Stop Hunt: How the Stop Loss Hunting Strategy Works in Trade

In stock trading, the fluctuation of prices can lead to a strategy known as Stop Loss Hunting. Traders often set a stop at a specific level, anticipating that if the price dips, it will trigger a sell-off at the next available price.

This can cause the price to bounce off support, allowing savvy traders to capitalize on the ensuing volatility. Understanding this tactic helps investors navigate the market more effectively.

In the crypto industry, unique opportunities present themselves to traders in split-second trading on the financial markets. A vast community of newbies and skilled traders continue to leverage the financial markets as a source of sustainable means of income, often employing strategies involving many stop-loss orders for risk management.

Trading cryptocurrencies and other financial instruments on the financial markets is a business that provides freedom. It offers traders a unique platform to leverage and scale without providing large sums of capital to invest in forex.

Due to the speculative nature and volatility of the financial markets, some traders lose trades and suffer losses due to market uncertainties and manipulation. Stop loss hunting is a form of market manipulation by top players.

This article will look at stop loss hunting as a protective strategy and a technical tool for consistently winning in financial markets trading. What exactly is stop loss hunting?

What Is Stop Loss Hunting?

The financial markets accommodate an ecosystem of traders with speculative ideas on market trends and price direction.

Multiple long and short leverage positions often follow this. Every trader’s buy or sell position is often based on the trader’s fundamental and technical analysis, which includes the concept of stop-loss orders placed at strategic levels.

To mitigate risks, traders entering buy or sell positions utilize a stop loss feature to cut losses at a set price point in case the market direction goes against their entry positions.

Stop Hunting is a strategic plan employed by market makers, investors, and big players to clear out stop loss orders of retail traders and players in the financial markets before prices increase.

