Ethereum Price Prediction: Will ETH Break $3,000 or Drop Below $2,400?

As of February 17, 2025, Ethereum (ETH) is experiencing a period of consolidation, with its price movements reflecting both market optimism and caution.

Current Market Overview

- Current Price: $2,667.33

- 24-Hour Change: Increased by $82.50 (approximately 3.13%)

- 7-Day Performance: Over the past week, ETH has shown resilience, with a notable rebound from a low of $2,600, indicating potential support at this level.

- Market Cap: Approximately $326 billion

- 24-Hour Volume: Trading volume has remained steady, suggesting sustained investor interest.

Ethereum movement indicates it has approached its main resistance zones for testing. The price must cross $2,800 to overcome resistance and reach the $3,000 psychological mark. Buying continues to provide reliable defense for Ethereum at $2,600, as this threshold has previously held firm during testing.

The cryptocurrency trades below its average price changes over 200 days, signaling a continued long-term price decline. RSI displays a value of 52, indicating indecision between buyers and sellers. The technical MACD indicator shows positive signs by preparing to cross bullishly through current patterns. Periodic spikes during price increases show many market participants are taking part at current levels. Future market activity depends on how traders feel and how the market changes at this time.

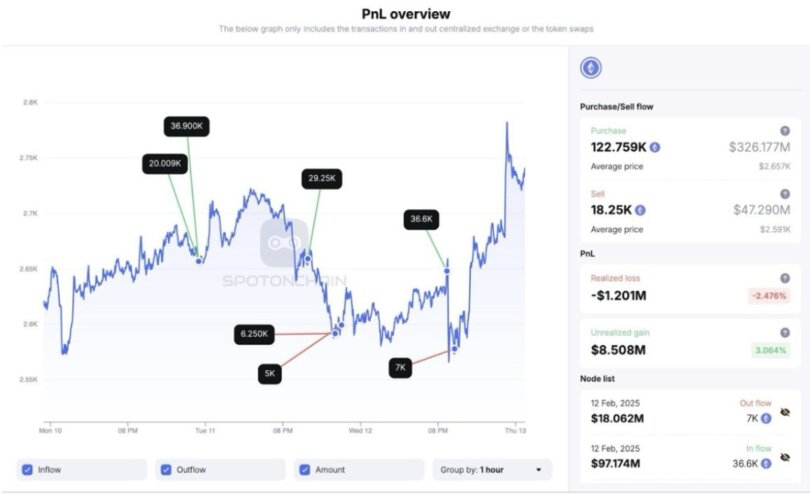

On-Chain Data: What Are Whales Doing?

From the last 48-hour period, a significant ETH whale emptied 104,509 ETH worth $279 million from Binance. The funds entered multiple DeFi platforms for staking and lending, such as Etherfi, Lido Finance, Spark, Compound, Aave, Gearbox, and Morpho.

Through Kraken, the Ethereum ICO participant sold their 6,672 ETH tokens worth $18.08 million by moving all 11,672 ETH to a new wallet address. This owner bought ETH at its lowest price of $0.31 and owns 5000 ETH to sell later.

From February 8th to 9th, 2019, the largest recorded transfer of ETH from crypto exchanges since December 2017 totaled 224410 units. Institutional investors tend to hold onto their assets when making sustained transactions of this magnitude.

New information shows that Looknonchain lists nine Ethereum ETFs in the system. Investors pulled 5,514 ETH from nine Ethereum ETFs, reducing the trading value by—$14.89 million. The red emoji shows decreasing or negative flow, which matches up with the ongoing bearish market phase.

During this period, the Grayscale Ethereum Trust saw major cash withdrawals of 11,375 Ethereum. After this selling activity, Grayscale ETHE now owns 1,304,767 ETH tokens worth about $3.52 billion. The mining industry shows no major selling activity as miner balances maintain stability.

Macro Trends: What’s Driving Ethereum’s Price?

A set of national and global financial conditions impact how Ethereum performs today. Understandable rules made by government authorities helped investors trust the market, so institutions joined the scene.

The Ethereum platform receives constant upgrade benefits through its network development work and future Pectra version to improve operations. Bitcoin traders watch economic global financial events and market attitudes for their next investment moves.

Crypto Analysts’ Twitter Discussions

Crypto market experts regularly talk about Ethereum price predictions on Twitter.

