Crypto Price Prediction: Bitcoin Drops Below $109K Post-Trump Inauguration, PEPE Faces Correction, and Ethereum Eyes DeFi Rally

The price of Bitcoin held steady above $102,000 Tuesday despite its previous peak of $109,588 reached on Monday. Data from Santiment shows BTC prices quickly dropped as traders became greedy and rushed to buy before missing out on potential gains.

Before President Donald Trump’s inauguration on Monday morning, Bitcoin shot up to its highest-ever price point at $109,588. After the inauguration, BTC suffered a steep 6.68% price decline and ended the day trading at $102,260. Experts believed the market fell after Trump spoke during his inauguration since he avoided talking about Bitcoin and other digital currencies.

According to Coinglass market information, Bitcoin liquidations totaled $253.45 million over the past day, with the top BTCUSDT liquidation at Binance reaching $12.54 million.

Santiment tracked intense market enthusiasm and panic among users on X Twitter Reddit Telegram 4Chan and Farcaster. Recently, the market has repeatedly buckled under public expectations before this pattern.

Monday’s surge in public predictions about BTC price increases showed traders might start selling their coins soon. In mid-December, Bitcoin prices fell right after social media users expressed bullish market outlooks.

Spot Market Buying Drives Recovery

Spot market buyers made significant buying moves last week, which drove Bitcoin’s market recovery, as revealed in the Bitfinex Alpha report. The Spot Cumulative Volume Delta indicator measured noticeable market buying pressure.

The CVD measurement shows the balance between buying and selling market orders during an observable time frame. When CVD shows a steep climb, buyers are buying more confidently as they raise pricing levels to show that demand is growing fast.

According to the report, most purchase orders from recent trading took place on US exchanges. The recent buying behavior tracked MicroStrategy’s acquisition strategy and ETF investing patterns, which demonstrated institutional Bitcoin interest.

Market observers follow Bitcoin’s price development cautiously since institutional purchasing continues, alongside positive signs from active buyers.

Bitcoin Price Analysis

Bitcoin (BTC) peaked at its highest-ever price point ($109,588) on Monday, yet dropped by 6.68% to finish at $102,260. Bitcoin prices continue trading close to $102,000 on Tuesday.

Market professionals expect Bitcoin to extend its rise past $125,000 when it surpasses its highest-ever recorded price. Based on the 141.40% Fibonacci level from $66,835 on November 4 to the current ATH of $109,588, the predicted price should be near $127,287.

Technical analysis shows BTC price movement is headed both up and down. Current data on the daily chart shows an RSI value of 58 that surpasses the 50 lines to show investors have more confidence in buying BTC. On 15 January the MACD trading tool showed a positive signal by crossing its fast average above its slow average.

If BTC fails to defend the $100000 price level, it may trigger a market-wide decline. Market uncertainty will rise when Bitcoin falls below $100,000 as traders watch for a potential move to $90,000 support.

Pepe (PEPE) Plummets Below $0.000015 Amid Weak Technical and On-Chain Indicators

According to data, Pepe’s price fell further and reached a value below $0.000015 on Tuesday. PEPE has dropped by more than 22% since Saturday, and technical indicators show it might continue falling. Market momentum signals weakened performance as traders moved to the sell side, and user participation decreased.

The price of PEPE met strong trading walls when it reached a downward trendline based on past high points since early December. Monday’s trading showed the price fell 22.86% because resistance stopped its advance and pushed the price beneath the 200-day Exponential Moving Average at $0.000017. Pump-PEPE failed to hold above $0.000015 on Tuesday after moving past its November lows at $0.0000077 and December highs of $0.000028.

Market analysts expect PEPE to lose 14% more if today’s trading closes below $0.000015 and could reach the $0.000013 support point.

Current momentum readings suggest investors are moving away from buying activities. The present strength index reading of 38 indicates buyers have lost their buying power for PEPE. On Sunday, the MACD indicator showed a key sell signal by crossing below the trigger, validating the ongoing price decline.

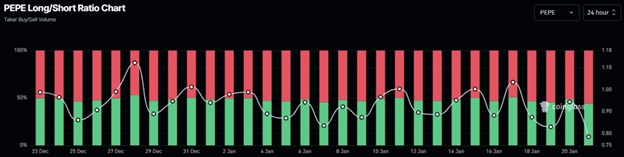

On-chain data adds to the negative outlook. The newest Coinglass data reveals PEPE’s long-to-short ratio has now hit 0.80 which represents a new monthly low. In market terms, trading ratios below one indicate traders expect market prices to continue falling. The market believes PEPE is less attractive because fewer users interact with it every day.