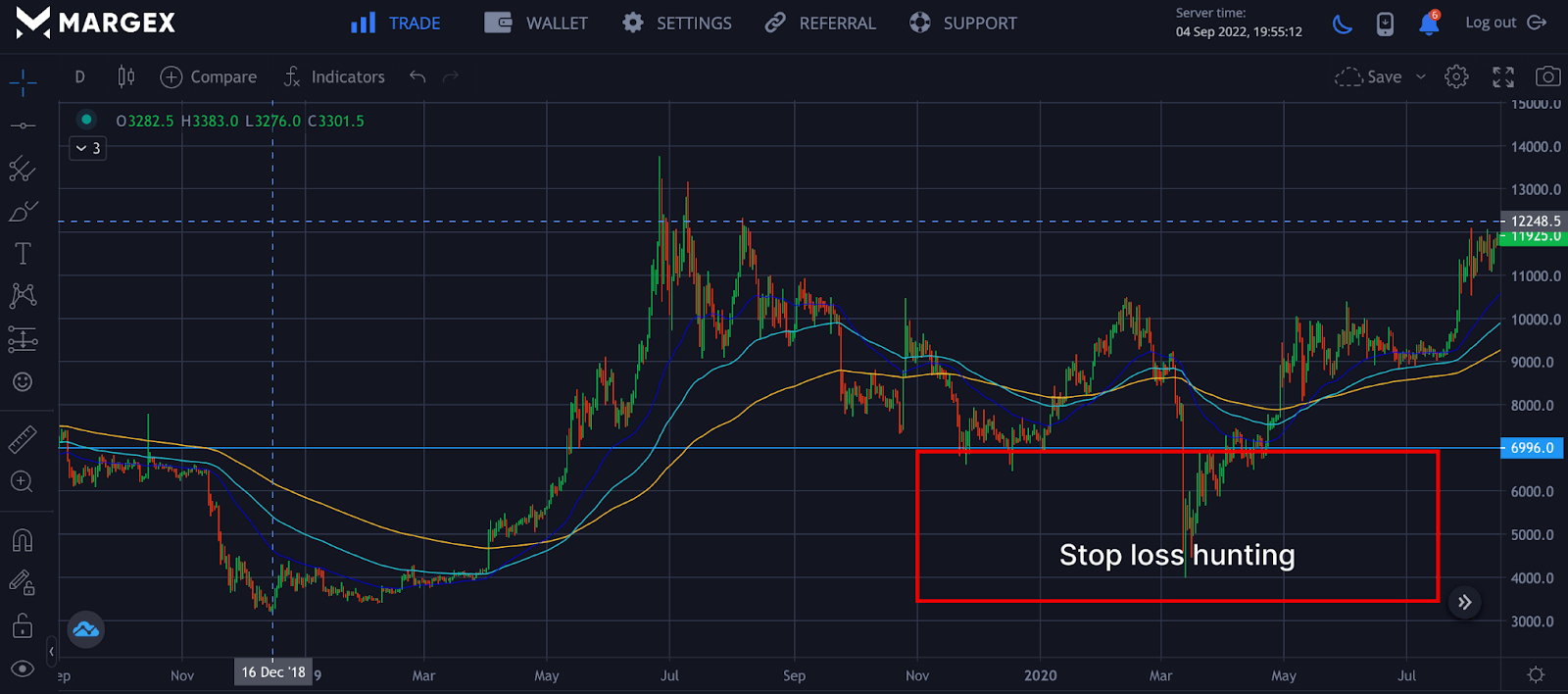

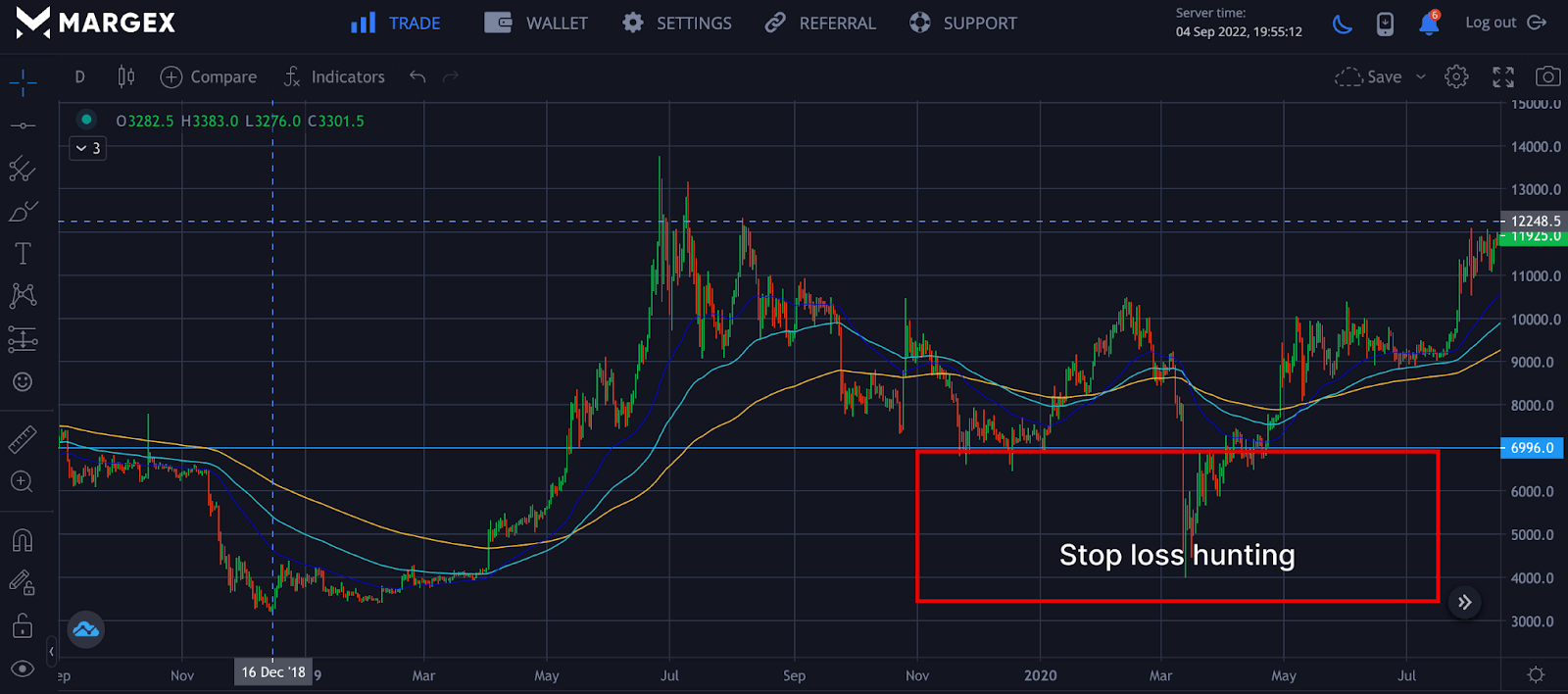

From the image above, in a bid to manipulate the market and fill their orders, institutions seek to activate the stop loss of retailers far below the support and resistance levels in order to push prices higher.

How A Stop Loss Order Works

| Position Type | Direction | Stop Loss Example |

|---|---|---|

| Long | Buy, expecting price to rise | Stop loss 10% below entry |

| Short | Sell, expecting price to fall | Stop loss 10% above entry |

A stop loss order is an order execution. It is an instruction given to a broker to cut losses at a particular price point of an asset if the price direction of an asset goes against a trader’s speculated price direction.

A stop-loss order is intended to reduce a trader’s loss on an entry, be it a long or short position. A long position is an entry position speculating uptrends in an asset’s price. Traders enter into a long position by initiating a buy order request from a broker at particular price levels of an asset.

A short position is the opposite of a long position. A short position is an entry position speculating downward movements or downtrends in an asset’s price. Traders enter into a short position by initiating a sell order request from a broker at particular price levels of an asset or instrument.

For instance, a trader may place a stop-loss order 10% below or above the price level at which an asset or instrument was bought or sold. The broker receives this instruction to sell the asset at a 10% loss below or above a price entry point.

The stop loss order, when utilized properly, is an effective risk management tool that guarantees traders’ security on open trades and helps them place their stop effectively.

How Stop Loss Hunting Actually Happens

| Tactic | Description |

|---|---|

| Push Price Below Support | Trigger retail stop losses, then reverse |

| Use High Volume Fakeouts | Temporarily move price to shake out weak hands |

| Cluster Around Key Levels | Target predictable SL zones (e.g. round numbers) |

Stop loss hunting happens when big traders take advantage of levels where most crypto traders initiate stop loss orders or entries.

This frequently happens in the markets due to an increased understanding of trade patterns of average traders and their susceptibility to stop-loss hunting. Insider information may also present data to key players on multiple levels of stop-loss entry positions.

When Does Stop Loss Hunting Occur

Institutional traders and crypto whales look for opportunities to hunt and stop losses as prey, and the main target, in this case, is the retail traders. To fill their orders and push the price of crypto assets in their favor, institutions and more prominent crypto players use manipulative plans and strategies to fill their orders, and that’s where stop loss hunting strategies are employed.

