Margex Crypto Week Trends: Bitcoin's Price Rally, Fed Policy, and ETFs Shape. Will BTC Skyrocket to $150K?

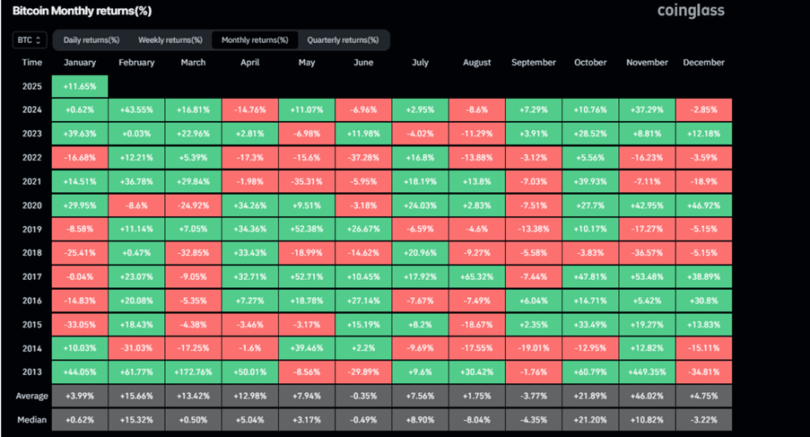

Bitcoin held at $104,000 on Friday when it recovered following its check against the 50-day Smooth Moving Average this week. K33 Research shows in their report that DeepSeek’s impact from China on Nvidia shares led to Bitcoin price fluctuations. Despite its volatile performance, Bitcoin achieved an 11% price rise at the end of January 2023. Records show that since 2013, Bitcoin reached its highest gains during February, with an average return of 15.66%.

Impact of Traditional Markets and DeepSeek on Bitcoin

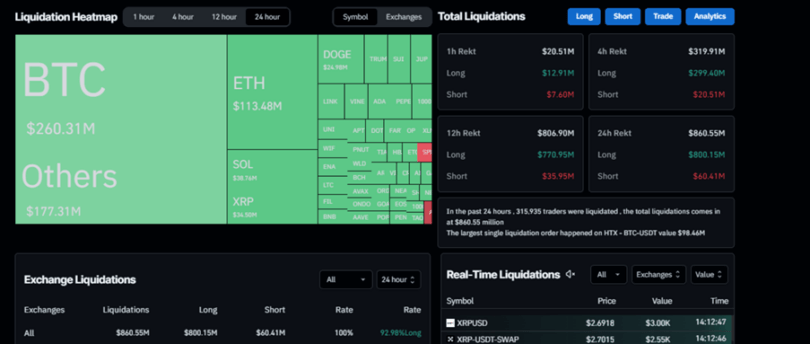

Bitcoin dropped to $97,777 early this week, but it was restored to $102,000 by Sunday night. During this period, a sudden market slide caused companies to sell off their assets, producing $860.55 million in losses, with $260 million from Bitcoin alone, according to CoinGlass metrics.

A research update from QCP Capital shows that Bitcoin’s price dropped under $100,000 following major risk asset market downturns. According to the report, BTC declined under $100K during the weekend when details about DeepSeek spread from China.

DeepSeek stands out as an advanced Chinese language model that worries people about its impact on U.S. artificial intelligence markets. The open-source and cost-effective AI technology developed by DeepSeek presents a threat to US AI companies, creating market volatility both locally and internationally across the crypto market.

| Day | Minimum Price | Average Price | Maximum Price |

|---|

| Month | Minimum Price | Average Price | Maximum Price |

|---|

K33 Research: Nvidia’s Stock Decline and DeepSeek’s Emergence Impact Bitcoin’s Price

According to the “Ahead of the Curve” report by K33 Research, Nvidia’s stock drop created by DeepSeek caused Bitcoin prices to fall.

The paper shows that BTC shares have a rising connection with the US stock market as it joined Nvidia’s market drop. Nvidia’s stock experienced a 17% decrease during this period, while the Nasdaq Composite dropped 3%. Bitcoin decreased by 2.6% despite facing a smaller decline than other markets.

The study finds substantial changes in the future trading platform of CME. For the first time since August 2023, investors showed increased caution by paying less to purchase CME Bitcoin contracts. The market displayed a major decrease in open interest, losing 17,225 BTC during this period. The decline in open interest for January contracts happened before their Friday expiration date.

The CME premiums have recovered positively, but K33 Research warns investors to stay watchful because market sentiment is still negative.

Bitcoin Price Reacts to US Macroeconomic Data Amid Fed Policy Stance

Bitcoin reacted normally to US data releases that revealed basic Federal Reserve policies and economic expansion numbers.

After the FOMC released its decision on Wednesday, Bitcoin’s price experienced minimal growth because the central bank kept its federal funds rates steady between 4.25% and 4.50%. The US Federal Reserve stayed neutral with its policies, though officials tracked rising prices and strong job numbers at their meeting. The Fed statement showed doubt about policy adjustment as it showed that the way forward probably needs more time before changing rates.

