Margex Analytics: Can XRP Hit $200B if SEC Approves Altcoin ETFs?

XRP’s value jumped past $2.42 during Friday trading which represented a 28% growth since its $1.90 weekly minimum. The cryptocurrency market saw an increase in value because the U.S. Securities and Exchange Commission (SEC) started negotiating settlement terms with Ripple. The market experienced a boost from rumors about BlackRock planning to release altcoin derivatives products and the ongoing settlement talks between Ripple and the SEC.

XRP Crosses $2.40 on Potential Commodity Classification by SEC

XRP increased by 5% to reach back to the $2.30 support level after reports indicated that the SEC might tag XRP as a commodity while negotiating with Ripple Labs. Such a regulatory change in XRP status would remove existing legal ambiguity allowing institutions to adopt it more frequently.

Market experts report that SEC personnel remain active in their evaluation process to determine if XRP should get commodity designation like Bitcoin and Ethereum which are listed as commodities. A commodities classification for XRP would strengthen the possibility for regulators to approve an exchange-traded fund based on XRP.

XRP Market Performance

Professional analysis indicates that XRP might experience significant price growth after the SEC officially declares its status as a commodity. Historical data shows that previously when regulatory statements appeared XRP jumped its price from $0.90 to $3.10 during a period of two months. Market watchers predict that if altcoin ETF approvals materialize XRP would seek another price uplift towards $3.

BlackRock faces mounting hype regarding its potential launch of XRP and Solana ETFs because of expanding ETF approval expectations. Nate Geraci from The ETF Institute as co-founder provided recent insights about this subject.

BlackRock acquired over 567,000 Bitcoin worth $47.8 billion during its 15-month involvement in the market although MicroStrategy owned 499,096 BTC. The increasing possibility that BlackRock will enter altcoin ETFs creates additional interest for strategic investors to buy XRP before anticipated institutional involvement begins.

XRP ETF application process has entered its fifth review term at SEC following the previous rejection in May 2020.

An XRP exchange-traded fund (ETF) needs the ongoing advancement of regulatory measures from the U.S. Securities and Exchange Commission for its final approval. The SEC’s evaluation of Ethereum and XRP ETF requests and other cryptocurrency ETF applications drives growing institutional demand for digital asset investment opportunities.

The arrival of an XRP ETF seems likely to get regulatory approval during the third quarter or the beginning of the fourth quarter in 2025 after Ripple’s legal challenges end. A successful Ripple settlement that establishes XRP commodity classification will expedite institutional approval procedures.

A 2024 SEC approval of Bitcoin ETFs as spot instruments triggered major institutional funding that created Bitcoin’s historic price peak. According to market experts an XRP ETF could obtain more than $5 billion of investments in the first quarter of its market introduction.

XRP ETF Approval Prospects Strengthen Amid Regulatory Shifts

The regulatory environment along with institutional focus makes XRP maintain its solid position to fulfill conditions for exchange-traded fund (ETF) approval. The Ripple vs. SEC court case results and regulatory official comments regarding Ethereum and Bitcoin classification status will serve as essential indicators to monitor.

The U.S. Securities and Exchange Commission (SEC) obtained new leadership which proved essential for regulatory changes. The change of SEC Chair Gary Gensler along with the appointment of new officials who support crypto has resulted in multiple regulatory sanctions being removed within recent weeks.

During the previous SEC administration these major crypto companies faced enforcement actions: Coinbase alongside Robinhood and Ripple holding XRP along with Uniswap. The trend that the SEC might recognize XRP as a commodity substance enhances the prospect for multiple altcoin ETF approvals in 2025 significantly.

The trading community at Polymarket gives XRP ETF approval before December 31, 2025 an estimated 73% chance. Multiple altcoins that have filed for ETF applications face the same chance of approval.

XRP Price Forecast: Can It Break a $200 Billion Market Cap?

The current XRP price sits above $2.40 while its market value stands at $140 billion after its peak value reached $3.10. The price of XRP needs to exceed $3.40 to achieve a $200 billion market value but could make this possible when ETF approvals happen alongside institutional buying patterns that followed Bitcoin derivative approvals in early 2024.

The XRP value has started to recover its recent declines by trading at approximately $2.42 where positive market trends are emerging. Commercial indicators point to elevated potential for XRP price escalation as it has increased by 28% throughout the last four trading days.

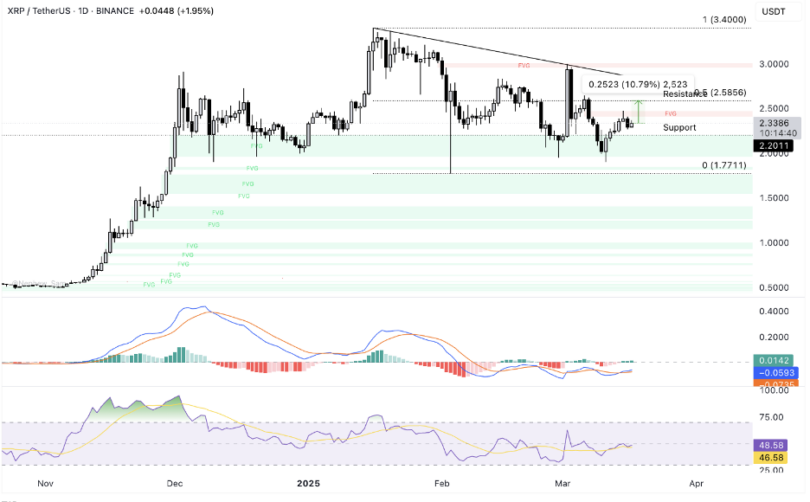

XRP faces resistance from the $2.99 Donchian Channel upper band but the $2.44 mid-band functions as a short-term pivot for its price. XRP would likely advance into the $2.60 to $2.80 price range if it manages to break past its decisive resistance at $2.99.

A positive change happened to the Relative Strength Index (RSI) because it went past the signal line at 47.64 to reach 50.89 which indicates upward momentum keeps growing. Investment interest has multiplied due to increased trading volume which now exceeds 1.13 billion.

The RSI shows upward momentum because its upward movement towards the 55–60 range indicates continued buying pressure that could drive XRP toward reaching the $2.99 resistance level. The failure to defend $2.30 support would make future price declines towards $1.90 more likely because it might indicate the recovery has not been successful.

The market shows a positive inclination toward bullish activity even though risks exist. XRP has the potential to rise to $2.80 as it stays above $2.44. Successful price movement above $2.99 should prompt a possible price confirmation at $3.40 that will expand XRP’s market capitalization beyond $200 billion.