Crypto Market Prediction: Bitcoin Drops Below $100K as China Retaliates on Tariffs, While Pepe Liquidations Exceed $20M

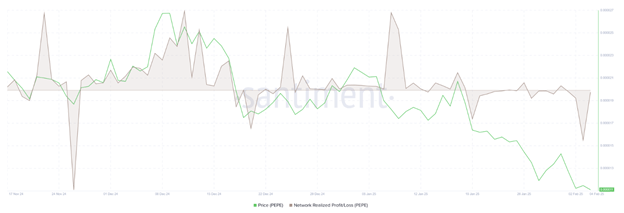

The frog-themed meme coin PEPE remained unpredictable on Tuesday at $0.000010 after a 23% drop last week. The PEPE market downturn triggered $20 million in investor sell-offs for two days straight. Market behavior shows traders expect prices to decline because funding rates have become negative, and Network Realized Profit/Loss numbers have fallen strongly.

On Monday, PEPE lost further value by 11% and reached its lowest price of $0.000007 on November 5 during the Asian trading hours. The token showed a small recovery, gaining 2% in price during the market close. On Feb. 5, CoinGlass data showed traders had to sell $20 million of positions within 48 hours of declining market values.

The continuous round of liquidations creates market fears through Uncertainty and Doubts as investors watch their positions go south. Market analysts predict that negative emotions and transaction volumes combine to undermine the price of PEPE.

On-Chain Data Signals Possible Further Downtrend

The available blockchain data shows Pepe’s poor market performance will likely continue. The OI-Weighted Funding Rate for PEPE shows a negative number since traders expect the price to keep falling.

Market professionals believe PEPE needs a positive change in trader mood and increased buying force to prevent further price drops today and tomorrow.

The current market shows Pepe (PEPE) investors becoming more negative because futures contracts and on-chain transactions indicate massive selling activity.

The latest futures trading activity shows traders with long contracts paying short others who hold Pepe (-0.0059%), which is usually viewed as a bearish market trend. A positive funding rate shows traders are optimistic, whereas a negative rate shows traders expect price drops in the market.

The latest NPL measurements from Santiment show that network investors took losses during this period. The NPL market stress indicator revealed that many traders sold their assets at a loss during the weekend as their value jumped from -1.32 million to -48.36 million between Saturday and Monday.

The strong downward movement in the metric shows when investors start selling in panic mode and admit defeat in their investments. Multiple bearish indicators make market watchers reluctant to predict Pepe’s short-term performance.

Pepe Coin Faces Continued Decline Amid Bearish Pressure

On Jan. 18, the PEPE price hit powerful resistance from a descending line that connected all its highs since early December. Two weeks later, the cryptocurrency market corrected 47% after investors rejected this level, dropping below its 200-day Exponential Moving Average at $0.000014. By Tuesday, the PEPE market value fell further and traded near $0.000010.

Since market experts watch for PEPE to stay above $0.000010 for one day, they see longer market drops ahead. A continuous price drop at $0.000010 might push PEPE down by 40% to reach $0.000010 from August 5.

Technical tools indicate a downward trend for PEPE because the daily Relative Strength Index stands at 32 and decreases. The RSI shows market prices need to fall more before selling strength decreases.

Bitcoin Rebounds After Weekend Sell-Off as Institutional Investors Step In

Bitcoin took a hit from intense investor selling as major economic nations clashed throughout the weekend. U.S. traders sold their risky assets before the market opened because they saw rising U.S. inflation risks and financial worries. The strong selling activity caused BTC’s value to plunge due to market participants’ negative views about trading.

After Bitcoin’s value wavered, institutions saw an opportunity to buy large amounts, which caused a rapid market recovery. The trading data on TradingView shows BTC gained 6% in price before hitting $101,000 when our report was made. These quick price rebounds demonstrate that investors use Bitcoin to shield their money from economic issues.

The ongoing trade tension creates global financial insecurity, but market experts predict Bitcoin will gain popularity. Traditional market volatility rises when protectionist economic measures appear, so investors invest in alternative assets. Market traders expect Bitcoin to equal or surpass its old price levels within the next few periods.

People track Bitcoin movements by studying Coinglass Liquidation Map charts, which visualize leverage-based trades. The charts show many large speculative positions have built up close to important prices, which traders will fight to defend. Market analysts predict that traders will strongly defend current Bitcoin portfolio positions, which adds significant barriers to tracking Bitcoin price movements quickly.

| Day | Minimum Price | Average Price | Maximum Price |

|---|

Investors use Bitcoin as a haven because global security challenges and economic patterns keep affecting the market.

