Crypto Market Update: Bitcoin Surges, Ethereum Rises, Uniswap Hits New Low

The price of Bitcoin (BTC) held at nearly $82,500 on Wednesday while showing a recent increase of 5.52% in the previous day. Recent research from K33 highlights ongoing selling pressure which affects both stock markets together with cryptocurrency markets because investors fear worldwide economic instability. Forthcoming United States macroeconomic indicators may intensify the price volatility of high-risk assets including Bitcoin according to market analysts.

The Tuesday issue of K33 Research’s ‘Ahead of the Curve’ report confirms how rising recession worries and political changes under President Donald Trump and growing tensions over a trade conflict result in major market volatility. Bitcoin set its annual minimum at $76,555 during November when the S&P 500 and Nasdaq experienced their worst decline since September. The cryptocurrency demonstrated a 5% depreciation over the week.

The document demonstrates that Bitcoin demonstrates stronger stability than stock investments during periods of general market volatility. Events under Trump’s administration strengthened financial market de-risking but led to the successful progression of Bitcoin-related promises through the creation of a working group and the development of a national BTC reserve several days ago.

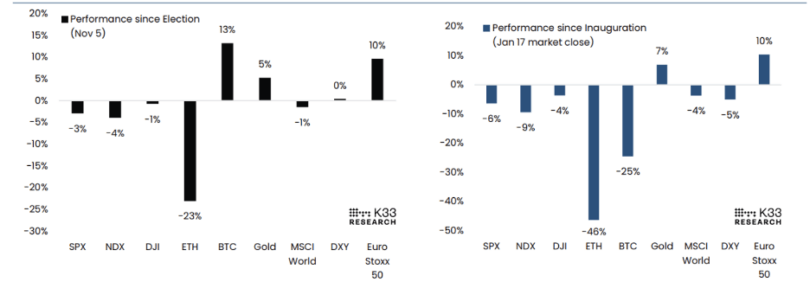

Bitcoin’s performance in the market reveals conflicting patterns documented through market statistics. Bitcoin achieved a 13% increase since the 2024 US presidential election thus outperforming other major investment classes. Since Trump took office on January 13 Bitcoin has undergone a 25% decrease while Ethereum lost 46% of its value to establish itself as the worst-performing cryptocurrency.

Market participants track the upcoming US CPI data for Wednesday as well as the PPI data for Thursday because these reports will shape Bitcoin’s future direction. These economic indicators will determine the industry’s risk tolerance and impact Bitcoin’s movement before the Federal Reserve makes its March 19 interest rate decision.

The crypto trading community expects market movements since Bitcoin remains between $83,000 and $76,000 at present. Additional downward pressure exists on Bitcoin along with other risk assets when the Federal Reserve adopts a hawkish stance which strengthens both US Dollar and bond yields.

Crypto Market Struggles Despite Policy Moves, Bitcoin Correlation Signals Volatility

Combining U.S. President Donald Trump’s executive orders with the proposed Strategic Crypto Reserve initiative and Senator Cynthia Lummis’ recommendation for Bitcoin accumulation of up to one million units within five years has failed to produce any market recovery indication.

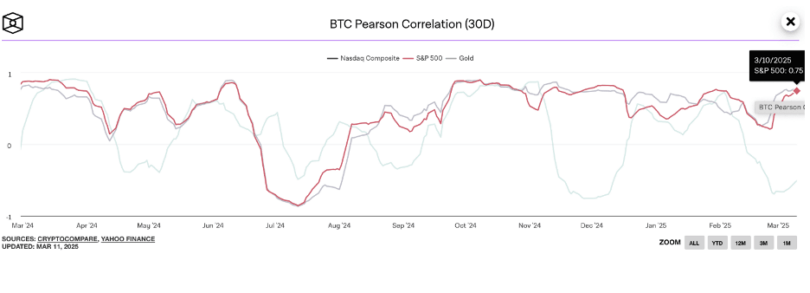

Data on TheBlock’s 30-day Bitcoin Pearson Correlation chart demonstrates substantial relationships between Bitcoin and the S&P 500. The current correlation value between Bitcoin and the S&P 500 stands at 0.75 as of March 10 on a scale from -1 to +1. The price fluctuations of Bitcoin demonstrate a maintained relationship with movements present in the U.S. stock market.