US Treasury bond yields rose by 4.5 basis points when investors bought 10-year bond notes that reached 4.581%. During this time, the US Dollar Index expanded 0.17% and touched its daily peak at 108.10. Despite economic tightening, Bitcoin experienced a 2.37% increase on Wednesday.

The initial Q4 2024 GDP results from Thursday showed that US economic growth reached 2.3% annually but failed to reach the predicted 2.6% and the 3.1% mark achieved in Q3. The unexpected slowdown in US economic growth pushed investors toward riskier assets, including Bitcoin, since it reduced demand for the dollar.

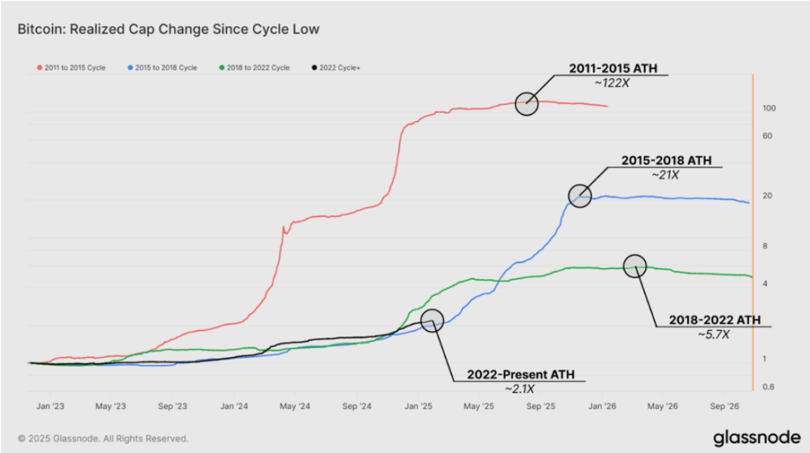

Glassnode recently released Thinking Ahead to show how Bitcoin’s rising market patterns in 2022 match what happened in 2015–2018. Market analysts observe that as this market evolves, it demonstrates smaller bull runs that decline less and grow its Realized Cap slower to produce a more predictable upward trend.

The document shows that Bitcoin’s growth in Realized Cap reached 2.1 times compared to only 5.7 times during the previous bull market. The market development today suits past movements, so an increase in euphoria-driven growth remains possible in the future.

Bitcoin’s market movements depend heavily on changing Federal Reserve decisions and economic growth expectations, which determine investors’ willingness to take risks with risk assets.

Bitcoin Balances on Exchanges Drop as ETF Holdings Surge

The latest figures show that centralized exchanges held only 2.7 million BTC on January 30, 2025, after July 2024, when they dropped to 3.1 million BTC. Recent research shows that most of the Bitcoin withdrawal decrease occurred when investors transferred their funds to Exchange-Traded Funds (ETFs). These custodial wallets at companies like Coinbase demonstrate a different BTC storage method than typical investor cash extractions.

The movement of Bitcoin from long-term holders to new investors forms the basis of how market experts predict price cycles. The ongoing distribution period shows market characteristics similar to those of previous bull markets at the end of 2017 and the beginning of 2021. As this buying behavior continues, Bitcoin might reach a stage of HODLing, which will probably last for a short while.

What Lies Ahead for Bitcoin in February?

Bitcoin opened 2025 by achieving its largest value at $109,588 on January 20 while generating more than 11% returns for that month. According to trading history, Bitcoin delivered its best returns in February, with a 15.66% increase, ranking as its third strongest month. Current market patterns suggest future price advances will appear soon, according to traders.

Bitcoin continues its solid rebound from support areas and generates hopes for another test at its previous peak.

Saturday morning, BTC recovered its price to $98,845 and gained 2.69% to reach $104,700 by Thursday. The Bitcoin price today stands at $104,000 while holding its upward movement.

Market experts expect that Bitcoin’s rising trend will test its previous peak of $109,588 on January 20, representing a new high record.

Technical Indicators Signal Mixed Sentiment

The Bitcoin Relative Strength Index for Tuesday’s trading strengthened at 57 as it moved beyond 50 and advanced its bullish trend. The Moving Average Convergence Divergence indicator shows traders are unsure of their next move as the lines merge.

Verification of the MACD buying signal below indicates that Bitcoin should advance to new price targets soon.

The decline in Bitcoin price below $100,000 will trigger more selling pressure when it drops below its 50-day Exponential Moving Average line on the daily chart. This development would push BTC towards testing $90,000 support.

Bitcoin (BTC) climbed above $104,000 on Friday, reflecting a rebound in market sentiment following recent macroeconomic developments. The world’s largest cryptocurrency has recovered from the impact of DeepSeek’s release and the Federal Reserve’s interest rate decision earlier this week.

According to crypto market analysts, Bitcoin continued to move without major change after Federal Reserve Chair Jerome Powell spoke about interest rates. Bitcoin demonstrates signs that it will attempt another test of its highest price of $109,588.

With its current price of 5% below the highest mark, Bitcoin recovered every cent lost on Monday. During the beginning of the week, BTC traders sold their positions before important U.S. market events and after technology stocks and stocks overall dipped in value.

In February, Bitcoin rose 44%, and the market expects another rally this year to $150,000. Current market trends suggest another major price rise this month, even though experts only predict speculation.