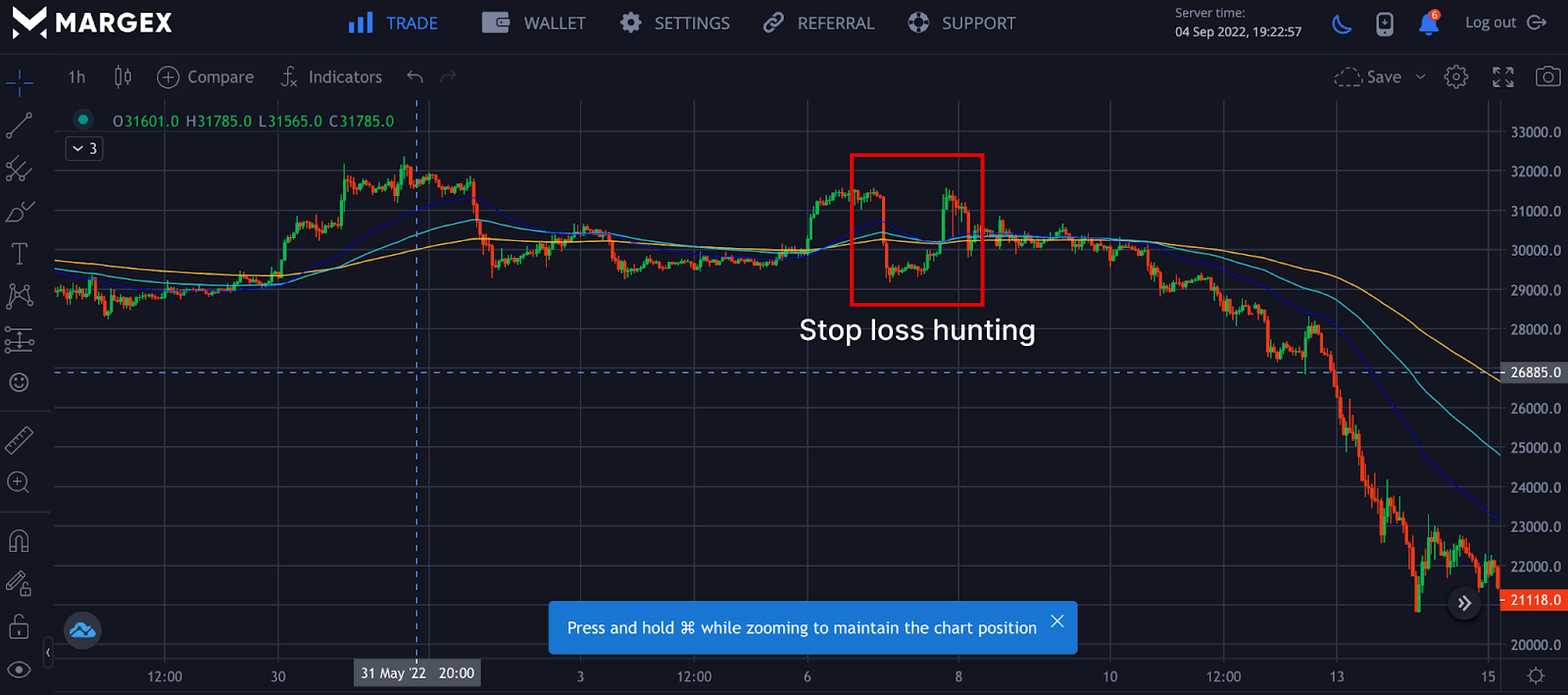

From the chart above, we could see a clear manipulation employed by investors on the asset pair of ETHUSD to fill their positions and stop the loss of retailers. As soon as the orders are filled price quickly moves upward.

Stop loss hunting also occurs when big market participants attempt to temporarily short or long an asset token or instrument at a price point where multiple stop-loss entries have already been established and activated.

Stop loss hunting on retail traders is sought after by more seasoned or institutional traders. Stop hunters have a variety of approaches to observing the trading patterns of newbies or beginner traders, including understanding stop hunting techniques.

Who Hunts Stop Losses In Crypto

In the crypto market, the concept of stop hunting refers to the practice where traders aim to hunt for stop losses to drive prices in their favor. This strategy works by triggering stop-loss orders placed by retail investors, often visible in the order book.

When stop-loss orders at levels are activated, many stop orders are triggered, which can result in a rapid price decline or a higher price surge. Traders often capitalize on this market behavior, taking advantage of mental stops and wider stop-loss orders as they fall victim to the falling market.

By understanding the trading range and the placement of stop-loss orders around key levels, savvy market participants can exploit the stop-loss orders to their advantage, enhancing their trading strategies.

The crypto market is a big playground comprising centralized exchanges (CEXs), big-time investors known as whales, and a growing class of skilled traders with larger portfolios who are on the hunt to prey on the stop loss of retailers.

