What Is Altcoin Season? When Is Altcoin Season and How to Prepare for It

The term altcoin season or altseason describes a period when alternative digital assets outside Bitcoin rise in value to give Bitcoin competitive value declines. Market elements, including enhanced liquidity patterns and increased altcoin prominence, and increased overall digital asset investor optimism, drive this price rise.

The cryptocurrency industry follows standard market patterns which comprise active and growing periods just like traditional financial systems. Altcoin season stands out among other market events because it attracts investor interest dedicated to finding possibilities outside of Bitcoin.

The structure of the altcoin season has experienced modifications in recent times because of stablecoin liquidity and emerging market advancements. The development of the crypto industry demands a complete understanding of altseason because this knowledge will help investors detect valuable opportunities alongside strategic risk control.

The altcoin market receives market influences from President Donald Trump’s administration because of his pro-cryptocurrency perspective. The executive order “Strengthening American Leadership in Digital Financial Technology” emerged when President Trump signed it in January 2025 to establish U.S. dominance in blockchain and digital assets technologies.

What Triggers an Altcoin Season?

An altcoin season would begin to take place when capital flows out of Bitcoin and into alternative cryptocurrencies. This usually happens in a predominantly bullish cycle that allows altcoins to win over Bitcoin in price growth and market momentum.

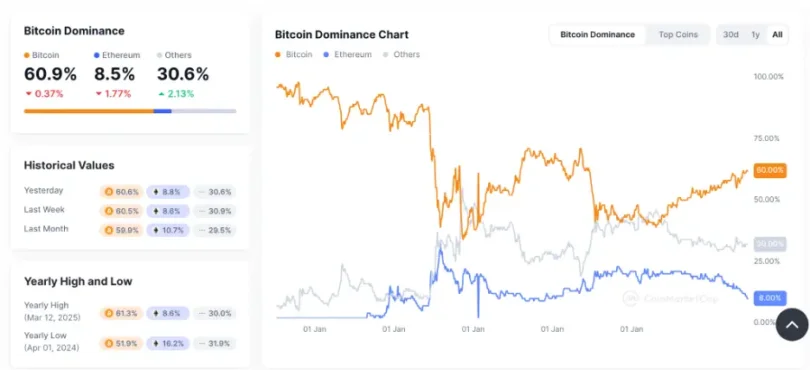

Historically, altcoin seasons have been marked by investors redistributing their profit from Bitcoin into assets with smaller market caps in search of higher returns. The two chief confirming signals will be: a drop in Bitcoin dominance, which is the percentage of Bitcoin out of the total crypto market capitalization, coupled with an expansion of altcoin trading volume.

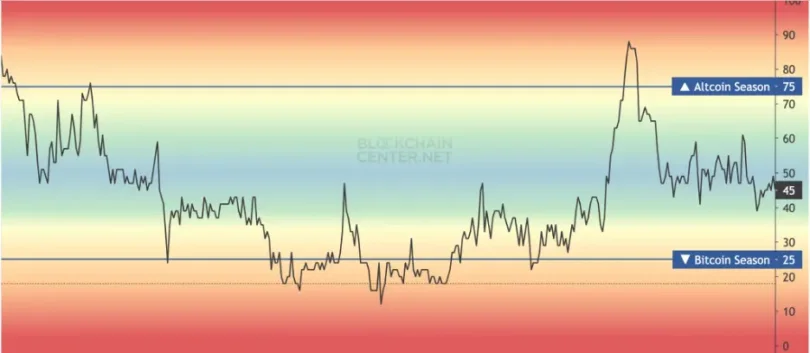

In modern times, we see a wider array of factors driving the altcoin seasons. These include increased institutional interest in altcoin projects, growing liquidity across altcoin-stablecoin trading pairs, and increased retail speculation. The confluence of declining BTC dominance, increased trading activity, and rising investor enthusiasm often acts as a harbinger of an impending altcoin season. One of the tools used to identify such periods is the Altcoin Season Index, which helps investors measure whether altcoins are truly outperforming Bitcoin across various timeframes.

When Will Altcoin Season Starts?

Many traders and crypto enthusiasts are now asking: when is altcoin season likely to happen next? The season of altcoin starts when traders move away from Bitcoin and begin turning their attention to altcoins, the other class of cryptocurrencies. It is that time of the year when the whole altcoin market experiences sudden price surges and increased trading coincidence. Tools as the Altcoin Season Index are typically employed to monitor this change, thereby assisting market players in determining when altcoins start to greatly outperform Bitcoin, indicating the nascent stage of an altcoin season.

This market transformation happens primarily because of Bitcoin’s fluctuating price values. The appreciation phase of Bitcoin price values eventually pushes away routine investors who redirect their money into altcoins looking for better returns. The cryptocurrency market demonstrates this cyclic pattern every time.

Bitcoin Season: A Period of Market Stability and Dominance

The market cap dominance of Bitcoin during Bitcoin season causes market conditions that force altcoin values to decrease. Bitcoin’s dominance index shows increased value because it measures Bitcoin’s market capitalization against the total cryptocurrency market capitalization. The market signal indicates that investors choose to invest in Bitcoin instead of alternate digital currencies known as altcoins.