The current correction in both the S&P 500 and Nasdaq Composite indices leads experts to predict Bitcoin prices will continue showing instability. The execution of Trump’s policies creates an expected downward trend in the crypto market that will possibly play out in upcoming days.

The Bitfinex report released Monday shows that Bitcoin prices declined due to major sell-offs caused by economic factors in the market. Research shows that investors are capitulating due to selling Bitcoin at losses which accounts for most current market pressure.

From February 28 to March 4 Bitcoin traders experienced a major loss of $818 million per day which became one of the worst financial outcomes they have faced.

Capitulation phases usually signal market stability yet analysts insist that current economic worldwide and geopolitical turmoil keeps traders extremely responsive. Buy-side absorption metrics along with ETF inflows should receive close monitoring by traders for making suitable trading choices in upcoming weeks.

Bitcoin Struggles Below 200-Day EMA, Eyes Recovery Amid Market Volatility

Bitcoin prices broke below the $85,664 value of its 200-day Exponential Moving Average on Sunday which led to a 9.14% market value decrease the next day. The primary digital currency found stability in the area of $76,600 while it bounced up 5.52% during Tuesday trading. BTC maintains its present value at the $82,500 mark on Wednesday.

Market experts predict Bitcoin falling beneath $78,258 based on ongoing market corrections as this level marks the February 28 trading low. Potential price declines would likely push the value toward $73,072 when operating under such market conditions.

The daily Relative Strength Index maintains a value of 39 as it moves upward from its position at 30 during Monday’s session. The current upward trend of the market shows that bearish momentum is fading which indicates the possibility of leaving in an oversold zone. Bitcoin needs the RSI to surpass the 50-point neutral level to build a sustainable price recovery.

A growing bullish sentiment might enable BTC to reach $85,000 while it claims back significant resistance zones.

Ethereum Rises 3% as Fidelity Seeks SEC Approval for ETF Staking

The continuous growth of Ethereum (ETH) by 3% on Tuesday happened just after Cboe BZX Exchange decided to submit a notification to the U.S. Securities and Exchange Commission (SEC) about Fidelity’s plans to combine staking with its spot Ethereum exchange-traded fund (ETF).

Fidelity Moves to Enable Staking in Ethereum ETF

On Tuesday Cboe BZX Exchange submitted a 19b-4 form to the SEC for modifying the Fidelity Ethereum Fund (FETH) to enable staking of the asset. The Exchange has requested alterations to specific parts of the ETH ETP Amendment No. 2, as amended, per the discussions with the Sponsor to enable staking of ether Trust assets, the filing mentions.

After Grayscale and 21Shares Fidelity has filed identical petitions to the SEC for authorizing stake holdings in their ETFs.

ETF issuers have focused on staking as an essential topic because this process lets crypto holders generate passive income by supporting blockchain security.

SEC Leadership Shift Could Signal Policy Change

Ethereum spot exchange-traded funds are likely to reintroduce staking now that Gary Gensler resigned as SEC chair on January 20 and new governance changes at the agency have taken place.

The majority of issuers dropped staking from their proposals to Ethereum ETFs in July 2024 due to doubts about how the Gensler-led SEC would receive the feature.

Under the older Trump administration and the leadership of SEC acting Chair Mark Uyeda who exhibits pro-crypto attitudes, the regulatory agency may review its position about staking.

Industry Experts See Staking as a Game Changer

According to ETF Store President Nate Geraci, the approval of staking protocols would enable US spot Ethereum ETFs to deliver greater performance than Bitcoin ETFs.

On Tuesday Ethereum ETFs managed a price increase yet saw a $37.50 million withdrawal in funds during the previous day Monday.

The cryptocurrency market signals potential upside potential for Ethereum whenever prices break past the $2,200 resistance level while massive trading positions suffer heavy losses.

