Crypto Traders Liquidated Nearly Half a Billion in a Day

The crypto market has lost over $300 billion since Friday, with the cryptocurrencies taking an abysmal beating over the weekend. The term ‘crypto’s Black Monday’ refers to a downturn that was being referred to by traders across social media, who were following a series of events that started on Thursday with just a short-lived market divergence. US stocks fell as a result of China’s announcement of retaliatory tariffs, which also brought a brief semblance of optimism.

Monday Sell-Off Continues Following Trump’s Statement

The crypto assets took a steep fall on Monday after US President Donald Trump said during a Sunday night interview aboard Air Force 1 that his administration has not planned to negotiate with China. His comments seemed to only add to investor sentiment that had already soured the crypto market, prompting a wave of sell orders.

Bitcoin Price Dips Under Increasing Pressure

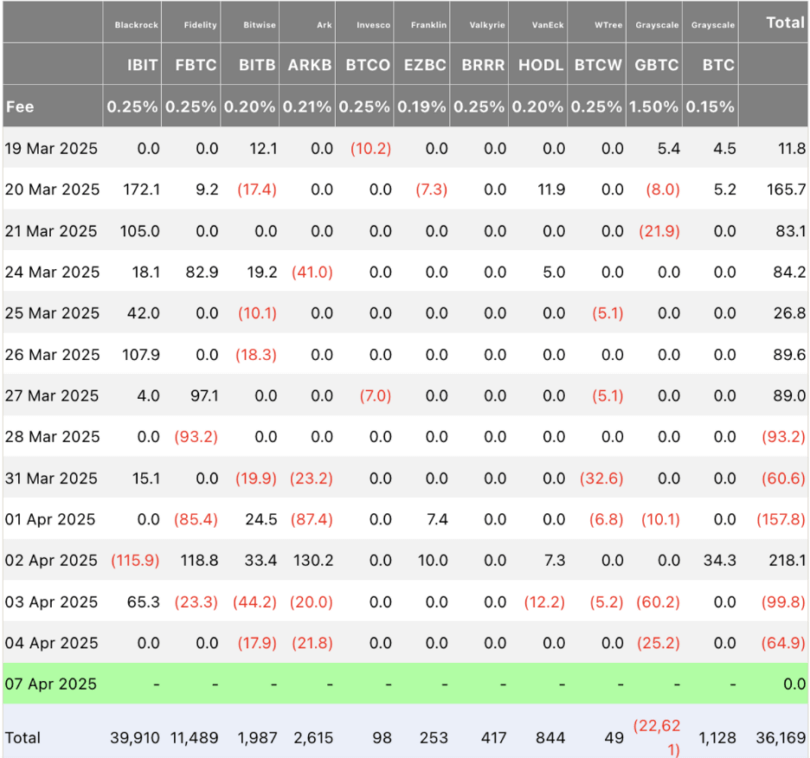

Bitcoin (BTC) partially recovers from recent losses to change hands at around $76,000 on Monday after striking a new yearly low of $74,508 during the Asian trading session. While the rebound, BTC has done it’s singular best, but is still going down. Last week, they corrected about 5%. Hundreds of thousands of Bitcoin are being liquidated due to the volatility brought about by the escalating global trade war, reducing Bitcoin equities by $1.39 billion and liquidating 452,976 leveraged traders over 24 hours. US institutional demand also appears to be weakening with a net outflow of $172.69 million from its spot Exchange Traded Funds (ETFs) last week.

Bitcoin’s exchange-traded funds (ETFs) lost $165 mln in outflows in the previous trading week’s final two days alone. And they added that the trend may continue to exert pressure on the US markets when they open on Monday.

The price of Bitcoin sharply fell to $74,508 during the Asian session, staying maintained at $76,000. BTC saw a near 5% decline in value due to US President Donald Trump’s announcement of national tariffs last Wednesday and almost all of it wiped up.

But China retaliated by imposing a 34% levy on US goods. The escalating events have led to a crypto slump and slumping of the Asian markets. In Japan, the stock market hit its lowest point since October 2023 on Monday.

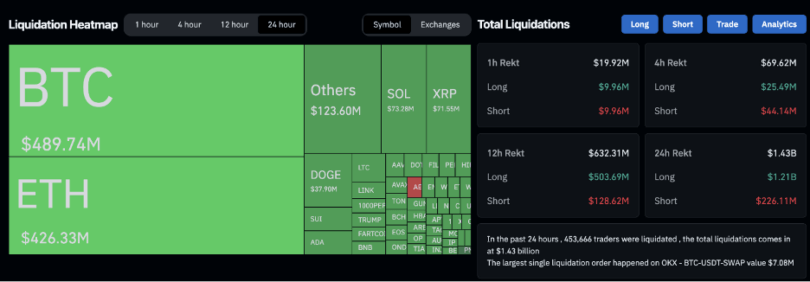

Global trade conflict causes massive liquidations in the crypto markets. The heat map over the past 24 hours shows a layer of cool 452,976 traders, and this was liquidated with a total of $1.39 billion. The $6.22 million liquidation order on OKX’s BTC-USDT-SWAP was the largest.