His post on X Mister crypto displays technical analysis graphs of Ethereum in a descending triangle pattern that signals a strong increase when the resistance level breaks. People in crypto communities support Ethereum because it remained strong after market declines and leads key blockchain applications.

When $ETH breaks this resistance we will have a big relief rally.

Don’t lose faith in Ethereum! pic.twitter.com/rumKJC9VKn

— Mister Crypto (@misterrcrypto) February 14, 2025

The study of Crypto Rover posted a chart using the “Triple Bottom” pattern, which shows trading technical analysis when a downward trend stops and switches directions after three identical price lows form.

Ethereum hit its highest point between February and May 2021, which helps explain why the post mentioned new record levels could happen.

The update shows strong investor hopes that Ethereum may beat its latest record price just like other cryptocurrencies do while attracting many buyers.

Ethereum Bullish and Bearish Predictions

Bullish: When Ethereum surpasses the $2,800 resistance point backed by high trading volume, it can aim for $3,000 as market sentiment and technological improvement boost its growth potential.

Bearish: The price of Ethereum could drop to $2,400 if buyers fail to defend $2,600 during market weakness.

Long-term investors should buy Ethereum when its price declines since its core technology and future growth offer attractive investment opportunities. Short-term traders should watch for important support and resistance points while implementing hard restrictions to stay safe from market swings. To succeed in crypto trading, stick to reliable news sources and follow your rules as market conditions evolve.

Ethereum Price Attempts Recovery After Steep Decline, Faces Key Resistance at $3,000

Ethereum’s price ran into buying trouble with its downward line trend on February 1, sending prices down 13.87% past the important $3,000 price mark. ETH lost almost 9 percent the previous week to $2690 before Friday.

Recent market trends indicate that Ethereum is returning after increasing around 3% this week. Market analysts predict ETH will attempt a price rebound toward the $3,000 barrier if current growth continues.

Technical indicators show mixed signals. ETH shows purchase strength, with the daily RSI at 38, as it pushes away from its 30 oversold territory. Trading volumes decline because traders stop pushing their sales. Some buying momentum appears at the mid-point level of 50 on the RSI, but consistent strength requires the indicator to cross 50.

The cryptocurrency may enter further downside when Ethereum stays under $2,359 on the chart before reaching its next weekly support line of $1,905. Market participants keep watching ETH’s price actions to forecast its future direction.

Ethereum stood at $2,689.77 as reported on February 14, 2025, and experienced a 3.36% change in its value from the previous day. This analysis examines Ethereum’s price prospects from 2025 to 2040 while considering important market factors shaping its future path.

Factors Influencing 2025 Prediction

The predicted market weakness next year has multiple specific drivers that will shape its decline. When cryptocurrency markets become more established, they produce smaller price changes. Market conditions governments implement globally can both boost or weaken cryptocurrency market participation and investment sentiment.

The roll-out of Ethereum 2.0 faces unexpected technology problems that might reduce its market success and value.

Ethereum Long-Term Prediction

The projections about Ethereum’s prices between 2026 and 2040 remain uncertain, but several market trends will determine its value development. Through smart contract technology, Ethereum has become the preferred platform for decentralized app creation. To grow its market value, more companies will use Ethereum for financial operations, supply chain management, and video games.

New blockchain networks with better functions may steal users from Ethereum and reduce its existing market control. The setup of layer-2 systems and Ethereum protocol updates will allow Ethereum to handle more transactions while drawing in more users and developers. The worldwide economy affects investor actions, while the blockchain’s performance depends on macro factors.

Ethereum Price Update: Market Trends, Predictions, and Future Outlook

The most recent figures from Changelly Blog show Ethereum (ETH) priced at $2,716.45. With Ethereum likely to reach a low on February 16, 2025, market projections show a possible 2.81% drop. Based on technical indicators implying a bearish attitude, 77% of the market is showing negative tendencies. Reflecting a balanced market attitude, the Fear & Greed Index reaches 48 (Neutral). Ethereum showed 14 green days (47%), with a price volatility of 9.47%, over the last thirty days.

predictionsHeaderTable symbol=”ETH”]

| Day | Minimum Price | Average Price | Maximum Price |

|---|

Updated statistics show that Ethereum’s price has risen to $3,762.59, securing its second-largest market capitalization among cryptocurrencies. With 120,128,509 ETH in circulation, the overall circulating supply is $451,994,509,32. Ethereum has been valued $120.03 in the past twenty-four hours. ETH has exhibited a 29.61% rise over the past seven days, with a steady upward slope. With a growth of 16.61%, the last month added an average of $624.97 to its worth, confirming its significant potential for investors.

