Margex Analysis: Bitcoin & Cardano Correct After Rally, XRP Dips 9%

Bitcoin (BTC) showed a small price decrease on Tuesday, trading near $86,600 before falling 10% the previous day. The market shows weak investor sentiment because U.S. spot exchange-traded Funds (ETFs) experienced $2.39 billion in net withdrawals last week.

QCP Capital’s Monday report shows that Bitcoin remains without strong momentum despite the positive performance of the risk assets on Sunday. The cryptocurrency market shows high levels of volatility, and BTC sustains positions close to its minimum trading zone over a multi-month period. The financial market data for Put Skew dominance displays reluctance among investors during the last three months of March.

The crypto price increased after former U.S. President Donald Trump announced on Truth Social about establishing a “Crypto Strategic Reserve.” This strategic initiative seeks to boost U.S. leadership in digital assets by concentrating on the vital components that include Bitcoin (BTC), Ethereum (ETH), XRP, Solana (SOL), and Cardano (ADA).

Upcoming macroeconomic releases this week may control market movements. According to the QCP Capital report, there will be continued substantial price movement in crypto assets, followed by what is expected to be a decisive White House Crypto Summit on Friday. The upcoming summit will deliver additional information about the U.S. crypto reserve policy alongside new potential regulatory frameworks.

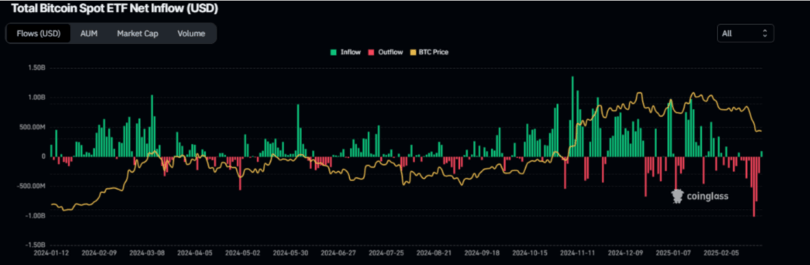

Institutional Demand Weakens as Bitcoin ETFs Face Heavy Outflows

Institutional support for Bitcoin is currently weakening, according to Coinglass data, which shows substantial Bitcoin spot ETF withdrawal activity. Cryptocurrency exchanges lost $2.39 billion in funds the previous week because investors continued the money exodus that began with $540 million last week. Institutional investors’ continued net sales likely create a risk for Bitcoin’s price to experience additional downward movement.

The current Bitcoin market is dreadful because volatility levels keep climbing. Positive market developments fail to shift traders’ cautious stance, according to the Crypto Fear & Greed Index measurements. Although market participants recently received optimistic news, they remain fearful.

The Bitbo Bitcoin Volatility Index has exhibited substantial price fluctuation increases while monitoring BTC-US dollar exchange values. Market uncertainty caused volatility to rise from 1.53% to 2.06% from February 23 to March 2.

A positive market environment normally leads Bitcoin to achieve higher value. When volatility levels in the market increase, Bitcoin’s price exhibits substantial price shifts. Bitcoin will likely experience a price correction after the speculation market hype disappears while other market influential elements take effect.

Bitcoin Price Prediction: Recovery in Progress or Further Decline Ahead?

Bitcoin prices plummeted significantly during the week, falling from their Monday peak value of $96,500 to $78,258 on the week’s final trading day. Throughout the weekend, Bitcoin demonstrated an 11.50% market recovery, which caused the cryptocurrency’s value to surpass $94,270 on Sunday. On Tuesday, Bitcoin’s trading value remains below $86,327

Multiple experts in the market believe Bitcoin might now push toward testing $100,000 resistance after maintaining its upward trend.

The signal data shows conflicting evidence. The daily RSI indicator is at 47 after moving out of an overbought territory the previous week. The price action encounters an obstacle around the 50 mark, which functions as a neutral resistance level. Bullish momentum will likely continue when Bitcoin maintains a sustained price increase above 50.

The price of Bitcoin will likely slide downward if it fails to maintain its position at around the $90,000 support zone, which could result in testing the daily support at $85,000.

Cardano Price Declines 11.5% Following Sharp Rally Amid Trump’s Crypto Announcement

The price of Cardano (ADA) fell 11.5% on Monday, trading at approximately $1 at writing time. The price fluctuation started after US President Donald Trump announced a ‘Crypto Strategic Reserve’ on his Truth Social platform, which led to over 70% growth on Sunday.

The declaration made by Trump, which features Bitcoin (BTC), Ethereum (ETH), XRP (Ripple), Solana (SOL), and Cardano (ADA), functions to enhance American dominance in digital currency markets. When President Trump made the Crypto Strategic Reserve announcement, the digital asset market reacted by sending Cardano into significant price growth that later reversed direction.

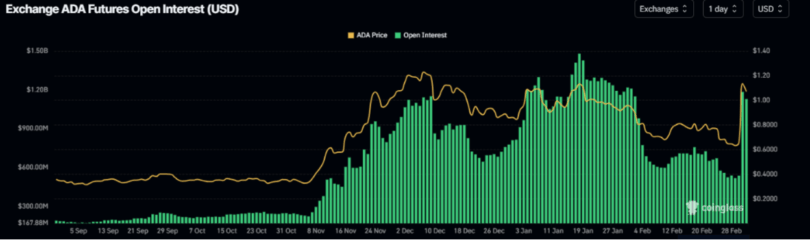

The price correction did not change the positive on-chain metrics or technical indicator signals pointing toward potential continued market gains. ADA’s market activity strongly engages investors because open interest keeps rising while trading volumes increase.