Investors show a preference for Bitcoin throughout these particular market periods for various motivating factors. Bitcoin functions as a digital asset known for its stable value, and investors analogously evaluate it through gold value comparison metrics. Investors adopt Bitcoin and stablecoins during economic uncertainties because they seek risk protection through these assets. The prevailing negative market sentiment throughout a bear cycle leads investors to reposition their capital toward Bitcoin along with a handful of established cryptocurrencies therefore resulting in minimal or negative value performance for altcoins.

Evolution of Altcoin Market Trends

The Crypto space integrates stablecoins into the market where Bitcoin previously held dominance.

The prior cryptocurrency cycles displayed Capital movements between Bitcoin and altcoins as a strong driver of altcoin market periods. When Bitcoin prices became stable traders changed their money flow into alternative cryptocurrencies in search of more value. During major events such as the ICO (Initial Coin Offering) phase in 2017 and the DeFi (Decentralized Finance) growth of 2020, this pattern became apparent in the market.

The market trends underwent fundamental changes. CryptoQuant’s CEO Ki Young Ju identifies fundamental changes in what determines when altcoin seasons will occur. In past years Bitcoin-to-altcoin capital movements started altseasons. The primary factor responsible for sparking altseasons in modern times is the altcoin-to-stablecoin trading volume. The true market expansion appears in altcoins through their trading behavior with stablecoins rather than with Bitcoin.

The increased liquidity that stablecoins USDT and USDC provide to altcoin markets drives wider adoption throughout the ecosystem. The success of stablecoins helps integrate them into modern altcoin markets, which reduces Bitcoin’s role as an exclusive market activity measurement tool.

Ethereum’s Role and Institutional Investments

Ethereum initiates many altcoin market increases because its expanding framework incorporates decentralized finance (DeFi) applications and non-fungible tokens (NFTs). Ethereum’s growth, according to Fundstrat analyst Tom Lee, will shape altcoin performance strongly because institutions expand beyond Bitcoin.

The expansion of altcoins receives substantial funding from institutional investors through Solana and Ethereum, along with other projects that offer attractive investment prospects. These blockchain assets offer access to new emerging products, thereby making them suitable for investors who want to take on highly rewarding yet high-risk investments above and beyond Bitcoin.

Bitcoin Dominance as a Market Indicator

The crypto analyst Rekt Capital indicates that Bitcoin market cap dominance serves as a fundamental tool to detect when altcoin seasons will begin. Historical data shows that Bitcoin dominance across the 50% mark marks the start of new cycle expansions for alternative cryptocurrencies. Rekt Capital indicates that Bitcoin’s stability between $91,000 and $100,000 could lead to favorable market conditions where Ethereum and other altcoins would gain liquidity and show substantial price gains.

A definitive “altseason” has not reached the cryptocurrency market since March 27, 2025, because less than 75% of the top 50 altcoins managed to yield better returns than Bitcoin over 90-day intervals. According to the Altcoin Season Index from the Blockchain Center, there were two brief altseason periods in March 2024 and January 2025, but they did not meet the criteria to classify as authentic.

The Altcoin Season Index currently shows a value of 20, revealing that a Bitcoin Season has begun because Bitcoin maintains dominance over most alternative cryptocurrencies. The current standing of the Altcoin Month Index (65) demonstrates that the previous thirty-day period failed to generate an Altcoin Month. The Altcoin Season Index is at 29, which reveals that altcoins performed subpar compared to Bitcoin for the entire previous year.

Bitcoin occupied 60.9% of the overall cryptocurrency market share on March 27, 2025, based on CoinMarketCap data. The market capitalization of Bitcoin represents 60.9% of the combined market capitalization value for all cryptocurrencies across the board. By tracking the Altcoin Season Index, Bitcoin dominance provides essential information about market mood alongside investor actions. Market investors show preference toward Bitcoin when its dominance figure rises because they consider Bitcoin a secure and stable cryptocurrency in volatile periods. Low percentage dominance demonstrates that investors are allocating their funds into alternative digital assets called altcoins because they aim to get better returns.

The performance of Altcoin Season Index indices act as essential metrics for market analysis, which assist investors and enthusiasts in monitoring Bitcoin and altcoins’ relative returns for strategic decision-making purposes.

The observation of Bitcoin’s dominance empowers investors to generate strategic decisions about their portfolio distribution and protect against risks through a better understanding of Bitcoin-alternative currency dynamics. This shift is frequently reflected in the Altcoin Season Index, which helps investors identify when altcoins start gaining momentum over Bitcoin and whether market conditions are aligning for the beginning of a new altcoin season.