The liquidations of bitcoin totaled over $464 million while Ethereum was set at $408.49 million. Such enormous liquidations will give FUD to Bitcoin investors, force more selling pressure and pull the price down further.

Market Uncertainty Weakens Institutional Demand

Market uncertainty continued and last week, institutional demand for Bitcoin began to appear to wane. SoSoValue’s data shows that the US Bitcoin spot ETF recorded a net outflow of $172.69 million last week after recording a positive flow of $196.48 million the previous week. Net flows after mid-February have been meager – the equivalent of approximately one month (from January 20) after the removal of US President Donald Trump. If such a trend of outflowing continues, then shortly the price of Bitcoin can see further corrections.

Signs of Optimism Amidst Challenges

Some optimistic signals remained despite growing tensions from the global trade war and fading institutional demand. While Hong Kong’s Securities and Futures Commission (SFC) has also updated its guidance for licensed virtual asset trading platforms (VATPs) and crypto ETFs, it is now allowing these services from VATPs, as well as from crypto ETFs. The aim is to enhance the region as a competitive crypto hub in the global market space.

Bitcoin’s decision to allow staking services on licensed platforms and ETFs is perceived as a positive change. Indirectly, supporting Bitcoin by facilitating institutional adoption, clearing regulatory pathways and enabling global competition, it is a signal of maturity for the crypto ecosystem. Although Bitcoin doesn’t benefit directly from Bitcoin staking, the broadening of crypto infrastructure in Hong Kong could lead to more demand for Bitcoin through ETFs, institutional investments.

Bitcoin Bears Hit New Yearly Low at $74,508

After Bitcoin was rejected at the key $85,000 level last week, the price of bitcoin lost almost 5% over the week. BTC’s previous yearly low of $76,606 (Marked on March 11) could not be broken and it too plunged below $78,258, the daily support level of BTC in Monday’s trade and hit a new year to date low at $74,508.

If Bitcoin continues its downtrend, it may hit the next support level at $73,072. The Relative Strength Index against the daily supports is 33, i.e., strong bearish momentum is being given but the RSI is not yet oversold. Also, Sunday’s Moving Average Convergence Divergence (MACD) indicator registered a bearish crossover, conveying a sell signal and corroborating that it could continue downward.

Altcoin Derivatives Liquidations Reach $1.4 Billion

Altcoins elsewhere in the market suffered deeper declines after their own $1.4 billion in losses from liquidated derivatives positions. Whilst $451 million in liquidations was suffered by Bitcoin traders, it accounted for just 30% of the total.

The bailouts were so dramatic that it suggests investors are selling altcoins at a rate faster than Bitcoin ones and, more broadly, are panicking throughout the crypto sector.

Ethereum Leads Altcoin Losses

As shown in recent charts, Ethereum emerged as the most severely impacted altcoin, incurring $419.2 million in losses from liquidated positions. Ripple (XRP) and Solana (SOL) also recorded heavy losses, with traders losing $74.5 million and $70.5 million, respectively.

The rapid liquidation of positions in these top-tier crypto assets casts serious doubt on the sector’s ability to remain insulated from global trade tensions. With escalating geopolitical risks, investor confidence appears to be eroding quickly.

Supporting this sentiment, Coingecko data confirms that Ethereum, Ripple, and Solana have each posted over 15% losses in spot markets—well above the broader crypto market’s 10.8% decline recorded on Monday.