The bullish momentum driving Cardano (ADA) tokens indicates that experts believe the price may reach $1.32 soon.

After its Sunday breakout, the Cardano (ADA) price surged 72.15% above a major descending trendline. The cryptocurrency shows a temporary price drop, keeping its value near the $1 level on Monday.

Based on recent market analysis, Cardano’s value will likely increase to $1.32 if the current bullish momentum continues.

Multiple technical analysis tools show direction in line with positive market conditions. The Relative Strength Index on the daily scale indicates strong bullish momentum because its value of 67 exceeds the midpoint of 50 by a substantial margin. The MACD indicator showed a bullish crossover on Sunday, which created a buying signal, thus indicating that market trends will remain upward.

The positive sentiment for Cardano receives additional support from its rising Open Interest (OI). The data provided by Coinglass shows that ADA’s future open interest across exchanges reached $1.18 billion on Sunday, which became its most elevated point since February. The increase in Open Interest indicates greater market involvement and brings new funds into the market, supporting positive price projections.

The ADA chain has gained more users and trading liquidity, which strengthens its positive future projections. According to Artemis statistics, the ADA Chain’s trading volume increased significantly, reaching $8.4 billion on Sunday after starting with $536.9 million on Saturday.

Ripple (XRP) Dips 9% After Trump’s Crypto Reserve Announcement Sparks Weekend Surge.

Ripple (XRP) dropped by 9% on Monday to reach $2.70 after its price increased 40% to $3 during the weekend market rally. XRP prices surged when U.S. President Donald Trump said he would create a crypto strategic reserve, sparking mass market growth and extensive debates regarding whether Ripple would be in the strategic reserve.

The weekend price increase of XRP began when President Trump released his executive order to create a federal cryptocurrency reserve and fulfill his campaign pledge. Truth Social released an official announcement describing the crypto strategic reserve as being made up of XRP cryptocurrency, Solana (SOL), Cardano (ADA), Bitcoin (BTC), and Ethereum (ETH). The XRP value surged instantly after the announcement, rising from $2.14 to $3 during the initial hours after the statement.

The price of XRP encountered opponent forces at the $3 level when traders seized the opportunity to capitalize and initiate profit distributions. XRP lost 9% of its value during the intensifying sell-off that began on Monday yet managed to regain stability up to press time.

Cardano CEO Clashes with Peter Schiff Over XRP’s Inclusion

On February 28, Ripple CEO Brad Garlinghouse publicly recommended to the U.S. Treasury that crypto strategic reserves should not be limited to Bitcoin, prompting the addition of XRP.

Bitcoin proponents criticize this decision by insisting that Bitcoin remains the only accepted cryptocurrency despite potential risks with alternative coins. The economist Peter Schiff strongly objected to the XRP reserve, saying it was unnecessary. According to Schiff, Bitcoin and the U.S. gold reserve share similar characteristics, but Schiff completely dismissed the inclusion of XRP, triggering more crypto discussions.

The strategic reserve’s current state of review, combined with market instability, projects extensive price changes for XRP during forthcoming marketplace sessions.

XRP Sees Surge in Exchange Deposits Following Market Retracement

During the 24 hours, traders facilitated the movement of 200,000 XRP, demonstrating that they expected more market changes. XRP exchange deposits increased substantially after a major market correction, which affected XRP and other tokens in former President Donald Trump’s strategic reserve announcement.

The crypto wallet platform CryptoQuant tracks XRP reserve movements at the Binance exchange by showing their changes. Exchanges held 2.7 million XRP coins at the end of February 28. The 200,000 XRP withdrawal led to record-breaking levels, with exchange reserves reaching 2.9 million XRP just before Monday.

The recent XRP price increase to $2.70 led to a 600 million dollar growth in short-term exchange trading supply after investors deposited 200,000 XRP.

XRP Price Prediction: Volatility Rises Amid Exchange Deposits

Exchange deposits of XRP have created supply volatility, which increases the number of available trading coins on exchanges.

When investors increasingly send their assets to exchanges, their trading behavior intensifies even though it causes more volatility in short-term prices. The market attitude remains vague following Bitcoin supporters’ negative comments on Ripple, and traders taking short-term profits triggered a 9% price decrease on Monday.

A bearish market correction needs traders to match their sell volumes from Sunday to trigger a meaningful price change. The bullish investment strategy involves position retention while investors expect an increased value after the U.S. government adds XRP to its newly introduced reserve assets.

The price of XRP has held onto most of its Sunday gains, which amounted to 40%, even though it faced a decline. An absence of unforeseen macroeconomic troubles would strengthen market bias toward bullish traders working toward sustaining a price rise above $3.

Strong demand and current inflows might create enough market liquidity to push XRP prices above $3 in upcoming market sessions.

For those looking to capitalize on XRP price movements, Margex offers an easy-to-use platform for trading with up to 100x leverage. Trade long or short positions with deep liquidity and competitive fees. Start trading XRP now: Trade XRP on Margex.