Margex Analytics: Bitcoin Drops Below $90K, Ethereum Faces Hacker Interest, Shiba Inu Holders Sell 61.5B SHIB

Bitcoin (BTC) reached its lowest price point of $88,200 during European morning trades on Tuesday before mid-November. The market-wide liquidations increased as Bitcoin dropped by 4.89% following the recent trading session. The total amount of liquidations from yesterday reached $1.34 billion, which resulted in 367,500 traders getting wiped out, according to Coinglass data. Binance experienced the biggest single liquidation order due to a closed $20.80 million BTC/USDT trade.

Market participants now express anxiety, which might create Fear, Uncertainty, and Doubt (FUD) conditions because of this recent sudden drop. The upcoming Bitcoin sessions may experience continued price drops because analysts predict escalating market selling behaviors.

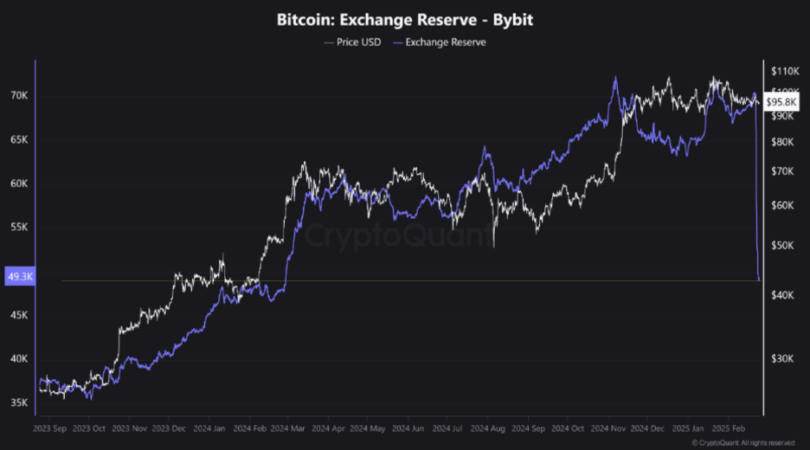

The market experienced additional negativity when Bybit customers learned about a major cryptocurrency exchange experiencing a security breach. Bybit lost $1.4 billion of funds after a security hack last week caused major damages to their financial reserves. The Bitcoin reserves on this platform were depleted by $2 billion based on data provided by CryptoQuant.

Between Friday and Tuesday, Bybit released 20,190 BTC from its balance sheet, decreasing its holdings to values observed in March during the early part of the month. Investor assets fled in large numbers because Bybit left its withdrawal system open after the Ethereum theft forced market participants to reposition their funds.

Bitcoin Price Analysis

The Bitcoin price broke down from its months-long static pattern by going under the essential $94,000 support mark to finish at $91,552 after a 4.89% decrease on Monday. Bitcoin maintains its downward pattern into Tuesday, reaching $89,300 after losing 2.45% of its value.

The market indicators point to additional price decreases, which could drive Bitcoin prices to reach the $85,000 support position. The Relative Strength Index (RSI), which tracks the daily chart, currently shows 30 after exhibiting a downward trend that makes it approach oversold conditions, indicating mild bearish pressure.

If investors push the market value upward, bitcoin has the potential to break past $100,000 over the coming sessions.