Dogecoin Tanks Nearly 20% as Global Market Turmoil Deepens

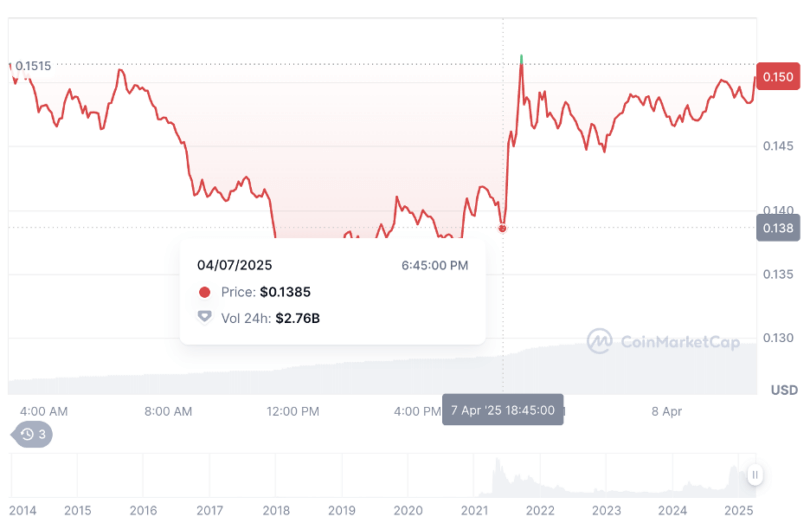

Like the rest of the market, Dogecoin (DOGE) witnessed a sharp fall on Monday. The cryptocurrency plunged 19.7% over the past 24 hours, falling to $0.1385 at the time of reporting, to represent its flaghip meme cryptocurrency. DOGE is down 19.4% on a weekly scale and the market capitalization also nosedived from $24.67 billion on Sunday to $19.78 billion.

Can Dogecoin Stage a Bullish Reversal Amid Bearish Signals?

The technical outlook of meme coin Dogecoin is weak after the $0.15 crucial support level was broken by the coin. A death cross has formed of the two crossovers, showing heightened bearish momentum.

Further adding to the negative sentiment is the fact that the Relative Strength Index (RSI) is at or approaching its oversold territory on the daily chart, bringing the time for traders to offload holdings near. The technical structure also points to a weakening structure; as another signal of a sell, the Moving Average Convergence Divergence (MACD) has flashed a sell signal. If, however, Dogecoin doesn’t swiftly recover above the $0.15 threshold, then it becomes very likely that the coin will drop to around the $0.10 mark.

A silver lining may have been the case despite the gloomy setup. There’s a start forming on the daily chart of a falling wedge pattern, which can be an often bullish signal of a potential reversal. The RSI is now just above levels that could turn things around to the upside. If Dogecoin sustains the above $0.12 support level, dip buyers can look for a short-term rally. If DOGE can confirm a bounce off this level, it will be just a floor for DOGE to regain momentum as it fights to break resistance levels above.

Crypto Sector Shaked Amid Warning of ‘Black Monday’ from Jim Crammer

Despite the ongoing slump, Dogecoin continues to be pulled down with mounting global financial uncertainty. Incorporated into the general conflict is the fact that U.S. President Donald Trump is using an appeal to the nation’s trade deficit for additional fuel in his insistence on maintaining elevated tariffs.

CNBC’s Jim Crammer warned Sunday that markets could be on the brink of a ‘Black Monday’ style collapse, referencing the infamous 1987 crash. However, unless Trump changes his tariff strategy affecting more than 100 countries, markets can spin further downward, warned Crammer.

Crammer added on Saturday that ‘if the president doesn’t try to reach out and reward these countries and companies that play by the rules, then the 1987 scenario — the one where we went down three consecutive days and then 22% on Monday — has the most cogency.’

On April 2, Trump said he would implement 10% reciprocal tariffs on Wednesday. Countries like China have already made a retaliatory response, which has worsened market volatility and stoked FDI fears.

Highlights from the Past Week

FTX Bankruptcy Estate Rejects $2.5 Billion in Claims Over KYC Failures

Nearly 400,000 customer claims worth up to $2.5 billion from the FTX exchange’s bankruptcy proceedings have been initiated by the estate, claiming reasons of incomplete Know Your Customer (KYC) compliance.

New information about disqualified claims has only recently been disclosed in a US bankruptcy court filing, which reveals a long-standing complaint of poor identity verification that was used during FTX’s operational period.

The estate’s broader strategy that involved claims reconciliation included these KYC related disqualifications. According to FTX, part of the plan has provided $11.4 billion for distribution and will start repaying primary creditors later this month.

Tether Prepares US-Compliant Stablecoin Ahead of Regulatory Shifts

However, as the US is poised to roll out versions of their stablecoin, Tether announced it is prepared to introduce a US-compliant USDT version as long as US stablecoin legislation passes in the country.

As lawmakers start to regulate the booming stablecoin sector, this strategy is no surprise. Tether said the compliant version would further the company’s goal of ‘making the US Dollar truly global’ and meeting regulatory needs.

Federal Agencies Ordered to Report Crypto Holdings to Treasury

A Treasury Secretary Scott Bessent mandate requires that all US federal agencies have to report their Bitcoin and crypto holdings to him by Monday, a White House official confirmed.

The move comes following President Trump’s March 6 executive order detailing a Strategic Bitcoin Reserve and Digital Asset Stockpile. Agencies were given 30 days to respond to a follow up document dated March 11, however, as outlined in that same document, agencies were given a deadline to comply.

The government now possesses 198,012 BTC worth roughly $16 billion, but the likes of its holdings reports are unclear. The submitted data is not being disclosed, and it isn’t required by the executive order.