Top Five Government Bitcoin Holders – Is New Race on Horizon?

By the end of June 2025, it’s becoming clear that some states have already begun accumulating Bitcoin, while others just hold their stashes without selling, as they have acknowledged BTC as a reserve currency.

Data provided by Arkham Intelligence shows that there are now at least five states that hold BTC, including large and developed ones, with some even shifting their economies on Bitcoin rails.

These holdings now represent the next stage in Bitcoin’s evolution as it has left behind the state of being a niche libertarian asset and started shaping as a tool of future national strategy and economic diversification.

Who knows, perhaps even the so-called “new world order” often expected by many people to come “soon” will take place thanks to governments adopting and holding Bitcoin. Some experts are also speculating if the two largest governments and geopolitical opponents – the US and China – are going to compete in BTC holdings, enlarging them and rivaling for domination in this sphere too.

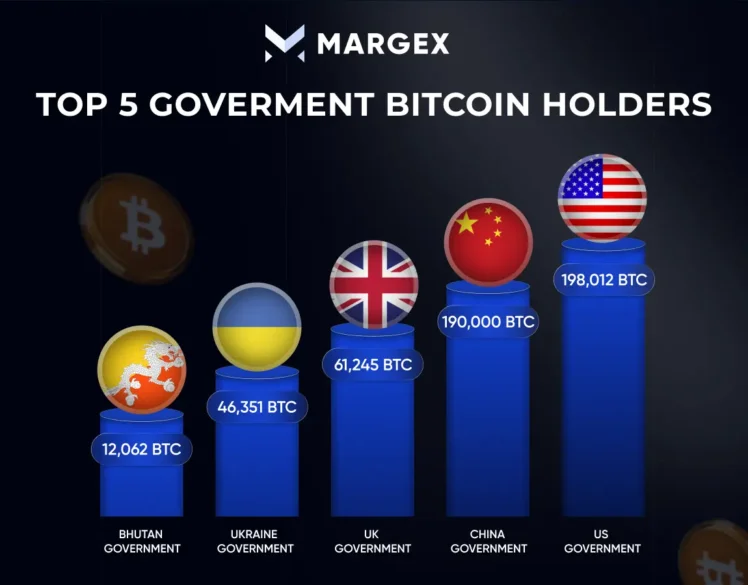

Top five governments and their Bitcoin holdings

The first spot on the Arkham list is held by the US government with roughly 198,012 BTC valued at more than $21 billion. However, it also holds a bunch of other cryptocurrencies – altcoins – including ETH, USDT, BNB, TRX, and SHIB. All in all, it owns a crypto stash worth $22,066,628,701.

The Bitcoin it holds includes BTC confiscated from illicit activities related to the infamous darknet marketplace Silk Road. Before Trump took the presidential office, the US Department of Justice got permission from the court to auction that BTC, but the sell-off never took place.

China is mentioned as the second-largest Bitcoin holder with around 190,000 BTC. This crypto was also seized by the government from criminal crypto activities, particularly from PlusToken and some unlicensed crypto exchanges. This year, China has been rumored to be actively building a Bitcoin reserve unofficially after US president Trump signed an executive order, commanding to creation of an official Strategic Bitcoin Reserve for the country. If China is indeed doing it, it is doing so despite the official ban on retail crypto trading and is accumulating Bitcoin passively through law enforcement.

The third-biggest Bitcoin holder is the UK government, with approximately 61,245 BTC obtained through active anti-money laundering actions and darknet shutdowns. It is followed by Ukraine with 46,351 BTC. The majority of this amount came as a result of multiple donations during the peak of its war against Russia. It was the first government to launch a transparent crypto donation campaign, attracting billions of dollars worth of it to support its military defense actions.

The list is enclosed by the little state of Bhutan holding 12,062 BTC worth $1,299,323,510. Aside from Bitcoin, it owns ETH, BNB, USDT, and small-cap altcoins. Those cryptos were acquired as part of the sovereign strategy adopted in 2024 to build a decentralized crypto treasury.

A few other states on the top-ten list of Bitcoin holders are also worth mentioning. One of them is El Salvador, holding 6,210 BTC. In September 2021, this country, run by president Nayib Bukele, adopted BTC as the only legal tender and began accumulating BTC through volcano-based mining sponsored by the state, Bitcoin-backed bonds, and direct acquisitions. As of now, this is the only nation-state that uses BTC as a legal means of exchange.

This list also shows crypto holdings of the North Korean government – 1,927 BTC, which it got hold of with the help of its Lazarus Group hackers, who actively hack crypto exchanges, conduct phishing campaigns, and conduct ransomware attacks.

The German government also held 50,000 BTC confiscated from local pirate movie Internet platforms. However, last year, they sold it, missing $2 billion in profits. In January 2025, BTC hit an all-time high of $108,000.

Bitcoin spikes to $108,500 despite geopolitical turmoil

In recent weeks, Bitcoin price performance has been mirroring geopolitical instability in the Middle East. After a temporary truce between Israel and Iran, BTC went up but then plunged as the US sent missile strikes from airplanes at Iranian strategic nuclear objects a week ago. Bitcoin went below the $100,000 level.

While Donald Trump boasted that Iran’s nuclear program was allegedly destroyed, Iran responded with strikes on Israel and stated that all the uranium had been evacuated from the plants before the US air strikes.

Over the past week, Bitcoin has recovered and today it peaked around the $108,500 level, adding 1.05%. However, it failed to fix there and went back down to $107,400 per coin.

In the meantime, it is not only governments that have been accumulating Bitcoin. Michael Saylor has again hinted at a new weekly BTC purchase, posting a tweet, where he stated that in 21 years investors will wish they had bought more Bitcoin – earlier, he predicted one BTC to cost $21 million in 21 years from now.