Margex Analysis: Bitcoin Set New ATH, AAVE Eyes $300 After Aptos Launch

Bullish views are growing following JPMorgan CEO Jamie Dimon’s confirmation on Monday that clients can now buy Bitcoin with the bank. The Texas House will also consider Senate Bill 21 a second time which suggests creating a state-managed set of Bitcoins.

JPMorgan CEO Greenlights Client Bitcoin Purchases Despite Personal Opposition

On Monday, CNBC reported that JPMorgan will allow investors to buy Bitcoin, a major move for the prominent American bank. Even though CEO Jamie Dimon continues to oppose cryptocurrency publicly, the bank is moving ahead with the market. According to Dimon, Bitcoin is frequently used in money laundering, terrorism financing, and sex trafficking.

Regardless, this decision shows that Bitcoin is gaining recognition on Wall Street. JPMorgan’s move was made after Morgan Stanley decided last month to allow some of its clients to trade Bitcoin ETFs directly. Because the Trump administration is pro-crypto and has removed several rules, banks in the U.S. can now hold digital assets.

Texas Advances Toward Establishing Bitcoin Reserve

At the same time, the Texas House of Representatives has scheduled its second reading of the Texas Bitcoin Reserve Bill, known as SB21, on Tuesday. If the bill is approved, it would open the way for a Bitcoin Reserve, showing that states are interested in using Bitcoin in their financial setup.

If passed, Senate Bill 21 would create the Texas Strategic Bitcoin Reserve, authorizing the state comptroller to manage a fund outside the state treasury to hold Bitcoin and potentially other digital assets. To qualify for inclusion in the reserve, digital assets must hold a market capitalization exceeding $500 billion—a criterion currently met only by Bitcoin.

The bill faces a critical deadline: it must advance out of the House Public Health Committee by Saturday to be eligible for a final floor vote before the legislative session adjourns in early June.

Should the bill pass, Texas would become the third U.S. state to establish such a reserve, following in the footsteps of New Hampshire and Arizona. Meanwhile, similar legislative efforts in Florida, Wyoming, Montana, and Pennsylvania have failed to gain traction this year.

Bitcoin Institutional Demand Shows No Signs of Slowing

Interest from institutions in Bitcoin was high at the start of the week. U.S. spot Bitcoin ETFs saw net inflows of $667.44 million on Monday, resulting in a fifth day of positive flows starting on May 14, as shown by SoSoValue. If things continue the way they have been, some experts expect Bitcoin might even reach its previous all-time high sooner than people think.

Support for Bitcoin has grown after the U.S. Congress cleared a procedural step for the GENIUS Act, legislation that would aid the development of stablecoins. The changes in legislation are a major achievement for cryptocurrencies. At the same time, Trump took to Truth Social to indicate that a possible ceasefire between Russia and Ukraine may soon happen—something that, previous reports show, could give Bitcoin a lift toward its previous high price.

| Year | Minimum Price | Average Price | Maximum Price |

|---|

Bitcoin Price Forecast: Momentum Indicators Flag Caution Despite Holding Key Levels

Sunday saw Bitcoin increase by 3.23% which pushed it above the key resistance of $105,000. Yet, today during the Asian session BTC dropped those gains, but it managed a small rise afterward in the New York session and finished above $105,500. The price remained close to $105,000 by Tuesday, having edged downwards and stayed there throughout most of the day.

The signs on momentum indicators are beginning to show early concerns. RSI stands at 67, is moving down and was recently unable to maintain its position above 70 which marks the signal for overbought.

On Sunday, the MACD formed a bearish crossover, causing the MACD line to move under the signal line. On Wednesday, May 21, Bitcoin set new All-Time High: $109,424.

XRP Holds Steady Around $2.34 Amid CME Futures Debut and Ceasefire Hopes

On Tuesday, XRP from Ripple decreased again, settling around $2.34 on the second straight day of such prices. The calm price change followed the CME Group’s launch of XRP futures on its platform after getting approval from regulators. CME has now listed XRP futures contracts after the Commodity Futures Trading Commission (CFTC) recently designated XRP as a commodity. Both investors and traders will be able to use the newly launched product which is cash-settled and pegged to the daily CME rate.

While there were gains in the crypto market, XRP did not show much movement, even as BTC and ETH moved up during the late U.S. session and into Tuesday in Asia. Not much was done even as international changes showed signs they could affect world markets.

Hopes for a ceasefire in the Russia-Ukraine conflict grew after President Trump’s phone conversation with President Putin on Monday. The President announced that both countries could talk immediately, encouraging hopes of restoring peace.

XRP Futures Launch on CME Sees Over $2.4 Million in First-Day Volume

On Monday, CME Group’s derivatives exchange introduced XRP futures trading and the listings saw a total amount of $2.4 million in the first few hours. CME records show there were nine standard XRP futures contracts traded that together represented around $1 million in value and were sold for an average of $2.35 per XRP.

Over 200 micro contracts were traded during the session. Micro contracts worth 2,500 XRP each have seen total trading of more than $1.38 million. A high number of trade블 otherwise known as volume на первое ды significantly suggests increased interest from institutions for XRP due to the rise in derivatives.