The crypto jargon ‘Whales,’ referred to as big-time investors have a major effect on the price shifts of cryptocurrencies. Big institutions, hedge funds, and traders have significant interests in hunting stop losses.

Due to insufficient liquidity and volumes associated with this class, massive pumps or dumps could occur if a significant whale or group of whales gives attention to a particular cryptocurrency asset in other to fill their positions.

Why Do Big Traders Hunt Stop Losses

Big traders often engage in stop-loss hunting to target stop-loss levels set by retail traders. When a stock is trading near these levels, stop-loss orders being triggered can create a surge in trading volume, allowing them to short the stock or buy back at a better price.

In this navigating the market strategy, they exploit the lot of volatility around stop-loss orders placed by retail traders. Stop-loss orders can provide an opportunity for big players to move the market price lower, triggered at the same time as others in the market react. By understanding levels like support and resistance, they can effectively protect your trades and open a long position after a rebound to the previous price point.

Moreover, traders using mental stops are less likely to be hit by these tactics, as their strategies may be more flexible compared to traditional stop-loss orders. Ultimately, stop-loss hunting occurs as big traders capitalize on retail trading activity to enhance their profits.

The financial markets, such as the cryptocurrency market, are a field of play for various traders. Every trader’s goal is centered on winning consistently and cutting losses. Traders may need to approach trading as a business. Major players trading in the cryptocurrency markets are in it for more liquidity.

The big traders have a significant effect on the markets. The understanding of market psychology, in general, enables the big traders to identify areas of interest where the majority of traders would likely set stop loss entries.

Example Of A Stop Hunting And How To Trade It On Margex How Do I Know I’m Being Stop Hunted?

Margex, a Bitcoin-based derivatives exchange, enables cryptocurrency traders and investors to trade a wide range of crypto assets with a leverage of up to 100x.

Furthermore, Margex offers a unique feature for traders and investors to trade while staking, which allows you to earn passive income despite how volatile trading can be.

With daily rewards paid into your stacking balance and there are no lock-up periods.

The Margex exchange is well-known for putting the interest of its users in concern by designing key staking features for both traders and investors, and an excellent user experience that makes trading simple even for inexperienced traders. These features are intended to help traders place stop-loss orders effectively to become more profitable.

Traders who consistently learn and build trading experience have an edge in the financial markets by understanding stop hunting practices. A trader might identify and be a victim of stop hunts when trade entries initiated are based on general market psychology and traders’ general patterns.

However, a seasoned trader is a trader that learns from experience and adjusts accordingly. Technical tools and indicators may help a trader spot false price movements and possible stop hunts. This may inform a trader’s decision on the use and adjustments of stop loss order entries. Buffering stop loss with the help of an indicator known as the average true range (ATR) is a strong strategy to avoid being prey to stop loss hunting.

Although many traders find it difficult to adopt as a strategy, stopping loss helps you as a trader minimize risk and exposure to huge price manipulations, especially when many stop-loss orders are placed below key support and resistance levels. A vast majority of traders leveraging stop loss orders adopt this strategy to manage liquidation risks in high price volatility.

Tips To Protect Yourself From Stop Loss Hunting

| Tip | Reason |

|---|---|

| Use ATR-based stop loss | Adjusts for market volatility |

| Avoid round numbers | Less likely to be hunted |

| Set mental stops | Not visible in order books |

| Use wider stops with small positions | Minimizes losses if triggered |

| Prepare re-entry strategy | Allows recovery after false moves |

Trading the financial markets comes with significant risks and opportunities for gains. By considering some factors, traders who leverage the markets may protect trade entries from stop hunts. Traders may utilize the following;

Locate The Stop Loss Orders

Traders who profit from the markets consistently look for positive confirmations on an entry. In comparison, stop hunters are always strategically positioned to clear out obvious levels where traders have placed their stop-loss orders.

Going by standards, it is ethically impossible to peer through order books containing the stop-loss orders of traders, as this will result in an unhealthy manipulation of the markets, particularly against those who have set their stop-loss orders close to resistance levels.