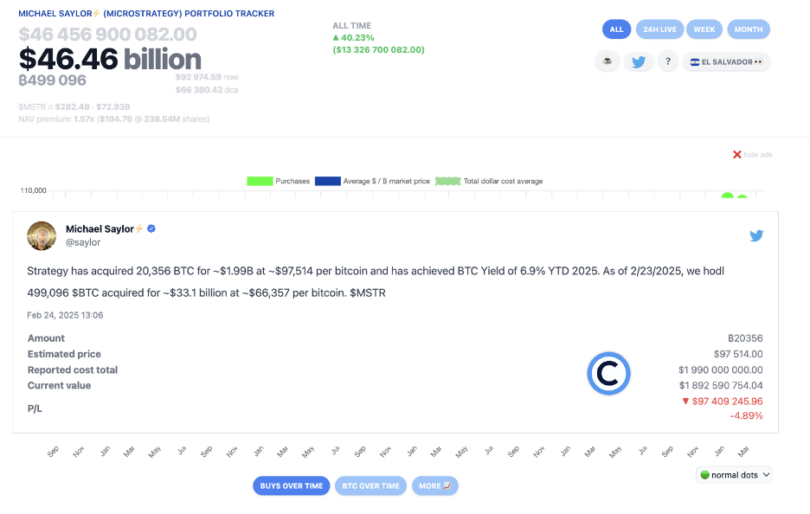

The Bitcoin price decreased by 3.6% on Monday after Strategy announced its $1.99 billion purchase. Readers are analyzing whether Michael Saylor’s Bitcoin Strategic Reserve strategy will shift market prices in the coming days.

Michael Saylor’s Bitcoin Strategy

The US-based IT firm Strategy (formerly known as MicroStrategy), under CEO Michael Saylor, presented its strategic plan for Bitcoin reserves to the US Securities and Exchange Commission, which could create wealth for the US Treasury between $16 trillion and $81 trillion.

Saylor’s method exists to handle the United States enlarging debt issue, and the debt responded at $36.2 trillion on February 5. The total debt amounts to $28.9 trillion in public debt and $7.3 trillion in intergovernmental obligations.

The Digital Assets Framework developed by Saylor includes his proposal, which became operational through its X platform debut in December 2024. The digital asset framework divides these assets into six categories: Digital Commodities, Digital Securities, and Digital Currencies with Digital Tokens, Digital NFTs, and Digital ABTs. Bitcoin fits the Digital Commodities category within this system, demonstrating its decentralized nature and lack of control from issuers.

The definition in this context divides Digital Securities into equity and debt token forms, and Digital Currencies represent fiat currency-backed stablecoins. Digital Tokens serve as fungible assets that function as utilities, Digital NFTs function as unique intellectual assets, and Digital ABTs link to physical, real-world assets.

Saylor presents his framework’s core elements, including a 1% management assets fee cap and a 10 basis point annual service expense limit. The SEC advanced regulatory clarity by forming a Crypto Task Force in January, which showed progress by moving past strict enforcement measures that blocked industry transparency.

The newly established working group creates new rules to drive innovative advances and defend investor financial interests. Last week, Saylor proposed that the US government acquire 20% of the available Bitcoin supply because he believes this move would make America dominant in digital economies while protecting against inflation.

Michael Saylor’s ambition to increase Strategy’s Bitcoin reserves shows no signs of slowing down. On Friday, Strategy announced through its name change to MicroStrategy that it had acquired 20,356 BTC, spending $1.99 billion on average costs per coin, equaling $97,514. This transaction places the company at the top position as the biggest Bitcoin holder among organizations.

In his X post, Saylor validated the Bitcoin acquisition details, stating that Strategy now possesses 499,096 Bitcoins. The company invested $33.1 billion in Bitcoin assets through acquisitions, costing $66,357 for each piece purchased. Through its most recent purchasing activities, Strategy has achieved a 6.9% Bitcoin gain for 2025 while establishing Bitcoin as a fundamental corporate treasury resource.

Ethereum Declines 5% Amid Rising Hacker Interest and Lazarus Group Concerns

The leading altcoin, Ethereum (ETH), lost 5% of its value on Monday due to growing cybercriminal attention toward the popular cryptocurrency. The market developed negative sentiment because analysts feared an upcoming supply surplus stemming from the Lazarus Group activities weakened the impact of Bybit’s reserve gap reduction efforts.