XRP Futures Launch on CME Marks Institutional Milestone as Price Tests Key Technical Support

Users of the futures contracts for XRP on CME Group will receive settlement in cash, based on the CME CF XRP-Dollar Reference Rate that is updated daily. Because they are suitable for both institutional and retail users, these contracts provide flexible methods for hedging and trading.

Brad Garlinghouse said on X that CME Group’s launch of regulated XRP futures is a major advancement for the cryptocurrency.

Recently, how people feel about XRP has fluctuated, affecting the cardinal price. The issue between Ripple and the U.S. Securities and Exchange Commission (SEC) was a major reason for Bitcoin’s fall. Judge Torres turned down a motion by both parties that would have let the court indicate how it would treat a proposed settlement of $50 million in place of the $125 million penalty set for 2024.

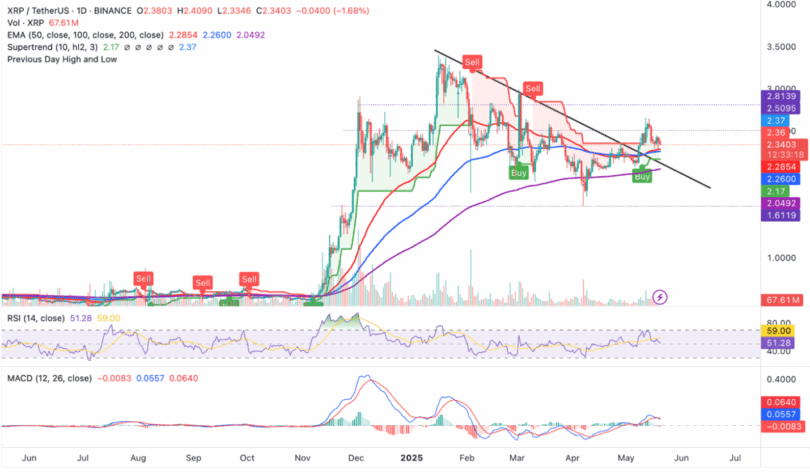

XRP Pulls Back from Recent Highs, Eyes Critical Support Levels

When this article was written, XRP was valued at $2.34, falling from the high of $2.65 last week. The 50-day EMA is helping support the price and it sits near $2.28.

If the level is lost, the next important support can be found at the 100-day EMA, near $2.26. With bearish pressure persisting, the prices of XRP could withdraw closer to the 200-day EMA at $2.04.

Technical indicators are rising and point to a bearish future. The daily chart MACD indicates a correction could get deeper, as the MACD line (blue) is now below the signal line (red).

Meanwhile, the Relative Strength Index (RSI) stands at 51 and is trending lower, indicating a retreat from overbought conditions. A decline below $2.26 could drag the RSI beneath the neutral 50 mark, reinforcing downside momentum.

Although there are signs of a bear market, the SuperTrend indicator is currently supporting a purchase recommendation for the market. ATR-based indicators react to volatility and are used as flexible and adaptable levels of support and resistance in the markets. When the price goes up beyond the SuperTrend line and its color becomes green, it usually points to a bullish trend.

AAVE Surges Past $264 Following Aave v3 Launch on Aptos Blockchain

AAVE is priced at around $264 today, riding high on positive emotions among investors within Aave’s community as well as throughout the industry. The increase in users came after Aave announced on Monday that its Aave v3 protocol had been officially deployed on Aptos. After the announcement, the DeFi token gained over 20% in just 24 hours and appeared prepared to climb over $300.

AAVE v3 Debuts on Aptos, Targets Cross-Chain Lending Innovation

Aave v3 working with the Aptos blockchain is a big move for cross-chain lending. The release marks the start of a bigger effort to reform main lending systems using the Move language. Announced on X, Aptos’ execution environment, handling of collateral flows, liquidation processes, and reward mechanisms will now be assessed by a fresh framework. The companies are working together to make the security and performance of Aave and Aptos’ decentralized finance systems better.

Because of the deployment, the market has seen a rise in active traders hoping for more gains ahead. Open Interest on Stablecoins is reportedly up by 42%, hitting a new level of $576 million, thanks to data from CoinGlass. The surge in capital inflow reflects increased optimism and involvement of investors in the market.

AAVE’s Uptrend Holds Above $260 as Bulls Eye Breakout Beyond $270

AAVE remains steady in its strong uptrend at $264, despite taking a dip from the resistance close to $270. Key moving averages are keeping the broader market strong and encouraging bullish behavior. Strong technical backing for more gains is suggested by the $194 50-day EMA, $197 100-day EMA, and $200 200-day EMA.

The stock could be on the path toward a bullish crossover, often referred to as a golden cross, if the 50-day EMA is lapped by the 200-day EMA. Should this occur on the daily chart, it could boost Bitcoin’s rise, possibly pushing prices toward $300.

They confirm that buyers are still in charge of driving the market. The MACD continues to show green bars gaining size above its neutral line which indicates that the bullish trend is strengthening.

Maintaining investor attention and avoiding a falling trend means AAVE must surpass the $270 resistance zone. Even so, we should keep a close eye since the RSI is now considered overbought at 75.44. Such readings have commonly been followed by declines in the overall market or by trends reaching their peak.

A downside is that traders are constantly checking important support levels. Among those are the group of EMAs between $194 and $200, the $162 level that was tried in March and the April low near $114, all of which could help stabilize the market in case selling continues.