Ethereum shows signs of future recovery following the recent $131.39 million liquidations of ETH futures contracts during the last day based on Coinglass data. Among the total market positions that were liquidated were $83.31 million from long positions and $48.09 million from short positions.

The $1,750 value serves as ETH support after analysts applied a downward projection using the percentage change from the $2,850 and $2,200 rectangular trading patterns.

The altcoin faces potential approval to target $2,850 if it sustains support at $1,750 while also reestablishing prices at $2,200. Market data shows possible signs of a turning point in the market trend. RSI and Stoch have recouped their extreme bearish ranges which demonstrates a weakening bearish market trend. When ETH closes daily below the $1,500 price mark it could prevent market recovery and drive the cryptocurrency toward the round figure support at $1,000.

Uniswap (UNI) Dips to $5.84 Amid Rising Selling Pressure

Uniswap (UNI) extended its falling trend on Wednesday when it reached $5.84 against a nearly 9% decrease between the previous and current days. The Exchange Flow balance of UNI showed a positive shift while the market observed this price drop. A Whale wallet known as Lookonchain sent 2.25 million UNI tokens worth $13.71 million into Kraken exchange. The transfer reflects a needed strategy to minimize financial impact during unstable market conditions.

On-Chain Data Signals Bearish Trend

The price decline of UNI has driven its value to August 7, 2024 levels which demonstrates widespread negative market sentiment. The growth in retail selling pressure becomes visible through in-blockchain analytic data.

The Exchange Flow balance measure from Santiment shows that UNI token supply on exchanges experienced a rapid surge. Positive Exchange Flow values indicate more withdrawal activities than inflow behaviors for UNI tokens thus demonstrating amplified selling interests on crypto exchanges.

During the period between Tuesday and Wednesday, the Exchange Flow balance of UNI at UNI’s exchanges altered substantially from -428920 to 2.23 million which led to hostile price expectations. The entire supply of UNI tokens available on exchanges expanded by 2.67% within one day due to decreased interest from investors during this period.

Uniswap Faces Bearish Signals as Network Activity Declines and Whale Transfers Tokens to Kraken

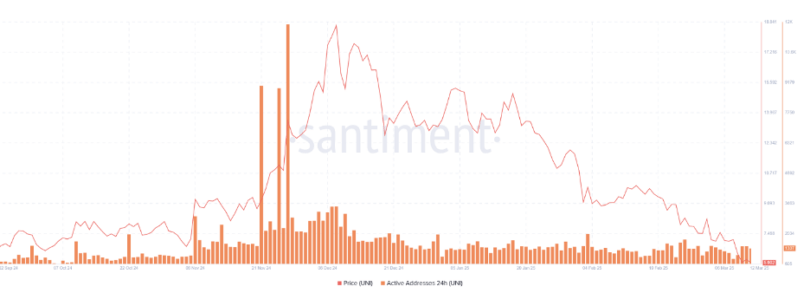

Uniswap demonstrates decreasing network activity based on the Daily Active Addresses index presented by Santiment. The time-based blockchain usage metric shows bearish market conditions when it decreases because it indicates a reduction in network demand.

The network engagement for Uniswap diminished as its Daily Active Addresses dropped constantly from mid-November. The decreasing trend in demand for UNI creates doubt about upcoming price movements in this token.

A whale wallet originating from Lookonchain sent 2.25 million UNI tokens worth $13.71 million to the Kraken exchange on Wednesday as reported by Lookonchain data. The wallet purchased tokens worth $6.92 on average from September 7, 2023 until November 18, 2024.

During the time of maximum value, the whale accumulated $26.5 million worth of unrealized profits. The market decline turned the wallet’s value into a negative figure worth $1.86 million. Experts speculate the transfer of funds to Kraken represents an attempt to reduce financial losses through trading activities which may worsen selling volume on UNI while pushing its price downward. For traders looking to capitalize on market movements, platforms like Margex provide a seamless way to buy and trade crypto with advanced risk management tools.