Ben Zhou, CEO of Bybit, revealed through X on Monday that his exchange had completed replenishing its deficit assets left after the Friday $1.44 billion Ethereum theft that Lazarus Group linked to North Korea. The company remedied the shortage by obtaining financial help from whale investors and Ethereum OTC traders, borrowing funds, and purchasing Ethereum directly from exchanges.

Bybit’s intensified ETH purchase strategy could not support ETH’s market value since ETH prices decreased more than 5% during the last 24 hours. Anxiety in the market persists because the Lazarus Group possesses 0.42% of the ETH total supply, making them the 14th largest holder. Potential market investors show caution because they anticipate a forthcoming sale that will create substantial market pressure.

Contrary to market concerns, analysts at QCP Capital suggested in a Monday investor note that the Lazarus Group typically holds onto stolen assets for extended periods before laundering them.

Meanwhile, cybercriminals targeted stablecoin bank Infini, stealing $49.5 million in USDC. The attackers subsequently converted the funds into DAI, which was used to acquire 17,696 ETH. The recent wave of security breaches signals a rising trend of hackers prioritizing Ethereum, further fueling market uncertainties.

Ethereum Faces $72.85M in Liquidations

According to Coinglass statistics, during the previous 24 hours, Ethereum (ETH) experienced $72.85 million worth of futures contract liquidations. Liquidated long positions totaled $59.71 million, and short positions totaled $13.14 million.

Ethereum maintained its position between ascending channel boundaries on Monday despite the price rejection at $2,850 last week. Since December 16, bearish forces have controlled the market as Ether failed to surpass its resistance level, which has bound the ascending channel.

ETH suffered intensified downward momentum across early February because it dropped below the 50-day Simple Moving Average (SMA) and the $2,850 price level. ETH keeps a modestly positive structure during long-term periods even though bears currently have control of short-term price movements.

To maintain their bullish stance, the bulls will need to protect the channel’s support line, which is reinforced by the 100-day Simple Moving Average. A sustained hold of this price level would create enough momentum to break through the essential $2,850 resistance barrier.

ETH’s future performance might activate an upward trend that would break through the descending trendline and 50-day SMA, allowing it to reach the channel’s upper boundary after recovering $2,850.

Shiba Inu (SHIB) Price Holds at $0.000013 Amid Whale Sell-Off, Signals Bearish Trend

On Tuesday, Shiba Inu (SHIB) continued trading at $0.000013 after experiencing a 12% decrease the day before. Available supply distribution data shows that whale investors who hold significant SHIB amounts have been making sustained reductions in their portfolio balance for the past ten days. Analyst tools point towards a substantial price pullback, showing that $0.000010 sets the main support boundary.

According to data obtained from Santiment, whale wallets conducted a total SHIB sell-off of 61.5 billion dollars during the last ten days. The SHIB tokens owned by wallets holding between 100,000 and 1 million units decreased from 139.16 billion on February 16 to 137.64 billion, according to the latest data.

During the same period, the SHIB holdings among wallets with 1 million to 10 million SHIB decreased from 2.07 trillion to 2.03 trillion, while wallets with SHIB between 10 million and 100 million SHIB reduced their positions from 9.41 trillion to 9.39 trillion. The decreasing token numbers in large investor wallets signify substantial position liquidations that intensify inventory sell-offs, raising bearish market sentiment for Shiba Inu.

Shiba Inu Price Analysis

The price decline of Shiba Inu started when it crossed its upturning trendline, which connected numerous low points from August 5 through January 24. In the past month, the price decline reached approximately 25% after the breakdown of the trend support level.

SHIB endured a major price decrease of 11.77% during the first day of the week until its value settled at the $0.000013 mark through Tuesday. Market stakeholders display mixed emotions about the meme coin due to its close position to this price point.

Extended price drops from current levels suggest SHIB may reach its August 5 value point of $0.000010. Technical indicators confirm the negative market outlook, with the daily RSI at 32 but still remaining above the oversold zone. If you want to trade SHIB and take advantage of market movements, you can check out Margex for a secure and user-friendly trading experience.