Notwithstanding, a mastery of traders’ psychology can drop pointers to levels and areas of interest where most traders would likely initiate stop loss entries.

Set Your Stop Loss Correctly

Proficient traders learn to utilize and set stop loss orders correctly. Traders perfecting this skill might anticipate stop hunts and false price movements.

Although it might seem impossible to avoid stop hunts completely, beginner and seasoned traders can build winning portfolios by learning to set stop loss orders correctly.

Traders may minimize the risks of stop hunts by not initiating stop loss orders just below key resistance and support levels.

Most traders are built with the psychology of setting stop-loss orders just slightly below or above support and resistance zones. Big traders are aware of the easy peasy setups of small traders and stop hunting at those price levels.

Traders may also apply an Average true range (ATR) strategy when setting stop-loss orders with considerable price distance.

An average true range is a technical indicator that calculates and measures the price volatility of an asset.

Utilizing the average accurate range indicator may give traders an insight into giving ample allowance while initiating a stop loss order by considering the average price volatility of an asset.

Leverage The Stop Hunting Strategy

Two can play the game. Beginners and skilled traders can also leverage the stop-hunt strategy of whales and big traders.

Traders seeking to win trades consistently may need to subject themselves to a study of price patterns and chart histories, which can help them trigger stop-loss orders at the right time.

History may always repeat itself, especially in the context of market conditions that lead to predictable stop-hunt scenarios. Paying attention to market psychology goes a long way in identifying stop hunts and profiting from stop hunts before and after it occurs.

Allow Your Trades Room To Breathe

Traders may give significant allowance when initiating stop loss order entries to set their stop-loss orders effectively. This might protect trader setups and market entries from stop-loss hunting events.

A trader might accommodate price reversals due to false price movements of stop hunters by leaving considerable gaps between entry points and stop loss entries.

When stop hunts occur, traders who make ample allowance for stop loss entry points and set their stop-loss orders wisely stay in trades and build winning portfolios over time.

Don’t Use Round Number Prices When Setting Your Stop Losses

Institutions, hedge funds, and big traders leverage the stop-hunt strategy against vulnerable retail traders seeking to manage significant risks.

Traders may avoid the risks of stop hunts by not using round number prices of an asset when setting stop loss entry orders.

Price levels with round number figures are easy targets for stop hunters. Smart money traders look for opportunities to take advantage of these rounded price points, especially when it falls around key support and resistance areas.

Prepare A Re-Entry Strategy For Missed Trades

In cases of high price action in the cryptocurrency markets, some traders may take advantage of price volatility to make massive gains in short time frames.

Increased price volatility may be schemes employed by stop hunters to create a false change in market direction and sweep stop loss orders of traders.

Trading the cryptocurrency markets may require some amount of patience. Smart traders might want to develop a re-entry strategy for missed trades when the market settles.

FAQ

What is the 7% stop-loss rule?

The 7% stop-loss rule is a risk management strategy where a trader sets a stop-loss order at 7% below the purchase price of an asset. If the price drops by 7%, the position is automatically sold to limit potential losses. This rule helps traders protect capital and avoid emotionally-driven decisions.

How to avoid stop-loss hunters?

To avoid stop-loss hunters, place your stop-loss orders at less obvious price levels—slightly below support zones or round numbers. Use wider stop-losses combined with smaller position sizes, or consider mental stops. Avoid setting stops at exact technical levels that are easily visible to others.

Do banks hunt stop losses?

Large institutions like banks don’t officially “hunt” retail stop-losses, but their large orders can trigger stop levels due to liquidity gathering. Market makers and high-frequency traders often exploit predictable stop-loss areas to create volatility and capture liquidity.

Is stop hunting a real thing?

Yes, stop hunting is real. It refers to the intentional movement of asset prices to trigger stop-loss orders before reversing direction. While it’s not illegal, it’s a common tactic in low-liquidity environments and can be exploited by savvy traders or automated algorithms to shake out weak hands.