Bitcoin Slips Below $100K as Market Reacts to US-China Trade Tensions

When trading started on Tuesday, Bitcoin’s value declined nearly three percent, reaching below $100,000. The price recovery from $91,231 the previous day influenced this movement. The digital currency market is unpredictable today because investors must consider rising US-China trade tensions, which create uncertainty among investors regarding risk-based assets.

According to Ben Zhou, the CEO of Bybit, total Monday liquidations reached values between $8 billion and $10 billion versus the reported $2 billion figure. He explained that Bybit data indicated $2.1 billion in 24-hour liquidations, while Coinglass showed only $333 million after accounting for API data limitations.

During the opening of Asian trading hours, Bitcoin dropped hard to $91,231 and then returned above $101,300 by Monday’s close. The first market downturn started after former US President Donald Trump initiated trade taxes on key international partners like China, Canada, and Mexico. This market policy negatively affected overall crypto prices.

| Month | Minimum Price | Average Price | Maximum Price |

|---|

Bitcoin bounced back after Trump introduced the idea of setting up America’s first-ever state-controlled investment fund for growth. The news has led crypto enthusiasts to guess if Bitcoin will join the fund and find new hope for investors.

Bitcoin Keeps Struggling During Ongoing Trade Negotiation Updates

The trading day started with Bitcoin struggling by 3% in European business hours. Traders watch US-China trade negotiations because they impact Bitcoin prices by affecting investors’ feelings about the market.

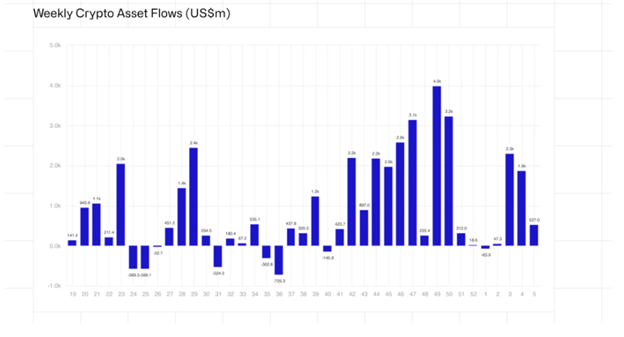

A CoinShares report from Monday shows Bitcoin and other digital assets are starting to recover after market softening. Investors put $527 million into digital asset investment products during the week but continued to watch the progress of the trade talks between China and DeepSee. Bitcoin’s inflow hit $486 million during the same period, but bitcoin short positions received $3.7 million for their second straight influx.

Bitcoin Price Forecast: Further Correction Possible

The bitcoin market shows a developing correction phase, with the currency being put at $98,200 on Tuesday. The market trend keeps pushing BTC prices down, so traders expect it to hit the critical $90,000 barrier.

The market indicators show that more traders are developing negative Bitcoin expectations. The daily Relative Strength Index shows 44 points as traders keep pushing prices down because it did not breach the neutral level of 50. The Moving Average Convergence Divergence indicator crossed below its signal line on Friday to hint that BTC needs to fall further in the upcoming days.

If BTC improves beyond $100,000, its price could recover from its peak of $106,012. However, bitcoin traders are hesitant because upcoming world trade changes and economic plans could strongly influence market trends.

Bitcoin now reacts faster to major macroeconomic changes than other U.S. stocks, which have responded to past decisions made by President Donald Trump. Even though Bitcoin links more strongly to world finance now, it has shown a strong market position through past periods. Despite economic downturns, Bitcoin’s price surpasses previous election levels while surpassing the S&P 500. Bitcoin closely follows the ongoing changes in worldwide money supply levels

The Bitfinex analysis shows that Bitcoin acts more like a monetary tool than a digital currency since it reacts strongly to US policy changes and global financial transfers. Market experts found that BTC values shifted as major economic measurements like inflation rates and Fed rate adjustments took effect in recent months.

| Year | Minimum Price | Average Price | Maximum Price |

|---|

The reaction in global finance markets grew stronger over four days due to President Trump’s statements that increased uncertainty for investors. Bitcoin reacted to this market situation by falling below the $100,000 point and reaching its lowest price of $91,657 on Monday. The market values of Bitcoin suggest the cryptocurrency could experience an important price shift

Bitcoin nosedived at the $108,000 mark after Trump’s start as president and has stayed inside a 15% price zone since mid-November 2016. Bitfinex analysts confirm that such price volatility creates either an upward or downward movement towards 80-90 days, which indicates an imminent price shift.

The Bitfinex team explains that BTC will continue to decline in market value unless major financial systems start gaining ground. Although Bitcoin faces market ups and downs at present, experts have a positive long-term opinion about its growth potential.

This content is not intended for U.S. or Canadian residents. We disclaim any liability for losses incurred based on the information provided.