The Influence of Regulations and Market Risks

Regulatory Impact

The market develops its sentiment through regulatory shifts, which experts agree investors must monitor. Market growth will accelerate when regulatory bodies approve to spot Bitcoin exchange-traded funds since this demonstrates confidence to investors. Negative regulatory changes create dampened market sentiment and affect market liquidity in adverse ways. Fundstrat analyst Tom Lee argues that positive crypto legislation could expand the altcoin season specifically because major institutions such as BlackRock are rumored to develop XRP ETFs.

Risks and Overleveraging

Market analysts recommend staying away from high-risk leverage strategies as well as impulsive speculations, which fuel the market hysteria during altcoin season periods. Since altcoins exhibit natural market volatility, proper risk control methods need to be applied. According to Doctor Profit investors should adopt a method of profiteering by portions to protect their profits and limit losses from sharp market fluctuations.

Key Factors Influencing the Altcoin Market

The evolution of altcoin market cycles now depends on how much stablecoin liquidity exists and how much altcoin market cap institutional investors bring to the market. The performance of alternative cryptocurrencies depends upon these two elements, which now serve as their main growth factors.

Altcoin market trends often start to rise when Ethereum experiences shifts in its price. Market trends demonstrate through Bitcoin dominance levels together with the Altseason Season Index that traders gain insightful information.

The altcoin market cap has surged as expansion opportunities grow, fueled by newly emerging narratives such as advancements in AI and GameFi sector developments. The market momentum continues to thrive because regulatory developments generate important guidelines, creating both investor confidence and regulatory certainty.

The crypto market is transitioning towards maturity because altcoins now gain value through technological innovation and practical use instead of only speculative bubble behavior. If you want to trade altcoins during this trending market phase, consider the safe and user-friendly platform at Margex.

Historical Altcoin Seasons and Their Influencing Factors

Previous events of altcoin season tendencies appeared during key technological achievements and significant developments in the cryptocurrency space.

Late 2017 through early 2018 caused Bitcoin dominance to drop from 87% down to 32% while altcoin values greatly expanded. ICOs brought forward new digital currencies known as Ethereum alongside Ripple and Litecoin, which gained considerable speculative value through investor interest.

The entire cryptocurrency sector experienced a major market capitalization growth from $30 billion to over $600 billion, along with numerous alternative tokens achieving new maximum valuations. The abrupt termination of this altcoin season in 2018 stemmed from enforcement actions against cryptocurrencies combined with failed cryptocurrency projects.

At the start of 2021, Bitcoin lost 32 percentage points of its market dominance, which kickstarted an expanding interest in alternative cryptocurrencies. The altcoin market share expanded to 62% from its initial 30% value during this period while simultaneously surpassing this number by more than double. The time witnessed tremendous growth of decentralized finance (DeFi) sectors and NFTs along with memecoin projects, leading to major value increases across smaller market capitalization cryptocurrencies.

The crypto market capitalization reached its maximum point of over $3 trillion at the end of 2021 because of technological innovation and enhanced retail user participation.

Analysts remained bullish throughout Q4 2023 and mid-2024 because they expected Bitcoin’s post halving event in April 2024 alongside expected SEC approvals for spot Ethereum ETFs in May 2024. The latest altcoin trend differed from earlier seasons, which concentrated on ICOs and DeFi, and NFTs because it spread across multiple market sectors such as game and metaverse and DePIN and web3 technologies.

The evolution of the altcoin market advances through technology innovations combined with regulatory changes and market sentiment which generates an active shifting market framework.

Trends Shaping the Crypto Landscape

Memecoins steadily extend their growth beyond Ethereum networks while Solana-based memecoins receive significant market interest. The Solana network experienced a major price rise of 945% with its resurgence from being labeled as a “dead-chain.” The recent growth of memecoins has strengthened the wider market adoption of these cryptocurrencies across various blockchain platforms.

The patterns of altcoin cycles consist of multiple structured liquidity movements that interact with specific market tendencies. The defined phases reveal important considerations for investors when they make their decisions.

FAQs

Is it Altcoin Season?

Altcoin season refers to a period when alternative cryptocurrencies (altcoins) outperform Bitcoin in terms of price gains. To determine if it’s altcoin season, traders analyze market trends, Bitcoin dominance, and altcoin performance. If Bitcoin dominance is dropping while altcoins are surging, it could indicate the start of an altcoin season.

When is Altcoin Season in 2025?

Predicting the exact timing of an altcoin season in 2025 is challenging as it depends on various factors, such as Bitcoin’s price cycle, macroeconomic conditions, and investor sentiment. Typically, altcoin seasons follow Bitcoin bull runs, so if Bitcoin rallies earlier in the year, an altcoin season could follow in the months afterward.

How Long Does Altcoin Season Last?

The duration of an altcoin season varies based on market cycles. Historically, altcoin seasons have lasted anywhere from a few weeks to several months. The length depends on market liquidity, investor interest, and overall crypto trends.

What is Altcoin Season?

Altcoin season is a market phase in which altcoins experience significant price increases, often outperforming Bitcoin. During this period, traders shifted their focus from Bitcoin to alternative cryptocurrencies, leading to higher trading volumes and rapid price gains in various altcoins.