Ethereum Price Forecast: 2025 and Beyond

Projections for 2025

Technical analysis suggests Ethereum’s lowest price in 2025 will be $2,075.21, with a top estimate of $2,497.08. The predicted trade price average is $2,918.95.

- February 2025: Analysts project Ethereum’s average trading price at $2,497.74, with potential fluctuations between $2,076.53 and $2,918.95.

- March 2025: Market predictions indicate Ethereum will likely trade between $2,709.43 (minimum) and $2,781.64 (maximum), with an average price of $2,745.54.

Long-Term Ethereum Predictions

Looking further ahead, analysts anticipate steady growth in Ethereum’s price:

- 2026: Expected to range between $8,252 and $9,543, with an average price of $8,535.

- 2027: Forecasts predict a minimum of $12,179 and a maximum of $14,590, with an average price of $12,521.

- 2028: Projections suggest a minimum of $17,388, reaching a high of $21,285, with an expected average of $18,014.

- 2029: Analysts foresee ETH trading between $26,047 and $30,607, with an average value of $26,948.

- 2030: Predictions indicate Ethereum could average $38,776, fluctuating between $37,698 and $45,283.

Ethereum Upgrades: Enhancing Scalability and Institutional Adoption

The Merge and Shanghai Upgrade

Ethereum’s shift from Proof-of-Work (PoW) to Proof-of-Stake (PoS) through The Merge sought to enhance sustainability and scalability. The Shanghai (Shapella) Upgrade improved the network by allowing ETH unstaking and lowering transaction costs. After the update, Ethereum’s price climbed to an 11-month high, overcoming worries about market selling pressure.

Dencun Upgrade: Reduced Fees & Enhanced Scalability

The Dencun Upgrade (March 2024) enhanced Layer 2 networks, reducing transaction fees and boosting scalability. This improvement made Ethereum a more formidable player in the cryptocurrency realm, fostering greater adoption.

Spot Ethereum ETFs: A Significant Shift for Institutional Investors

The U.S. SEC’s approval of spot Ethereum ETFs in July 2024 was a noteworthy achievement. It enabled institutional investors to access ETH via regulated financial markets. This action is anticipated to enhance Ethereum’s liquidity and trading volumes, reinforcing its status as a significant digital asset.

| Month | Minimum Price | Average Price | Maximum Price |

|---|

| Year | Minimum Price | Average Price | Maximum Price |

|---|

Market Influence and Ethereum’s Path Ahead 2024 Outcomes & Significant Factors

Ethereum’s expansion in 2024 was driven by network enhancements and market shifts. The Dencun upgrade improved transaction efficiency, and the approval of spot ETH ETFs encouraged institutional investments. Furthermore, Donald Trump’s re-election in November resulted in a significant rise in the crypto market, with Bitcoin hitting $89,000 and Ethereum surpassing $3,000.

Read more: Bitcoin Crashes as Trump Imposes High Trade Tariffs: Possible Scenarios for BTC

Ethereum Price Predictions by Analysts

Market analysts are optimistic about Ethereum’s future. Various companies have shared their predictions:

- Finder forecasts that Ethereum might exceed $6,100 by 2025 and reach a valuation of $12,000 by 2030.

- Wallet Investor anticipates that ETH will hit $3,900 in a year and surpass $7,000 in five years.

- Gov Capital forecasts Ethereum to reach $5,400 by the end of 2025 and $6,100 by 2029.

- DigitalCoinPrice predicts Ethereum may exceed $6,900 next year and reach $11,000 by 2026.

Final Thoughts

Forecasting Ethereum’s price path from 2025 to 2040 is significantly unpredictable because of the cryptocurrency market’s ever-changing landscape. Although predictions such as the expected minor drop by February 2025 offer some perspective, investors should consider various elements, including technological advancements, regulation shifts, and prevailing market trends, when assessing Ethereum’s long-term prospects.

This content is not intended for U.S. or Canadian residents. We disclaim any liability for losses incurred based on the information provided.