The current market challenges have investors carefully monitoring PEPE’s key price points for signs of strength as they wait for wider market patterns to develop.

Declining Network Activity Signals Bearish Outlook for PEPE

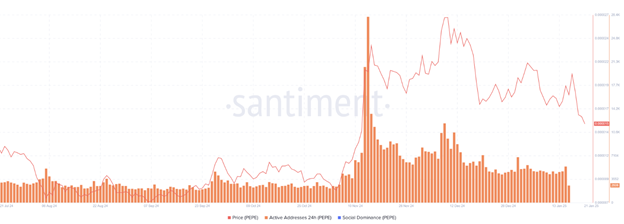

PEPE, the frog-themed meme coin experiences a bearish market condition according to Santiment’s Daily Active Addresses index which measures PEPE’s blockchain transactions. The index tracks blockchain activity through user engagement where higher active account numbers mean growing network demand but falling numbers show decreased user participation.

PEPE’s network usage has sharply decreased, with Daily Active Addresses falling from 28,131 in mid-November to 2,606 last week. The massive drop in blockchain usage shows investors no longer need or want PEPE, which creates downward pressure on the coin’s future value.

Fewer active users on the network prove investors are backing away, supporting PEPE’s bearish market outlook. Lower user engagement on the blockchain makes it hard to predict PEPE’s future market success.

Ethereum Trades Above $3300 Amid Market Decline

The cryptocurrency market downturn pushed Ethereum’s price slightly down to around $3,330 on Monday. The crypto market fell after U.S. President Donald Trump took office without referring to cryptocurrency in his inauguration speech yet trader activity remained moderate. Ethereum may experience growth in the coming year as the Ethereum Foundation released a plan to address market criticism of its trading methods.

The Ethereum Foundation posted on X that it will use 50,000 ETH from its treasury assets to participate in DeFi projects. The foundation started its new program by performing a transaction on Aave lending to demonstrate its interest in expanding beyond trading ETH.

This response follows Monday’s criticisms after the foundation reportedly sold its 100th ETH currency. User groups within the crypto space accused the Foundation of primarily trading ETH on Ethereum by showing its $13.3 million ETH sales over twelve months.

Eric Conner, an angel investor proposed the foundation put aside some of its Ethereum holdings as a solution to reduce the effects of selling while managing expenses. Ethereum co-founder Vitalik Buterin disagreed with Eric Conner’s plan to stake tokens. Buterin explained that historical problems with regulatory issues and hard fork disputes made staking unsuitable. Buterin confirmed that the remaining regulatory issues are lower, but he notes that managing hard-fork situations remains a current concern.

Tim Beiko runs the core protocol meetings for Ethereum and shared more details about this situation. He showed that investing the Foundation’s remaining 269,000 ETH into staking would produce just 8,000 ETH per year, which is $26 million today. Staking the Foundation’s Ethereum assets will create $26 million in income in 2025 but this represents just 20% of their annual spending plans.

Moving the 50,000 ETH into DeFi opens up new revenue-generating possibilities for the foundation. Through the DeFi yield program, the Foundation plans to increase its assets while ensuring long-term financial strength.

Leadership Changes and Market Optimism

Buterin noted that the Foundation is reorganizing its leadership team into a new structure. We brought new professionals and strengthened our technical team capabilities to match today’s crypto environment.

Ethereum continues to demonstrate success in its activities beyond the recent public controversy. CoinShares data shows that Ethereum ETFs drew $246 million in investments last week. Strong investor interest remains high for Ethereum, although the market shows signs of short-term instability.

The Foundation’s recent strategic moves show they want to solve community problems and set up Ethereum for steady expansion and future growth.

Ethereum Price Analysis

Over the past day Coinglass tracked $179.9 million in ETH futures contracts closing at a loss. The total liquidations showed $133.52 million from long positions and $46.45 million from short positions.

On Monday, the altcoin held steady between $3,200 and $3,500 after bouncing back from the $3,216 support mark. ETH’s upward progress meets strong opposition near its 100-day moving average and December 16 downtrend zone.

Ethereum needs to surpass the current resistance before reaching $3,776 and continue toward its ten-month high at $4,100. If buyers cannot overcome the ongoing downward trendline, the price of Ethereum could return to $3,216. If weak demand pushes prices below $3,216, traders expect the $3,000 support line to stop ETH’s price decline.

Trade signals demonstrate the buying power is increasing across the market. Both the Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) now move above their neutral areas, which shows that ETH is moving up.

Traders need to watch out because breaking below $2,817 on a daily candlestick would bring doubt to the bullish outlook and change how the market behaves.