocurrency shows a Head-and-Shoulders pattern on its 8-hour graph once it crosses below the $3,200 resistance level. Experts predict ETH could decline 25% after it breaks through the $3000 barrier when trading volume remains strong below that value and moves toward the buying zone at $2200. By measuring the H&S pattern from $3,000, we obtain this specific target for the market.

ETH’s price may face slower bearish pressure when traders break through $2,817 because that price point successfully defended the market from April to July 2024. If trading volumes push Ethereum’s price below $3,000, it will accelerate its price decline.

Upside Potential and Technical Indicators

The recent movement shows Ethereum could grow again when it clears a descending selling range that began last December. A strong daily close above $3,550 would end the bear market expectations and create an opportunity for Ethereum to return to an upward trend.

The bear market continues to dominate because the RSI and Stoch have fallen below their important threshold lines.

The Ethereum market depends on these price points to determine where the asset will go. Investors track these points as the network moves through its significant moment.

Bitcoin Price Falls to 12-Day Low Amid Whale Sell-Off Post-Trump Inauguration

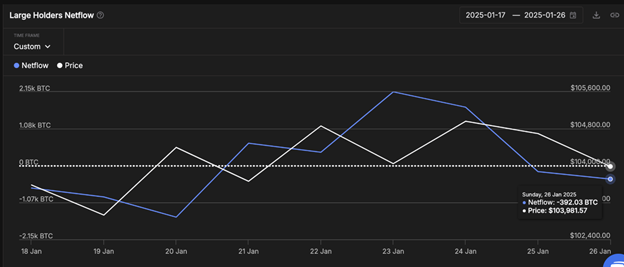

On Monday, Bitcoin hit $98,500, its lowest value in 12 days since January 15. The analyses show that whale investors made specific money moves after Donald Trump became president, which first pushed the bitcoin market downward.

The cryptocurrency market experienced a sudden price drop due to multiple positive Trump events returning to focus. On January 20, Bitcoin peaked at $109,000 during the inauguration ceremony before price fluctuations brought it down to the $105,000 range.

Bitcoin lost value during Monday’s U.S. trading session as investors struggled to achieve their target of breaking past $110,000. Within 24 hours, Bitcoin’s price decreased by 6%, reaching its lowest level in 12 days when we analyzed on-chain figures.

Whale Activity Triggers Market Volatility

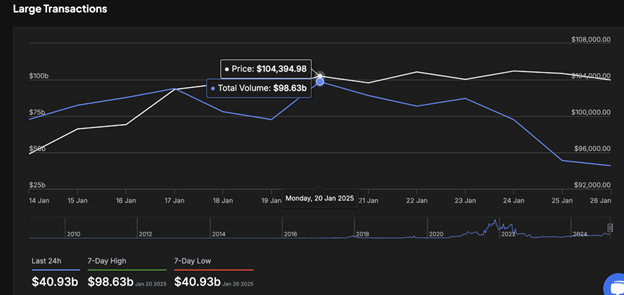

Bitcoin touched bottom due to reduced buying by big investors who sold $58 billion of short-term holdings. According to IntoTheBlock information, big transactions surpassing $100,000 showed a drop.

Market participants adopted this new perspective primarily because they focused on industry value changes. The inexpensive Chinese AI product Deepseek challenges the valuation assumptions of major AI firms, creating investment strategy challenges.

The Trump presidency’s volatility makes corporate investors reassess their strategies which adds to Bitcoin’s market pullback.

Bitcoin Whale Transactions Plunge Following Inauguration Euphoria

The largest Bitcoin transactions hit $98.3 billion on January 20 as traders reacted strongly during inauguration celebrations. After Bitcoin whales witnessed Trump’s media coverage turn to memetic policies, they dropped their BTC trading amounts.

The latest IntoTheBlock Sunday update shows that this market topped out at $40.9 billion in large Bitcoin transactions on January 20. According to the data, Bitcoin large holder transactions have decreased since Thursday. Users made a large BTC sell-off of 566 coins worth $55.5 million during the 48 hours before Bitcoin market prices fell on Monday.

During Trump’s initial week as president, Bitcoin stayed above $103,000 because of his administration’s chosen plans. During Trump’s first week in power, $TRUMP and MELANIA meme tokens were launched alongside Gary Gensler’s SEC departure and WLFI acquisitions alongside Trump’s Department of Government Efficiency DOGE establishment executive order.

Even though trading activities increased with these events, they didn’t lead to meaningful improvements in cryptocurrency fundamentals. Large institutional investors withdrew $58 billion from the whale market after noticing the opening rally momentum dying.

After Monday’s $860 million cash offering, most institutional investors stayed safe from significant losses while Whales still held major assets. Research says companies will see ways to buy Bitcoin again once its value falls further.

Bitcoin Price Analysis

The daily BTC/USD chart shows technical indicators moving toward balance after recent selling pressure continued. Bitcoin trades at $103,255, showing an increase of 2.5% in 24 hours.

The Parabolic SAR places dots above prices to show a downward market trend until Bitcoin breaks through $109,588 to signal a shift. RSI indicates a neutral position at 48.75 because the indicator holds a value between 0 and 100. The market continues growing as the Relative Strength Index shows low purchase intensity.

Its critical support and resistance areas will determine Bitcoin’s moving direction. Bitcoin usually moves higher after sustaining its price above $97,500 because this barrier represents a past support area that launched the price upward. When this scenario happens, Bitcoin will probably bounce back to $103,260, which may begin another bullish market phase.

If the $97,500 support breaks down, the market will accelerate towards $94,000 and possibly lower prices. When this happens, the price strength indicator will likely fall into a highly negative range, confirming a negative market direction.

Market players carefully monitor these important price boundaries as Bitcoin moves through its unstable times.